Table of Contents

Michael Sonnenshein, CEO of Grayscale, is stepping down and will be replaced by Goldman Sachs' head of strategy, Peter Mintzberg.

Minztberg will officially take the helm on 15 August 2024. CFO Edward McGee will lead the company on an interim basis until Mintzberg fills the role.

This year marks Sonneshein's tenth year at Grayscale. Serving as CEO since 2021, Sonnenshein is credited for bringing Bitcoin ETFs to the market.

"The crypto asset class is at an important inflection point and this is the right moment for a smooth transition. I wish the Grayscale team every success in its next chapter.” Sonnenshein said.

"Michael guided Grayscale from $60 million to ~$30 billion of assets under management and through its historic court victory against the Securities and Exchange Commission, which enabled Grayscale to uplist the first spot Bitcoin ETF to NYSE Arca alongside the largest players in traditional finance," said Barry Silbert, Founder & CEO of Grayscale's parent group, DCG.

1/ As we position @Grayscale for its next phase of growth, excited to welcome Peter Mintzberg as Grayscale’s CEO, effective August 15. Joining from Goldman Sachs, Peter has 20+ years of experience across prominent asset managers, including BlackRock, OppenheimerFunds & Invesco…

— Barry Silbert (@BarrySilbert) May 20, 2024

Mintzberg brings over 20 years of experience from leading asset management firms, including roles at Goldman Sachs, BlackRock, OppenheimerFunds, and Invesco. He is known for developing and leading growth strategies.

“Peter is an exceptional strategic leader with global expertise across the most prominent asset managers, which are critical ingredients as we position Grayscale for its next phase of growth,” Silbert said.

Mintzberg said he "admired" Grayscale's position as a "leading crypto asset management firm."

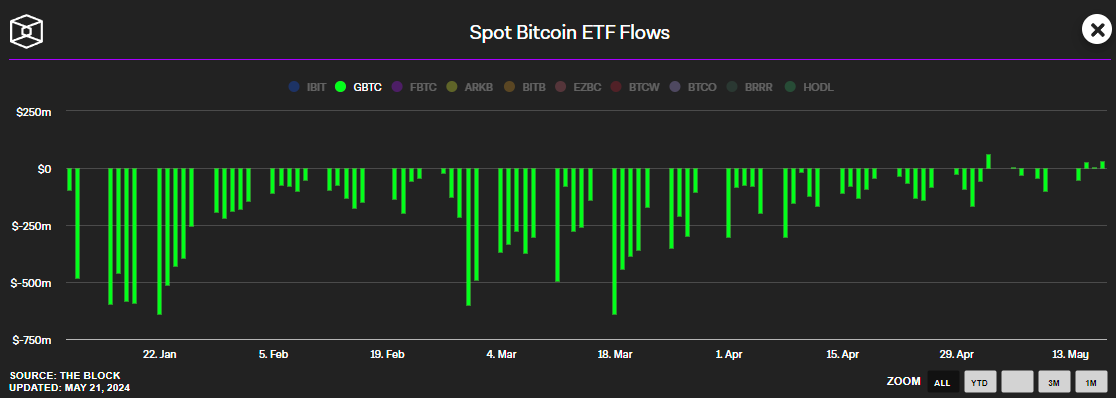

Grayscale's Bitcoin ETF (GBTC) has the largest AUM among its peers, holding $24.33 billion. The fund has seen about $17.4 billion in outflows but has enjoyed a handful of net inflow days this month.

Institutional crypto adoption has ramped up, with the likes of Morgan Stanley recently reporting a holding of $269 million in GBTC, making it the third largest holder of GBTC. The Wisconsin Investment Board also purchased over 1,000,000 shares of GBTC for a total value of $63.7 million.

DCG saw its revenue jump 51% year on year and 11% over the quarter, despite Grayscale's flood of Bitcoin ETF outflows. DCG's revenue came in at $229 million, while Grayscale accounted for $156 million of its first-quarter 2024 revenue.