Table of Contents

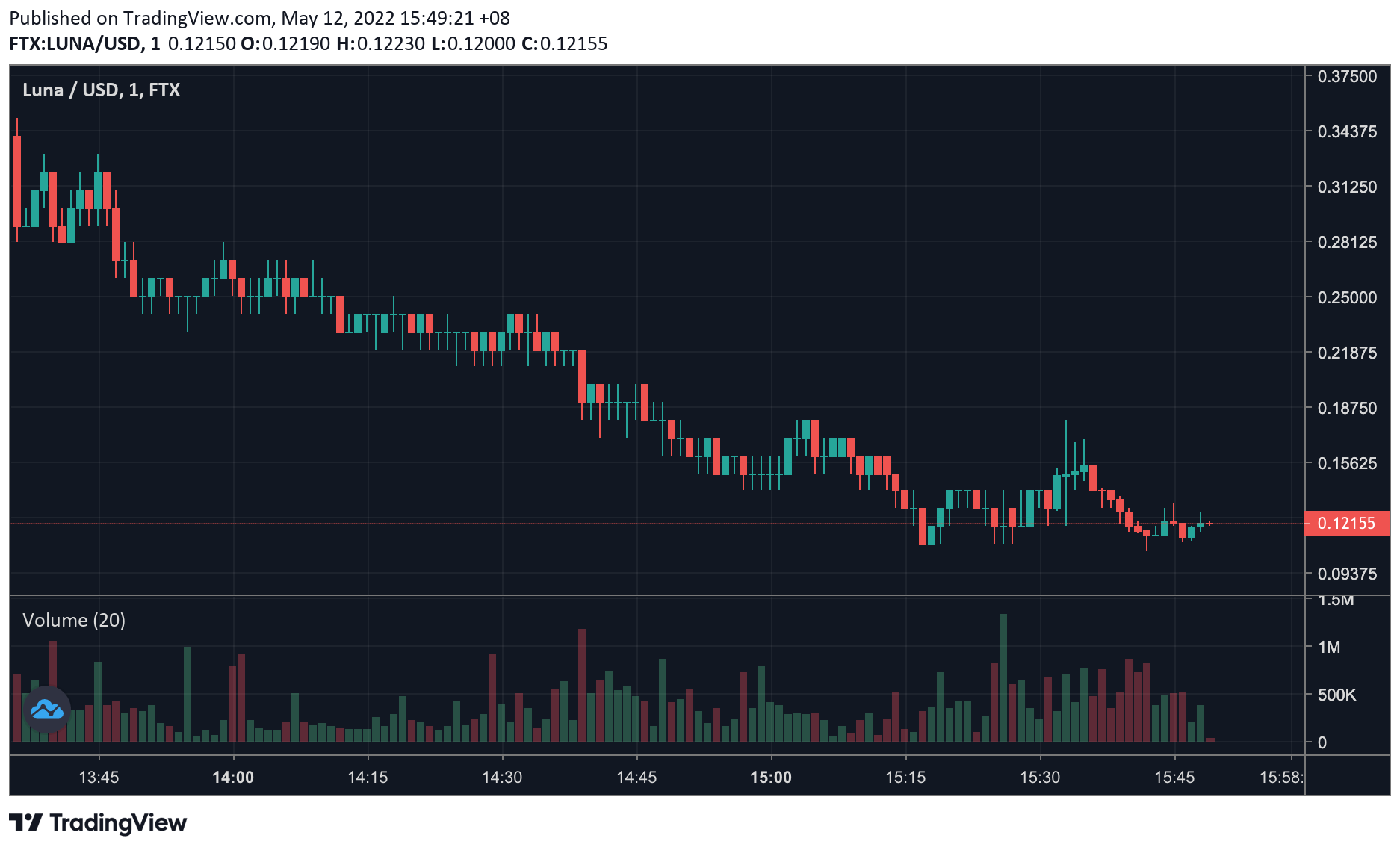

It’s been a sad week for LUNA holders. This time last week LUNA was worth north of US$87. At the time of writing, the stablecoin is worth a measly US$0.12.

The madness was triggered by the de-pegging of Terra USD from the US dollar earlier this week. Since, the cryptocurrency has been on a downward trajectory.

Read more: TerraUSD Just Depegged and Everyone’s Panicking – Should You Be Concerned?

Now, all eyes are on founder Do Kwon to see if the crypto veteran can re-stablise the stablecoin. In a series of tweets, the founder explained that “before anything else, the only path forward will be to absorb the stablecoin supply that wants to exit before $UST can start to repeg. There is no way around it.”

“Terra’s focus has always oriented itself around a long-term time horizon, and another setback this May, similar to last year, will not deter the #LUNAtics,” he continued. “Short-term stumbles do not define what you can accomplish. It’s how you respond that matters. Terra’s return to form will be a sight to behold. We’re here to stay. And we’re gonna keep making noise.”

1/ Dear Terra Community:

— Do Kwon 🌕 (@stablekwon) May 11, 2022

Citadel and BlackRock

Asset manager BlackRock and hedge fund giant Citadel Securities have been blamed by Crypto Twitter for being accelerating the downtrend.

It is believed that the giants collectively borrowed 100,000 BTC from Gemini to purchase UST with 25,000 BTC just to short the stablecoin, causing the market to crash and wipe out over US$25 billion in LUNA market value.

The pair then allegedly started dumping the remaining 75,000 BTC aggressively, and as BTC reached US$30,000, the firms began dumping UST to make it lose its peg.

Kwon and other UST whales were then forced to sell 25,000 BTC at a loss to recover the peg, ultimately dumping the price of BTC even further whilst BlackRock and Citadel were shorting it.

If the blackrock/citadel rumors are real…wowza pic.twitter.com/cADnrcv0Yv

— 🏴☠️Duck.loopring.eth🏴☠️ (@wenpayduck) May 11, 2022

A tweet from Gemini denied the claims, stating: “We are aware of a recent story that suggested Gemini made a 100K BTC loan to large institutional counter-parties that reportedly resulted in a selloff in $LUNA. Gemini made no such loan.”

Some still remained sceptical. Cardano founder Charles Hoskinson shared Gemini’s tweet, adding, “well shit, back to the drawing board then. Anyone else got anything?”

Well shit, back to the drawing board then. Anyone else got anything? https://t.co/i93g0fGvTF

— Charles Hoskinson (@IOHK_Charles) May 11, 2022

Citadel have since claimed the company “does not trade stablecoins, including UST” whilst BlackRock spokesperson Logan Koffler declared, “Rumors that BlackRock had a role in the collapse of UST are categorically false. “In fact, BlackRock does not trade UST.”