Table of Contents

Welcome to Blockhead's Daily Digest, your go-to source for the latest and most exciting news in the world of cryptocurrency. Our mission is to provide our subscribers with accurate, insightful, and timely coverage of the rapidly evolving crypto space.

Crypto spring is warming up as Fahrenheit has sealed a hot deal to acquire insolvent crypto lender Celsius Network.

The Blockchain Recovery Investment Consortium, which includes Van Eck Absolute Return Advisers Corporation and GXD Labs LLC, was selected as the backup.

To finalize the deal, Fahrenheit must pay a deposit of $10 million within three days. Fahrenheit will inherit Celsius's institutional loan portfolio, staked cryptocurrencies, mining unit, and additional alternative investments. More about the terms of the winning bid by Fahrenheit here.

The new company will receive a scorching sum of $450 and $500 million in liquid cryptocurrency and US Bitcoin Corp will ignite the construction of various crypto mining facilities, including a blazing 100-megawatt plant.

Celsius froze withdrawals in June 2022 when plummeting crypto prices triggered a withdrawal frenzy, revealing the platform's chilling liquidity issues. Its collapse foreshadowed the deep freeze that would engulf the crypto industry.

On to Friday's toasty update:

JUST IN: 🇨🇳 China's Central Television network just broadcasted the news that Hong Kong is allowing retail investors to buy #bitcoin

— Bitcoin Magazine (@BitcoinMagazine) May 24, 2023

China is quietly allowing it again... 👀 pic.twitter.com/M2qy6ig7x0

- Hong Kong's crypto scene took center stage in a recent clip aired by CCTV, China's major broadcaster, and observers are saying it could suggest a softer stance towards digital currencies in China. Following the segment, Binance CEO Changpeng Zhao stating “CCTV just broadcast crypto. It’s a big deal. Chinese-speaking communities are buzzing. Historically, coverage like this led to bull runs.” However, the euphoria was short-lived, as Chinese authorities appear to have taken down the link just two days after the program aired.

- ChatGPT founder Sam Altman's Worldcoin project has announced the completion of a $115 million Series C round led by Blockchain Capital, with participation from a16z, Bain Capital Crypto, and Distributed Global. The startup wants to create a global blockchain-based identification system using iris scans. Funds from this round of financing will be used to accelerate the development and growth of the Worldcoin project and the World App. The news comes as a black market for Worldcoin credentials has emerged in China.

- Multichain, a blockchain bridge project, has experienced technical issues and a lack of communication from its team, leading to concerns and rumors of arrests in China. Users reported transactions getting stuck, and the project acknowledged the problem, citing a longer-than-expected back-end node upgrade. However, subsequent updates have been scarce, fueling speculation and unease. The situation has raised concerns not only for Multichain but also for Fantom, which has close ties to the project. The Fantom Foundation withdrew a significant amount of liquidity from SushiSwap, and other large holders have started selling off Multichain tokens. Binance has also suspended deposits for bridged Multichain tokens until further clarification is provided.

- Nike's .SWOOSH Web3 platform has launched its first NFT sneaker collection, generating over $1 million in sales of digital sneakers, despite persistent delays and technical issues.

- Circle has officially launched a euro-backed stablecoin, Euro Coin, on Avalanche. "Launching Euro Coin on Avalanche increases euro liquidity and simplifies the user’s transactional experiences of an app built on Avalanche, and fills the absence of a trusted and fully-reserved native euro stablecoin," the company said in an announcement on Thursday.

Even Singapore is Crypto-Friendly Compared to the US

Can Singapore provide refuge to American crypto firms? CakeDefi, Ripple, RockX and StraitsX seem to think so....

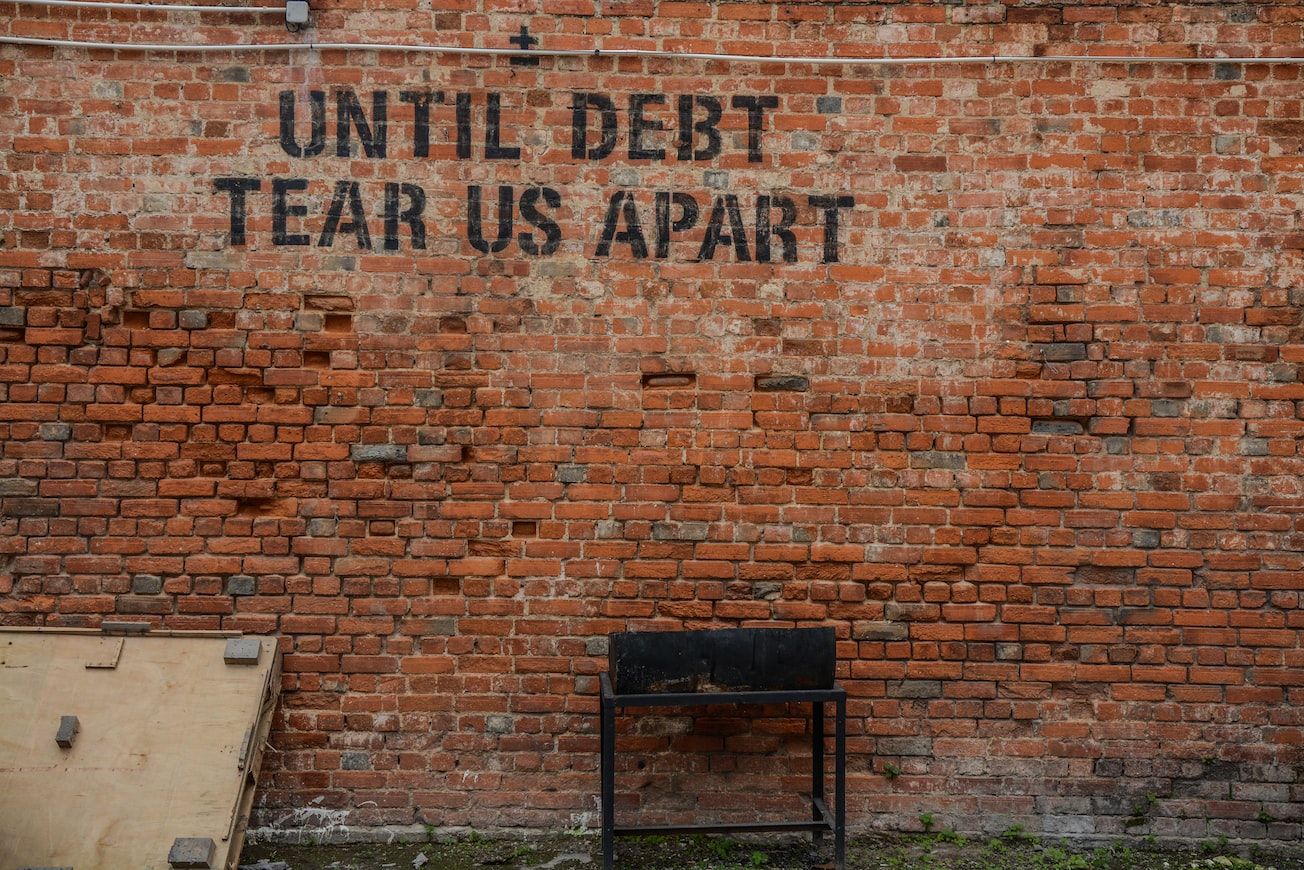

Not US Debt Default, But Fed Path to Drive Crypto

Something had to break from the US Federal Reserve's aggressive rate hikes over the past year or so. And it did.

Blockcast 25: The Future is Scary – Worldcoin & an AI Explosion

This week, we discuss ChatGPT founder Sam Altman's cryptocurrency Worldcoin, Hong Kong's opening of the retail crypto market, and the hype surrounding new memecoins.

Blockhead sits down with Circle VP for strategy and policy, APAC, Yam Ki Chan, to discuss outlook, the SEC, CBDCs, APAC and crypto prices

That's all for today. If you're not subscribed to our newsletters, please do so for access to member-only articles, like the one above, and more.