Table of Contents

Trades in global financial markets are driven by the now clear mantra: interest rates to remain "higher for longer."

US economic data have been robust, and the latest jobs figures completely whack March rate cut bets and weigh even on May wagers.

But from the macro perspective, one thing is now becoming clear - tightening interest rate regimes are well in the past, and the timing of rate cuts is delayed well into this year.

"That's (the delay in Fed rate hikes) not a bad thing for markets in the long run as it assures the investing community that policymakers are using common sense to address fundamental macro issues rather than economic models," a chief investment advisor at a large European Fund house in London told Blockhead.

"The longer the Fed delays, the better it is for the current economic cycle - as the biggest reason for the US central bank to kick the easing policy down the road is solid data," added the fund advisor.

Hedge Funds' Massive Gains Trigger Demand for Catastrophe Bonds

More traditional investors are interested in the instruments that have allowed hedge funds to achieve record profits in a particularly risky sector of the debt market.

The top-performing hedge fund strategy from last year was based on catastrophe bonds, and since then, they've been outperforming other high-risk fixed-income instruments in terms of return.

Compared to high-yield US corporate bonds, which rose 13% in 2023, the securities increased 20% that year. US Treasuries increased by almost 4%.

The insurance business uses catastrophe bonds (cat bonds) as a safety net in case of uninsurable losses. Instead, it shifts the risk to investors who are ready to lose some or all of their money in a calamity. In return, they gain substantially if a predetermined disaster does not materialise.

Although cat bonds have been around for a while, climate change-related weather events have given them a new lease of life.

Cat bonds have seen unprecedented amounts of activity from issuers and investors due to the rising cost of rebuilding following natural catastrophes and decades-high inflation.

Simultaneously, investors and cat bond funds have benefited from the reduced payment chance of some bonds' stronger trigger provisions.

Institutional investors from the mainstream are increasing their presence in the cat bond market, even if specialised hedge funds still control most of the market.

The global market for insurance-linked securities (ILS) has grown to around $100 billion.

According to Artemis, which analyses the ILS market, the entire market for the securities reached $45 billion in 2023, with cat bond issuance reaching an all-time high of over $16 billion (including non-property and private transactions).

Dollar Hits Pre-Fed Pivot Levels

The strength of the world's biggest economy encouraged traders to pull back their expectations for interest rate cuts, which boosted the value of the US dollar.

A significant change in the Federal Reserve's monetary policy outlook is also impacting the digital assets market, given the susceptibility of Bitcoin and the larger crypto markets to shifts in mood and perceptions of liquidity.

On Monday, when the value of the euro and yen dropped to their lowest points since November, the Dollar Spot Index surged 0.6%, reaching its highest point since November 17.

The dollar has risen vs the currency of almost every member of the Group of Ten since the beginning of the year.

Forecasts on the timing of the first Fed rate cut have been pushed back by resilient US macro data, such as last week's unexpectedly good employment report, and by global factors, including geopolitical worries and China's economic woes.

As a result, the dollar has become more attractive as a safe haven bet.

The US dollar has recovered from its December lows, when the Fed hinted at a possible shift away from rate hikes and towards a series of rate cuts, thanks to this strength and the expectation that rates will remain elevated for longer.

In January, Fed policymakers officially ended their aggressive drive to hike interest rates.

However, they also wanted to establish new expectations for how quickly interest rates will ease this year now that inflation pressures are fading.

Following the decision, Chair Jerome Powell expressed scepticism about a rate cut in March.

Policymakers in the eurozone are also challenging the notion of impending cuts. The euro is being pressured by speculations that ECB officials would cut borrowing costs before the Fed, which is bet to happen as early as April.

The euro has lost 2.8% of its value against the dollar since the beginning of the year due to concerns about a widening interest-rate difference in favour of the US.

As the Bank of Japan maintains its ultra-easy monetary policy without clearly indicating when it will be changed, the yen has fallen more than 5% this year, making it the worst performer among the G-10 currencies versus the dollar.

A strong economic outlook also makes dollar bulls remain optimistic.

The further the Fed pushes rate cuts this year, the more it will weigh on global currencies and digital assets.

There is a significant inverse correlation between cryptos and the dollar over the past year, with only a few exceptions.

Fedspeak, Strong Data Knock Out Stocks & Bonds

Strong economic data bolstered the belief that the Fed isn't prepared to declare victory over inflation just yet, leading Wall Street traders to send Treasuries and equities down.

The fresh worry that the excitement around disinflation may have been exaggerated put more pressure on Treasuries.

Institute for Supply Management's services indicator reached a four-month high while prices stepped up, further indicating that the world's largest economy is doing well.

After hearing cautious comments from many Fed speakers, including Jerome Powell, the news shocked trade even further.

Yields on US 10-year notes increased by 14 basis points to 4.16%, while those on two-year notes were close to 4.5%.

Fed swaps show the probability of a rate cut in May has diminished, and the likelihood of a rate move in March has been nearly eliminated.

With advances driven by chipmaker Nvidia, the S&P 500 recovered from session lows.

Still, some traders say the stock rally last week is on shaky ground.

Two of the three largest debuts this year failed to entice investors, so things aren't looking good for initial public offerings either.

Bill Gross has stated his intention to wager on the possibility that the interest-rate curve would revert to its usual form, eradicating the inversion that has endured after the Fed ceased its interest rate hikes.

According to the bond market tycoon's statement on social network X, he is buying contracts connected to the Secured Overnight Financing Rate for September 2024 and selling them for September 2025.

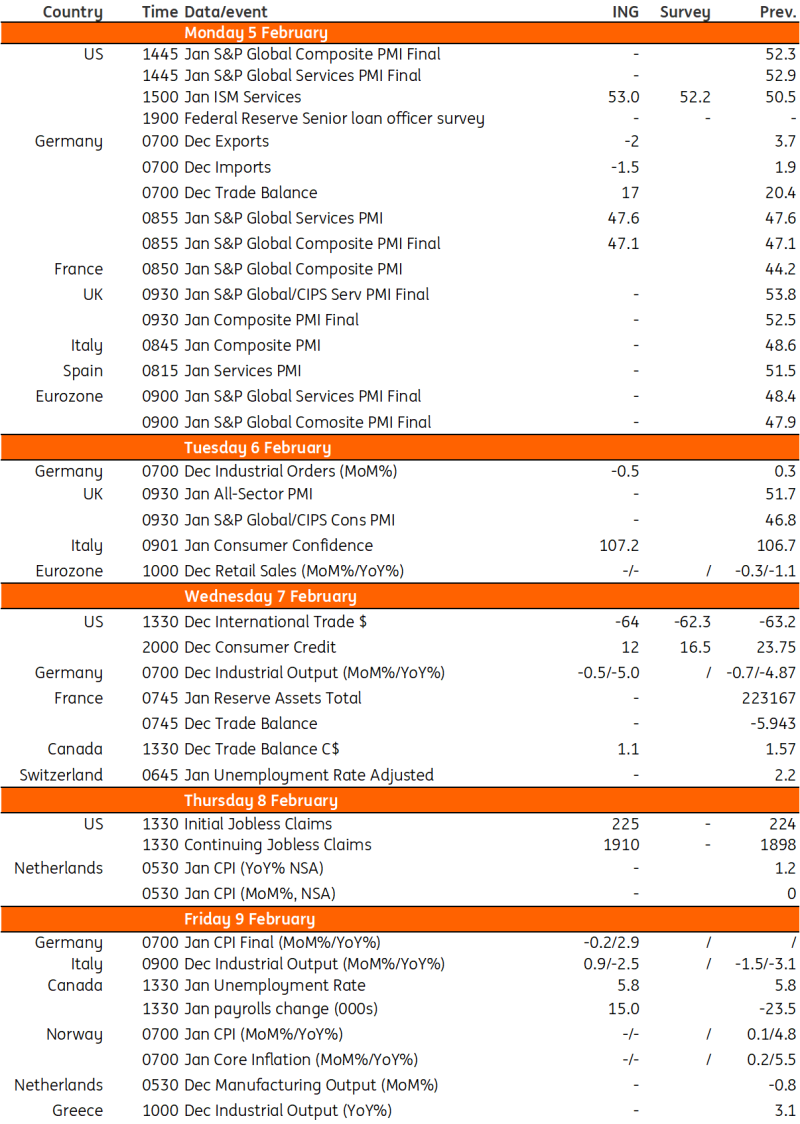

THE WEEK AHEAD

A quiet week ahead in the US and the developed world, with just the strong ISM services activity reading already released on Monday.

Turkey's inflation is likely to remain under pressure in the near term given a higher-than-expected minimum wage hike and increases in administrative prices due to special consumption tax and revaluation rate-related adjustments.

Macro Data Calendar

Asia Week Ahead

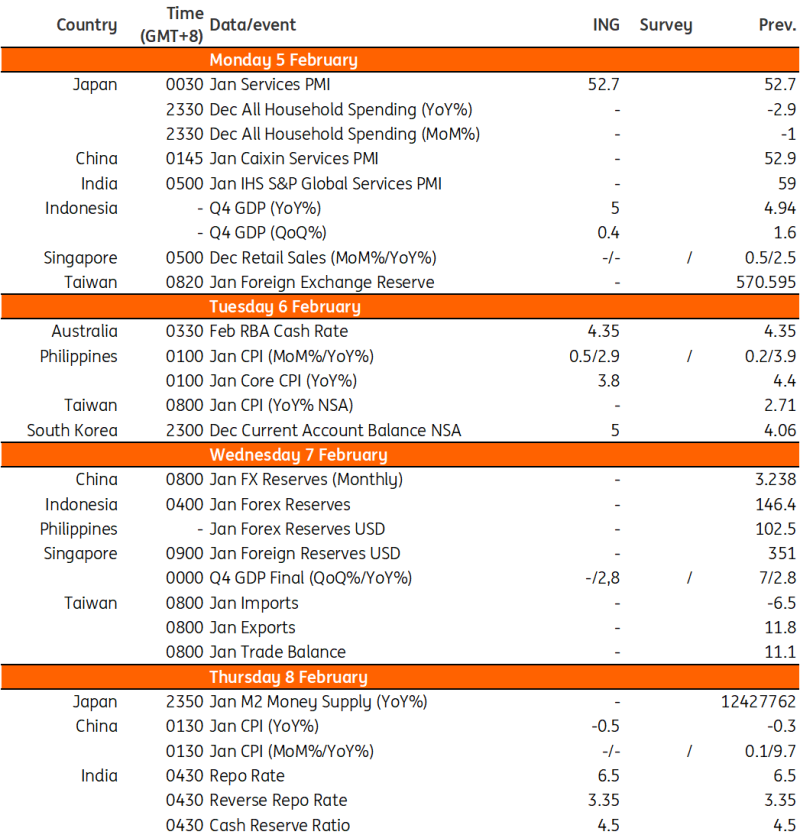

The RBI and RBA meet this week to decide on policy, and both are expected to pause.

Indonesia's GDP and regional inflation numbers form the biggest draws for this week.

Macro Data Calendar

No End in Sight For China's Market Troubles

Led by a rush to liquidate margin debt, China's leveraged stock positions had their steepest decline since the beginning of 2016.

On Monday, the total amount of outstanding margin debt dropped by 2.7%, the biggest drop since January 2016, when the stock market was experiencing a historic decline from its mid-2015 record high.

On Monday, the CSI 1000 Index dropped almost 6%, coinciding with a greater selloff for small-cap companies and the recent decline in margin trading.

Investors are worried that if share prices continue to collapse, they will be obliged to sell their positions even faster due to margin calls, which they have identified as the main cause of the present meltdown.

Leveraged deals fell to a year-low total of 1.42 trillion yuan ($197 billion).

To assuage investor concerns, China's securities regulator has stated that it will guide brokerages on how to modify margin call levels and keep liquidation lines flexible.

Margin calls have liquidated just 900 million yuan of leverage this year, according to the China Securities Regulatory Commission.

This accounts for approximately 0.06% of the overall volume of such financing.

In their efforts to stem the selloff, Chinese authorities are cracking down on domestic institutional investors by increasing trading restrictions.

Since Monday, certain quantitative hedge funds will be unable to place sell orders, and a channel that mainland investors use to short Hong Kong stocks has been restricted.