Table of Contents

After much anticipation, this week marks the fourth round of Bitcoin halving. Miners are getting rewarded less but so are Bitcoin bulls apparently, as the world's largest cryptocurrency has done diddly squat since the halving.

Consequently, Bitcoin's price has faltered back down to the $64K mark but largely moved sidewise. Ethereum is also closer to $3K than $4K. Overall, a rather anticlimactic week for such a hyped event in the crypto calendar.

The market has long assumed the Bitcoin halving was already priced in. It's not like the event sprung up on us; the event was scheduled since Bitcoin's inception.

Although Bitcoin and Ethereum prices have failed to capture the attention of crypto fans, drama over at the SEC might. Everyone's favourite regulator has been busy handing out Wells Notices but has also become the recipient of lawsuits and scrutiny from even the US government.

If that isn't juicy enough for you, how about a Binance executive who will be celebrating his 40th birthday from inside a Nigerian prison as the world's biggest exchange is accused of crashing the country's national currency?

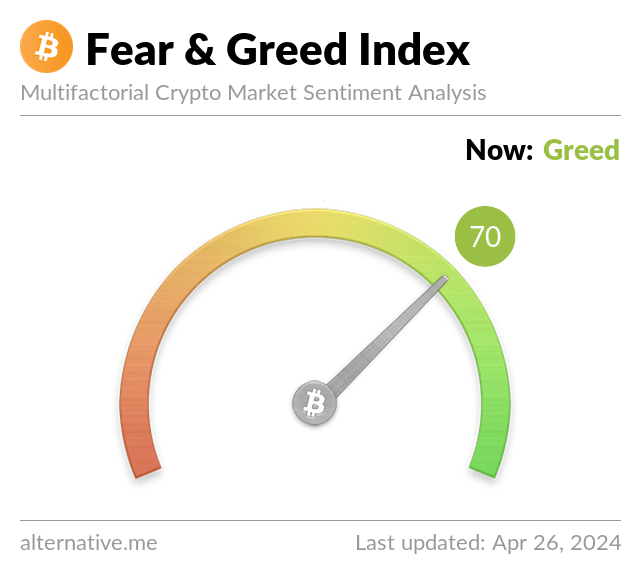

Meanwhile, risk appetites on the Fear & Greed Index have risen from 66, "Greed", to 70, also "Greed."

The Fear & Greed Index uses 5-6 measurements to assess the current sentiment of the market and then rates that level of emotion on a scale of 1-100 – 1 is extreme fear and 100 is extreme greed.

But what happens next? Luckily for you, the bright minds at Blockhead's brn already predicted that Bitcoin halving would be a "non-event" and have geared themselves up for upcoming price movements.

“Firstly, the put/call ratio of .70 (volume) indicates that some investors are hedging their positions against expected volatility surrounding the halving. This cautious approach suggests that while optimism exists, investors are also preparing for potential market swings,” a brn analyst explained.

“Moreover, the upcoming options expirations on April 26 and May 28, occurring one and five weeks after the halving, add to the uncertainty. Options expirations often lead to increased market volatility as traders adjust their positions, potentially amplifying price fluctuations during this period.”

To find out how these indicators will affect the performance and prices of digital assets, subscribe to brn for early access. Ahead of the launch, newsletters featuring detailed insights will be free.

Bitcoin Halving's Aftermath: Glass Half Empty or Half Full?

Bitcoin's big day has come and gone but like most events in the crypto calendar, the build-up was far more exciting than the aftermath. Binance CEO Richard Teng, AsiaNext CEO Kok Kee Chong, Metalpha's senior analyst Lucy Hu, and Blockhead's brn analysts offer their take. We know whose advise we'd trust.

Grayscale Sets 0.15% Fee for Mini Bitcoin ETF Spinoff - the Lowest Among Peers

Grayscale has revealed that a 0.15% fee will be offered for its spinoff fund, the Bitcoin Mini Trust (BTC).

Grayscale's Bitcoin Trust (GBTC) is the current leader in terms of AUM among its Bitcoin ETF peers but also has the highest fee of 1.5%. Grayscale's Bitcoin Mini Trust will offer the lowest fee, undercutting Franklin Templeton's EZBC fee of 0.19%.

SEC Claims Jurisdiction as Justin Sun Livestreamed From US to Promote Tron

The U.S. Securities and Exchange Commission (SEC) has amended its filings against Tron founder Justin Sun on the grounds of jurisdiction. In March 2023, the SEC alleged that Sun sold unregistered securities – a familiar charge faced by the wider crypto industry.

The SEC has amended its complaint to highlight that Sun travelled "extensively" to the US to market Tron, BitTorrent and Rainberry.

Katherine Ng's Katashe Solutions Launches as Asia’s First Web2, Web3 Hybrid Venture Builder

Asia's first Web2 and Web3 hybrid venture builder, Katashe Solutions, has officially launched with key clients.

Co-founded by blockchain industry veteran Katherine Ng, Katashe brings "traditional technology paradigms" into Web3.

Even the US is Calling Out SEC's 'Abuse of Power' on Crypto, Resignations Triggered

The SEC has long been at loggerheads with the crypto industry. From battles with longstanding battles against Coinbase and Ripple, the SEC has served as the thorn in the industry's side for many years. But it now seems that even the US legal system is fed up with the SEC's power flex and its “gross abuse” of power.

Binance Exec Will Spend His 40th Birthday in Nigerian Prison as Bail Hearing Postponed

Binance executive, Tigran Gambaryan, will remain in Nigerian custody until 17 May 2024, spending his 40th birthday behind bars.

US Citizen Gambaryan, who serves as Binance's Head of Financial Crime Compliance, will have his bail hearing postponed until after he is tried on money laundering charges.

Worldcoin to Increase WLD Supply by 19% in 6 Months Through Institutional Sales

Worldcoin will increase its supply of WLD tokens by up to 19% in the coming six months as it sells to non-US institutions.

World Assets, the subsidiary of the Worldcoin Foundation in charge of token issuance, will sell 0.5 million to 1.5 million WLD ($8.2 million) every week through "private placements to a select group of institutional trading firms operating outside of the US."

SEC Wants $5.3 Billion From Terraform Labs, Do Kwon

The US Securities and Exchange Commission (SEC) is seeking $5.3 billion from Terraform Labs and its founder Do Kwon.

$4.7 billion comes from Terraform Labs and Do Kwon's disgorgement and prejudgment interest, while additional civil penalties of $420 million and $100 million are being sought respectively.

Crypto Bro Culture Returns: Coinbase's $15M NBA Ads, Adidas' Metaverse, Man City's OKX NFTs

With Bitcoin ETFs re-igniting the flame of crypto, the industry is breathing new life, powered by TradFi funds. US institutions are clambering over each other for crypto exposure while TradFi firms are eagerly waiting at their gates for their respective regulators to trigger the green light.

But as institutional giants flood the crypto market with TradFi money, is the focus on retail being diluted too? Is crypto bro culture being drowned out by Wall Street bros?

Web3 is still dude-centric as Coinbase, Adidas, Manchester City, and OKX perpetuate crypto bro culture.

Changpeng Zhao Faces 3 Years in Prison After Binance Allowed Hamas, ISIS, Al Qaeda Transactions

US prosecutors are seeking a three-year prison sentence for former Binance CEO Changpeng Zhao (CZ) after he pleaded guilty to violating anti-money laundering laws.

Prosecutors filed the request on Tuesday in a Seattle federal court, arguing that imposing double the maximum 18-month sentence recommended by federal guidelines would reflect the severity of Zhao's crimes and serve as a deterrence.

Hedera’s HBAR Pumps Then Dumps Amid BlackRock Misunderstanding

Hedera has managed to pump and dump its own token, HBAR, after sending a misguided tweet about tokenizing with BlackRock

On Tuesday, HBAR foundation announced that the firm was making "RWA history as BlackRock's ICS US Treasury money market is tokenized on Hedera with Archax and Ownera."

Hong Kong Bitcoin, Ethereum ETFs Start Trading on 30 April

Spot Bitcoin and Ethereum ETFs will commence trading next week according to three asset managers.

On Wednesday, the Hong Kong branches of China Asset Management, Harvest Fund Management, and Bosera Asset Management announced their intention to launch their ETFs by 30 April.

Meta Reduces Metaverse Loss But Stock Price Plummets Anyway

Meta has disappointed Wall Street in its latest earnings report, causing its stock price to wipe out $200 billion in market cap after hours.

Mark Zuckerberg's tech giant revealed it plans to increase spending, scaring the market. Meta plans to up spending from an earlier prediction of $30-$37 billion to $35-$40 billion in 2024.

Nonetheless, Meta actually beat expectations on earnings. First-quarter revenue rose 27% to $36.46 billion, beating analysts' expectations of $36.16 billion.

Is Bitcoin Behaving Like a Boring Traditional Asset?

The largest cryptocurrency is stuck in a range despite the halving event. With much of its market hype driven by ETF approvals, has Bitcoin become more of a traditional asset snooze fest?

Broadly, the newsflow on the ebb and flow of when the Fed will cut rates has driven markets in recent months, with the trading in cryptos mirroring those moves.