Table of Contents

It's actually happened. Changpeng Zhao (CZ) has actually stepped down. Sure, yesterday we shone a light on the Binance founder's uncertain fate, but we did not expect it to be written and sealed just one day later.

In case you missed it, the US Justice Department slapped a $4 billion fine on Binance. The hefty sum served as a resolution to the long-standing investigation into the world's largest crypto exchange. Market participants took to the news favourably, sending Binance's token, BNB, up over 8%.

However, as we stated yesterday, whilst the fine marked an end to this riveting chapter for Binance, CZ's fate was undetermined. CZ still faced charges in the US as the DOJ investigates alleged money laundering, bank fraud and sanctions violations.

Fast forward 24 hours, CZ has stepped down as CEO, pleaded guilty to anti-money laundering violations, and has agreed to pay a $50 million fine.

"I made mistakes, and I must take responsibility," he tweeted, announcing his decision to step down. "This is best for our community, for Binance, and for myself."

Today, I stepped down as CEO of Binance. Admittedly, it was not easy to let go emotionally. But I know it is the right thing to do. I made mistakes, and I must take responsibility. This is best for our community, for Binance, and for myself.

— CZ 🔶 Binance (@cz_binance) November 21, 2023

Binance is no longer a baby. It is…

Changpeng Ciao 👋

Whilst we weren't expecting to be reporting CZ's exit today, we can't say we're exactly surprised. Binance has been facing legal scrutiny for a good half of the year, and although much of the industry has found itself in the crosshairs of US regulators, the crypto exchange's concerns were far more troubling.

Regulators took issue with the likes of Ripple and Coinbase but their concerns were rooted in debatable definitions of how crypto should be classified. The SEC vs Ripple or the SEC vs Coinbase were just the SEC vs crypto in disguise. This was not the case for Binance. Instead, US regulators took issue with how Binance allegedly laundered money, committed bank fraud and violated sanctions.

As the world's largest crypto exchange, Binance is a pillar of the industry; a pillar built on questionable financial ethics. With Bitcoin ETFs on the verge of approval from the SEC, the crypto industry urgently needed to tidy up.

Back in June, Ikigai Asset Management founder Travis Kling highlighted how there is "no chance" of Bitcoin ETFs being approved with Binance in its current position of market dominance.

"If this ETF is approved, Binance is either gone entirely or their role in price discovery is massively diminished. If Binance holds on to its current level of influence, no chance this ETF is approved," Kling stated.

Lots of chatter on this Blackrock #Bitcoin ETF. And rightfully so. Blackrock more or less IS is the US government. They’ve also received approval on 575/576 of ETF applications.

— Travis Kling (@Travis_Kling) June 16, 2023

One thing I’ll say- there is no chance, and I mean zero, that this ETF is approved with Binance in…

CZ's exit is essentially proof of Kling's fable unfolding. With the "control" person behind Binance's operations now gone, faith in the crypto industry is gradually becoming restored, at the behest of regulators. Compliance is key and the market couldn't be more supportive.

I've NEVER BEEN more BULLISH 🐂 on a #Bitcoin ETF than I am now.

— Jesse (@Micro2Macr0) November 21, 2023

They said that @Binance will work with regulators to stay in compliance from here on out. And that this wasn't an attack on the crypto sector, but work to move the biggest exchange into compliance.

Why would they… pic.twitter.com/ATS7xVEgS6

Binance has clearly felt the pressure to fix up and look sharp too. Over the past few months, a slew of executives have jumped ship.

Here is a list of top executives who have left Binance in recent months:

- Jonathan Farnell - Chief of Binance's UK arm and CEO of its payments subsidiary Bifinity

- Stéphanie Cabossioras - General Manager of Binance France

- Vladimir Smerkis - General Manager of the CIS region

- Gleb Kostarev - Regional President for Eastern Europe, the CIS, Turkey, Australia, and New Zealand

- Leon Foong - Head of Asia Pacific

- Patrick Hillman - Chief Strategy Officer

- Han Ng - General Counsel

- Brian Shroder - Binance.US CEO

- Mayur Kamat - Binance's global head of product

Most of these executives cited "personal reasons" and a "well-deserved break" for leaving the exchange. With regulators breathing down Binance's neck, now seems an inconvenient time to take a personal break.

Richard Who? 🕵️

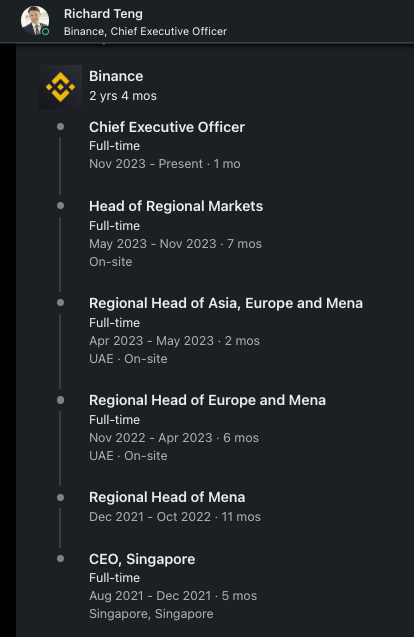

Described by CZ as "a highly qualified leader with over three decades of financial services and regulatory experience," Richard Teng will be taking the helm at Binance.

Teng is a name most might be unfamiliar with unless you're Singaporean and are somewhat in touch with regional crypto happenings.

The Singaporean's impressive career began at the Monetary Authority of Singapore (MAS), where he served as a Corporate Finance Director. In his own words, Teng was involved in "broad-ranging transformation of Singapore's financial services sector in the late 1990s, spearheading efforts to develop private banking and capital market sectors."

Teng then shifted from one Singaporean government entity to another, taking on the role of Chief Regulatory Officer at SGX. Seven years later, in 2015, Teng left the Little Red Dot for the scorching desert sun of Dubai, where he served as CEO of Abu Dhabi Global Market (ABDM).

Likely getting his first taste of digital assets and crypto in Dubai, Teng returned to Singapore after a six-year stint in Dubai to bring his expertise back home. He quickly became heavily involved in the Web3 scene in Singapore, becoming an Advisory Board Member of the Blockchain Association of Singapore.

Before long, Teng's talents were noticed by Binance, which appointed him as CEO of its Singapore arm. As if the Singapore CEO role wasn't enough, Teng rapidly climbed the Binance corporate ladder to Regional Head of Mena to Regional Head of Europe and Mena to Regional head of Asia, Europe and Mena, to Head of Regional Markets, and finally, CEO.

Singapore to The Rescue 🇸🇬

In his obligatory LinkedIn update, the Singaporean announced his appointment as Binance CEO as "an honour" through which Binance can "continue to meet and exceed the expectations of stakeholders while achieving our core mission, the freedom of money."

"To ensure a bright future, I intend to use everything I’ve learned over the past three decades of financial services and regulatory experience to guide our remarkable, innovative, and committed team," he said.

Teng pledges to focus on instilling confidence in users regarding the company's financial robustness, collaborating with regulators, and fostering growth in Web3.

It's not the first time we've seen a Singaporean take the helm of a Chinese tech titan facing US regulatory scrutiny. Singapore Shou Zi Chew was appointed CEO of TikTok in 2021 as ByteDance faced increasing US regulatory pressure. Earlier this year, Chew testified in Congress before the House Energy and Commerce Committee, which notoriously went viral due to Congress's painfully embarrassing questions ranging from WiFi to batteries to electricity.

Of course, TikTok is a completely different beast to Binance but perhaps Singaporeans should be proud to be called upon at times of crisis.

What Next For CZ?

Alongside his fine and resignation, CZ has been banned from operating or managing the business for 3 years. Not that he needs the money.

But fret not dear CZ, the world is still your oyster. Prior to his Binance days, CZ showed prowess in volleyball competitions and even served as a volleyball referee. Maybe life as a referee again will give CZ a taste of the regulatory life.

Alternatively, taking up martial arts could be a good new pastime. After all, CZ did do well in fending off regulators for the longest while.

Elsewhere