Table of Contents

Ethereum staking protocol Swell Network has released its mainnet today, in a “guarded” launch that will take place in four phases on the Ethereum mainnet.

Swell Network is the first liquid staking protocol to use atomic deposits where stakers stake ETH directly into the Beacon Chain. It is also the first-in-market protocol that allows stakers to select the node operators they wish to stake ETH with.

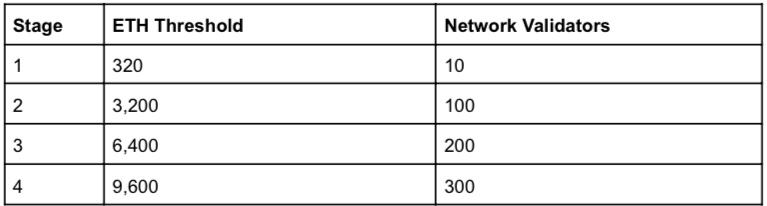

Phase 1 will begin on August 22 @ 00:00 UTC. Each phase will have a deposit limit and once the limit is reached, stakers won’t be able to stake until the next phase opens. After the fourth phase is complete, Swell Network will be uncapped and available for anyone to stake and/or become a node operator.

“The Mainnet Guarded Launch represents a major milestone for Swell Network’s next-generation liquid staking protocol offering. The Guarded Launch will provide an opportunity for a controlled and multi-

stage deployment into a fully open and permissionless protocol”, Daniel Dizon, co-founder and CEO of Swell Network, told Blockhead in a conversation ahead of the launch.

The Merge

Dizon also offered his insights on the broader implications of Ethereum’s upcoming merge, including its implications for the network itself.

“The merge will enable greater decentralisation by enabling more people to participate in Ethereum’s full PoS consensus mechanism,” he explained.

“It improves security as it will lead to higher rates of staking coupled with an expectation of a higher ETH price in fiat-denominated terms. Combined, this will significantly bolster the economic security of the blockchain by raising the capital bar needed to pose a material security threat to the system,” he said.

Dizon also noted that while the current PoW chain has been “creeping” towards centralization due to the presence of large mining pools, the centralisation of PoS actors will also become a concern as more capital flows into ETH staking. For now, he believes that the implication of the merge is not fully priced in, and that more upside should be expected for ETH.

“It’s expected that there will be a significant demand for ETH as the rewards from participation in ETH staking will be increasing significantly from priority fees and MEV (maximal extractable value) capture,” he said, adding that the increased demand and reduced issuance for ETH will result in a “structural upward pressure on price.”

No more “Ethereum killers”?

When asked about the impact of the Merge on other ecosystems, especially the ones currently dubbed “Ethereum killers” due to their higher scalability and lower gas fees, Dizon explained that the industry will always be a free market and that’s healthy for the broader ecosystem.

However, he expects that Ethereum’s merge will optimise the network for greater decentralisation and security, and it’s the right trade-off at the base layer to allow other players to build atop of it.

“Years ago when Ethereum was in its infancy (during PoW), there were builders and VCs attempting to capitalise on weaknesses within its roadmap for scaling operations and improving transactions needs,” he said.

“Following the merge, PoS will really give testament to Ethereum’s ability to execute multi-stage plans in parallel. As it continues to push forward as the dominant blockchain ecosystem, it will be harder for other players to ‘kill’ Ethereum,” he added.

Read more: Ethereum Merge Could Come Sooner Than Expected, But Will its Price Fall?