Table of Contents

Hey there! Just a quick note to let you know that this edition of the Blockhead Business Bulletin is brought to you by our sponsor, Franklin Templeton. They're a global investment management organisation with over 75 years of investment experience. Being a California-based company, they offer value by leveraging its Silicon Valley roots and relationships with countless fintech, blockchain, and AI companies to bring insights directly to their clients. So, please sit back, relax, and enjoy today's news, knowing that it's made possible by our friends at Franklin Templeton.

Crypto Boosted After Binance's "Guilty" Plea

There was a period of cautious optimism in digital asset markets when the possibility of a settlement to the US criminal investigation into Binance emerged.

After news that the Justice Department is seeking more than $4 billion to terminate the years-long inquiry, tokens like Bitcoin and BNB, the currency tied to Changpeng Zhao's Binance ecosystem, saw a boost.

The idea of US criminal charges being levelled against Zhao has been discussed between the department and Binance.

Bitcoin was trading at $37,399 — a 1% increase over the report's price — and BNB was 6% higher.

An analyst at a large investment firm in Boston said, "Given Binance's position as a liquidity leader, a good outcome to the probe into the exchange would be quite encouraging."

"The market as a whole has been experiencing a tremendous upswing recently, and investors are still processing this news." added the analyst.

Investors in digital assets also noticed that the US government was cracking down even harder on cryptocurrencies after the SEC accused the Kraken exchange of breaking securities laws. Kraken strongly disagreed with the SEC case and intended to "vigorously defend" its stance.

After suffering huge losses in 2022, the cryptocurrency market has partially recovered this year. Bitcoin's price has more than doubled on speculation that the SEC is now ready to approve the first US spot Bitcoin exchange-traded funds, a move that has surprised many.

Looking Ahead

Monday saw a sluggish start for Asian equities as investors braced for market-moving inflation data from the US and Europe later in the week and a meeting of oil producers that might halt or prolong the recent price decline.

Investors may be wary as the month ends, especially considering their substantial gains. On Thursday, the market will get more evidence that the next Federal Reserve move will be to lower interest rates, as the preferred inflation indicator is predicted to fall to its lowest level since mid-2021.

At least seven more Fed speakers are scheduled for this week, including Chair Jerome Powell, who will have the opportunity to counter the doves during a Fireside Chat on Friday.

Global Stocks Head Toward Big Monthly Surge

In a shorter, more subdued trading day after the US Thanksgiving holiday, major Wall Street indexes gained ground on Friday as global shares headed towards their largest one-month surge since November 2020.

Investors' growing confidence that US interest rates have peaked has shifted the market narrative to the timing of rate cuts, sending the MSCI index of global equities up and on track for a nearly 9% monthly gain.

Investor caution was the biggest loser in November's explosive stock surge. Protective strategy demand has nearly disappeared due to what is quickly becoming one of the largest market meltdowns in the previous hundred years.

The S&P 500 has risen about 9% so far this month, and traders of all stripes are struggling to keep up.

All of this is driven by the idea that interest rates will be lowered by the Federal Reserve in 2024 rather than raised any more. As a result, bond and stock portfolios, divided 60/40, are poised for their best month since 2020.

With a 1% gain, the S&P 500 extended its winning streak to four weeks, during which it has seen only three losing sessions in nineteen trading days.

In November, the benchmark is expected to gain more than all but five of the months since 1928. Another important economic indicator that investors follow, the Russell 2000, also rose 0.5% this week.

The two-week inflow into global stock funds is the most since February 2022, according to data from EPFR Global. November is shaping up to be the second-greatest month for stock exchange-traded funds this year, with $43 billion in assets raised thus far.

The demand for hedging has plummeted to record lows since 2013 when the cost to insure against a market selloff dropped by about 10%, or one standard deviation.

Additionally, demand for tail-risk hedges, which provide payouts in the event of a 30% decrease in equity, has fallen and is currently around its lowest level since March.

The VIX, a "fear gauge" used by Wall Street, fell to 12.46, its lowest point since January 2020.

Former safe-havens, such as inflation-protected bonds, cash exchange-traded funds, and bearish options, are being sold — their stead: a growing interest in low-cap stocks and junk bonds.

Treasury Market's Dramatic Recovery

The largest bond market in the world has recovered from being underwater for most of 2023. Many people watching the US debt now see signs of a genuine recovery.

Yields on US 10-year Treasuries have fallen 37 basis points this month, reaching 4.49%, as bond prices have rallied on the prospect of loosening borrowing rates.

Although there has been a spike of confidence in global markets this month, investors may see a period of calm as they prepare their portfolios for 2024.

Given the deluge of debt issuance required to finance an enormous US deficit, most Wall Street analysts are projecting that lower yields will continue and pave the way for widespread gains in 2024.

Naturally, some of these same market analysts were projecting a banner year for bonds in 2023, but that has yet to happen. However, this time around, they have several pieces of evidence that will assist them win.

10-year Treasury rates were hovering at about 4.47%, down from a 16-year high of 5.02% on Oct. 23. Last month, two-year rates reached a cycle high of 5.26% and are now trading at 4.95%.

Dollar Slips on Fed Easing Bets

Despite reports of stable US company activity in November, private sector employment fell in line with projections for a fourth-quarter economic slowdown, and the dollar weakened against a basket of currencies.

Bond prices have rallied on the prospect of a loosening of borrowing rates. The dollar has suffered as a result, falling 3% against a basket of major peers so far this month.

Last week, the dollar index—which tracks the value of the US dollar relative to six other currencies — fell 0.4% to 103.35, maintaining close to the 2-1/2 month low of 103.17. After falling 1.9% the week prior, the index fell 0.5% last week.

As speculation mounts that the Fed may begin reducing interest rates next year, the index is heading towards its worst monthly performance in a year.

Apart from that, the news that Japan's core consumer price rose stepped up slightly in October, causing the yen to strengthen, and it was nearly flat versus the dollar at 149.45.

According to the numbers, investors are right to worry that the BOJ may soon be obliged to reduce monetary support due to persistent inflation.

Economists from ING predict that the Bank of Japan will abandon its ultra-accommodative policy in 2019.

In Asia, analysts predict that the yuan will be supported by year-end tailwinds and the expectation that exporters will increase dollar sales due to China's recent resurgence.

The currency has risen in November and December for the last six years, with the most significant increases occurring in 2022. As a result of exporters' need for additional local currency to fulfil cash demand before year-end and Lunar New Year, the yuan often rises during these months.

Brent Still Above $80 Per Barrel

Following signals from both Israel and Hamas that the current Gaza truce might be prolonged beyond Monday to facilitate the release of further detainees and hostages, traders will also be closely monitoring the price of oil and gold.

Meanwhile, OPEC+ is getting closer to resolving the production quota disagreement that postponed their crucial meeting over the weekend. The price of oil levelled out following a three-day decline.

On Monday, there was no movement in oil prices; investors were waiting for an agreement to limit supply until 2024 at the OPEC+ meeting later this week, and Brent remained over $80 a barrel.

Expectations that OPEC+ would discuss plans to decrease supplies further and that Saudi Arabia and Russia could extend voluntary production cuts beyond early 2024 supported a small increase in both futures last week, the first weekly rise in five.

Midway through last week, prices plummeted due to the postponement of a ministerial meeting until Nov. 30 by OPEC and its allies, which includes Russia, to resolve disagreements over output targets for African producers.

According to four OPEC+ sources who spoke with Reuters on Friday, the group has made progress towards a deal since then.

According to their estimates, OPEC members' exports have fallen to 1.3 million barrels per day below April levels, which is in line with the group's supply objectives ahead of the OPEC+ summit.

Traders and Reuters data indicate that the UAE is expected to increase shipments of flagship Murban crude in early 2019 in response to a new OPEC+ mandate and barrels redirected to the global market due to refinery maintenance.

Even if the OPEC+ nations prolong their cutbacks into next year, the International Energy Agency forecasts a little surplus in global oil markets in 2024.

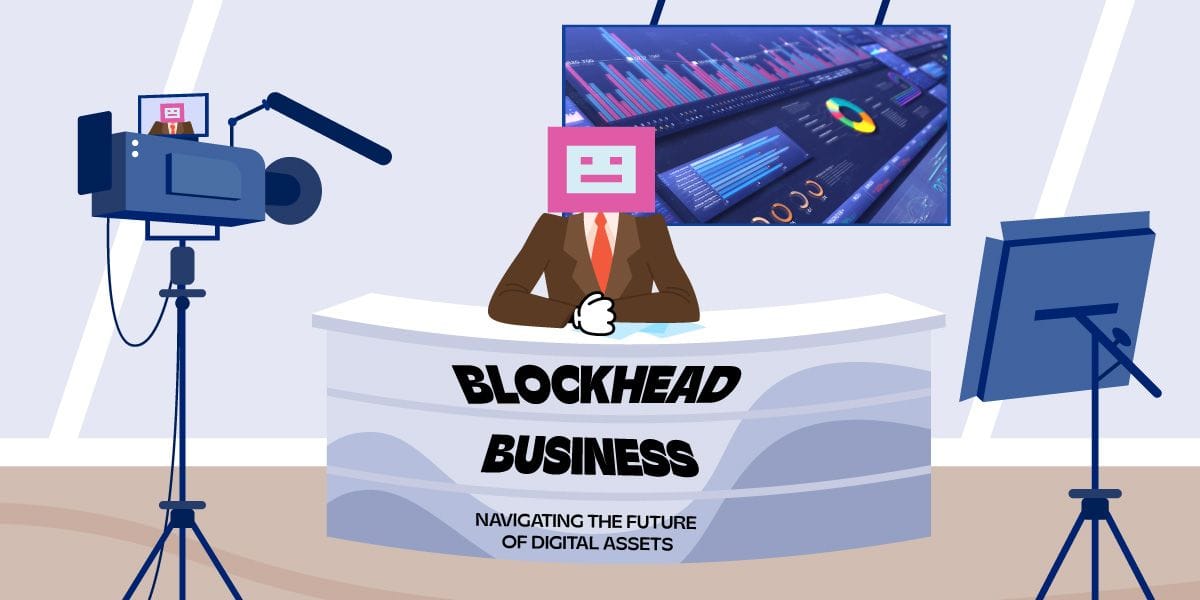

THE WEEK AHEAD

In the United States, this week, all eyes will be on the ISM manufacturing index and the inflation gauge that the Federal Reserve favours. Markets anticipate more improvement and a core rate down to 4% in the euro zone - all eyes will be on the region's CPI figures.

Macro Data Calendar

US: All Eyes On Any Signs of a Rebound

Markets firmly believe that the Federal Reserve won’t hike interest rates any further and that 2024 will see a series of interest rate cuts from the second quarter onwards.

Around 90 basis points (bps) of cuts are currently priced. In contrast, bond markets forecast 150 bps for next year because consumer weakness is likely a key theme given subdued real household disposable income growth, fewer savings resources and less borrowing as interest rates continue rising.

This should allow inflation to slow more quickly, giving the Federal Reserve greater scope to loosen monetary policy.

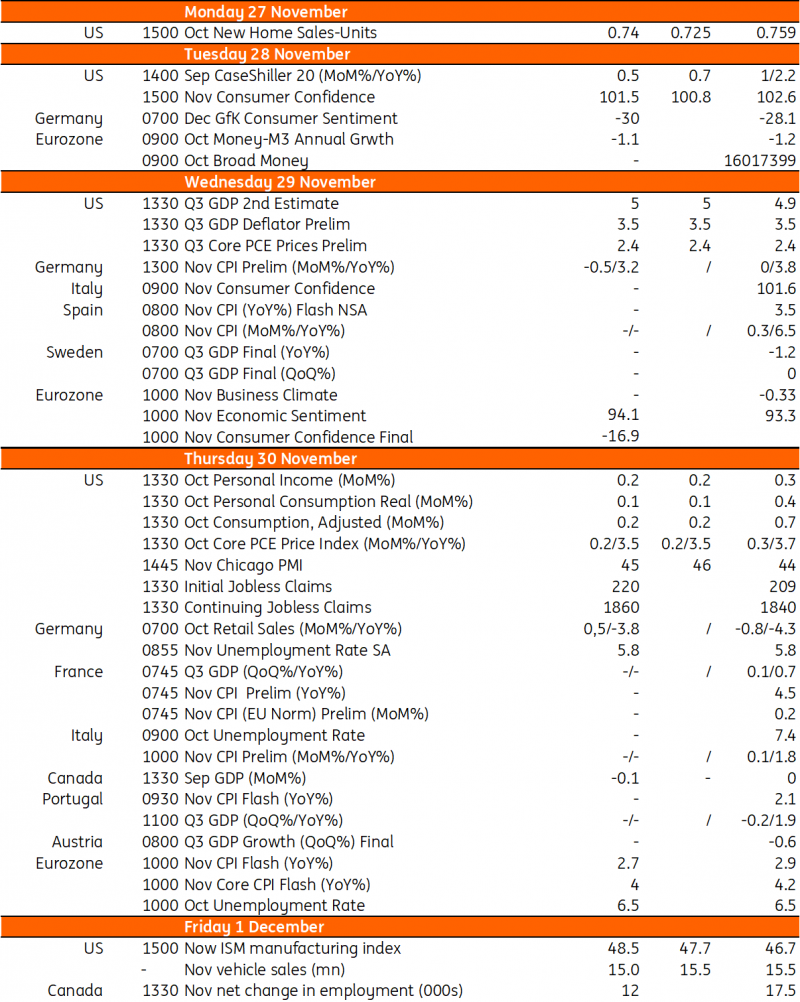

Asia Week Ahead

Markets are bracing for the Bank of Korea to implement another hawkish pause at next week's meeting due to ongoing concerns over inflation's recent acceleration. The release of Chinese PMIs, Australian inflation statistics, Indian GDP numbers for the third quarter, and maybe even more encouraging news from Japan are all on the horizon.

Key Events in Asia:

- China PMIs to show recovering manufacturing activity

- Inflation out from Australia

- India GDP could moderate but stay above RBI projections

- BoK to carry out another hawkish hold

- Upbeat data likely out from Japan

Macro Data Calendar

Major Pitfalls for Bumper Emerging Markets, Anyone?

Although emerging market equities and currencies are poised for their strongest month since January, the surge might be thwarted by upcoming significant obstacles.

Upcoming months bring challenges, such as the possibility of a more hawkish stance from the Federal Reserve and elections in important countries like India and Taiwan.

A new president in Argentina might bring about significant economic changes, while a referendum in Chile could lead to unrest.

Lastly, a reversal is possible only because November saw such large increases.

Both the MSCI emerging market equity index and a comparable currency index had their best Novembers since January, with increases of 7.2% and 2.4%, respectively.

Hopes that the Fed's tightening cycle is coming to a close and a meeting between US President Joe Biden and his Chinese counterpart Xi Jinping, which was seen as a sign of a thawing of geopolitical tensions, were positive catalysts.

Still, with much of the good news now factored in, emerging markets may be vulnerable to some bearish risks.