Table of Contents

Ah Monday... Everyone’s favourite day of the week. Whilst you were all living it large this weekend, Blockhead was busy keeping up with the ever tireless world of crypto. Here’s what you missed, and what to look forward to in the week ahead, condensed as Blockhead Brief. As ever, if you’re here from a friend, subscribe now.

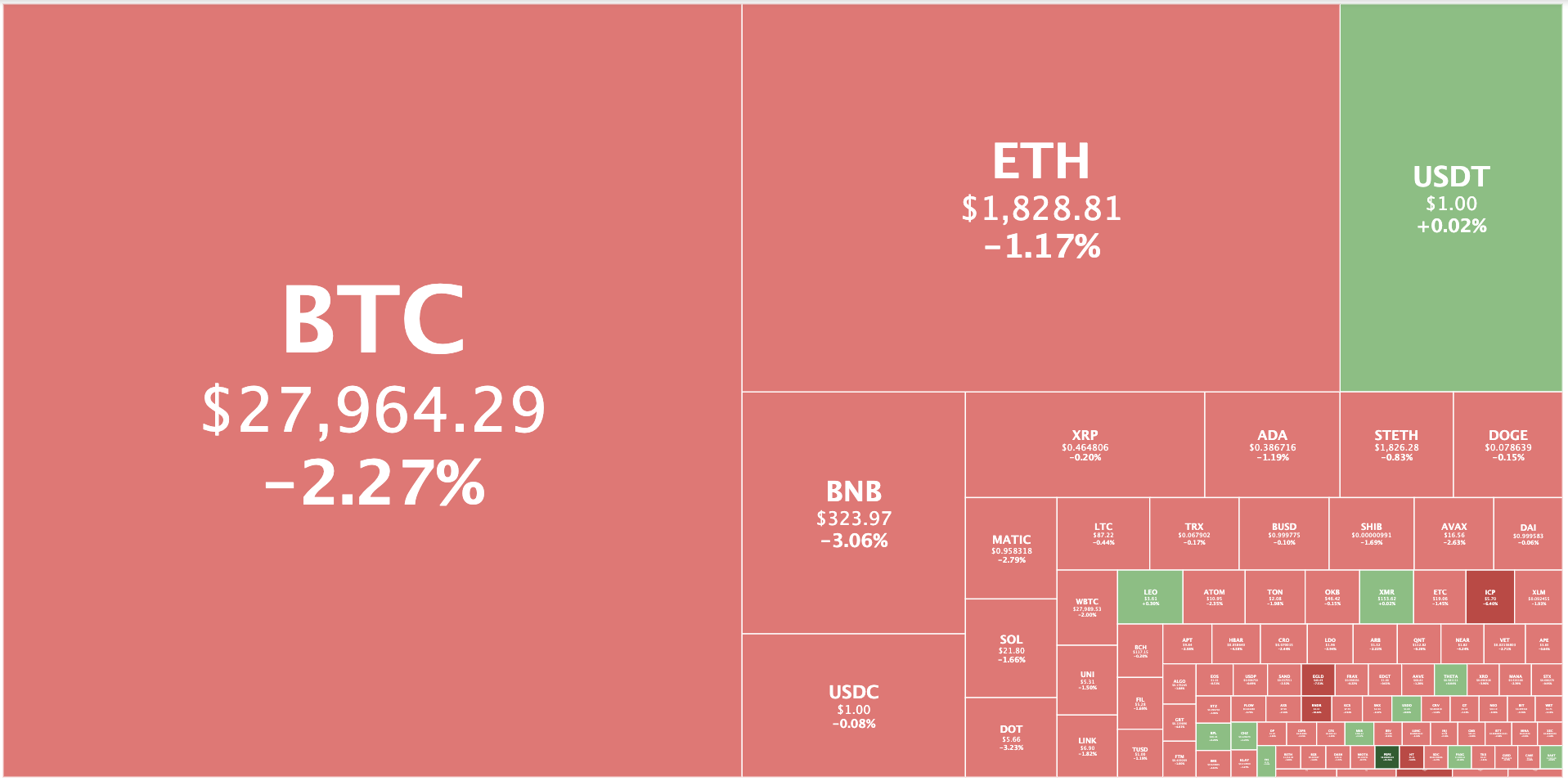

We trust you had a great long weekend because cryptocurrencies certainly didn't. Bitcoin and other leading cryptocurrencies lost their week's advances, with the world's leading crypto currently sitting at around US$27,900, down over 5% over the past five days. Ethereum is down more than 4% over the same period, positioned at just under $1,830.

The altcoin market mirrored the trajectory of its blue-chip counterparts over the past five days – Cardano (ADA) is down 6%, Litecoin (LTC) is down 3%, Binance Coin (BNB) is down 2%, and Polkadot (DOT) is down 4%.

First Republic Bank's Closure Signals Broader Issues Beyond Cryptocurrency

US regulators seized First Republic over the weekend, and JP Morgan quickly swooped in to acquire most of the bank's assets and deposits, while the FDIC is coughing up around $13 billion to cover the bank's failure.

The closure of First Republic Bank is an alarming development that highlights broader issues in the banking sector beyond digital assets and cryptocurrency. Regulators and analysts have suggested that the bank's collapse was not linked to crypto, given that it had minimal if any, exposure to the asset class.

First Republic's collapse follows three other bank closures this year: Silvergate Bank, Silicon Valley Bank, and Signature Bank. The Federal Deposit Insurance Corporation (FDIC) linked Silvergate's failure to its heavy reliance on crypto, which it deemed a risky business model. The agency suggested that Signature Bank's demise was related to crypto-market-related fears that triggered a run. Signature Bank and Silvergate were seen by the public and the media as "crypto banks," which likely intensified the runs on the institutions.

Related: Silvergate Becomes First US Bank Casualty of FTX Collapse

In contrast, First Republic Bank's closure has no connection to cryptocurrency, and its collapse is a testament to the broader problems that the banking sector faces. The bank's minimal exposure to digital assets implies that it was not reliant on crypto, and its demise highlights other pressures that banks face in the current economic climate.

While regulators have pointed fingers at digital assets and crypto for previous bank failures, First Republic's closure indicates that the industry's issues are more profound and require more comprehensive solutions.

Related: Silicon Valley Bank's Collapse Underscores Risks From Rising Cost of Money

4 Years in Jail for Bitcoin Thief

A Bitcoin thief has been sentenced to four years in prison in the US. Gary Harmon allegedly stole 713 Bitcoin from a computer seized by the government in a case against his older brother Larry Harmon.

In April 2020, the Ohio man used his brother's credentials to recreate eight Bitcoin wallets stored on a device in an Internal Revenue Service evidence locker. A total of 4,877 digital tokens were seized from Larry when he was charged in February 2020 with laundering $311 million in crypto transactions on Darknet sites.

After agents realized the Bitcoin was missing from the seized device, they soon discovered a photo of Gary on his cellphone showing him in a bathtub at a nightclub filled with dollar bills.

Gary allegedly used 68 Bitcoin as collateral for a $1.2 million loan and spent some. of it to buy a luxury condo in Cleveland.

The accused lawyer claimed Gary's actions were no different from obtaining a key to a safe deposit box and taking its content. Prosecutors felt differently, likening Gary's actions to tunneling into a bank vault and siphoning out funds whilst law enforcement was trying to access the bank's front door.

Gary pleaded guilty in January, agreeing to forfeit cryptocurrencies and property worth over $20 million. His brother pleaded guilty in 2021 and is awaiting sentencing.

Sotheby's Launches On-Chain NFT Marketplace for Secondary Art Sales

Sotheby's, one of the oldest and largest auction houses and brokers of art, collectibles, jewelry, and real estate globally, has launched a portal on its Sotheby’s Metaverse platform that enables peer-to-peer secondary sales of NFT artwork through automated smart contracts, with payments in Ethereum or MATIC. The NFTs are minted on Ethereum and Polygon, with Sotheby's offering a rotating, curated selection of leading artists for collectors to make offers on.

The platform's secondary sales section is designed to pay secondary on-chain royalty fees specified by artists. Sotheby's Metaverse is powered by Mojito, an NFT tech and commerce suite developed by Serotonin, which Sotheby's became an early investor in last year.

Sotheby's has been actively involved in the NFT/digital art space in recent years. The auction house made headlines in March 2021 when it announced it would be accepting Bitcoin and Ether as payment for Banksy's artwork "Love is in the Air" at an upcoming auction. In May 2021, Sotheby's sold an NFT artwork by digital artist Pak for over $16 million, and it has since held several other NFT auctions, including one featuring artwork seized from the bankrupt hedge fund Three Arrows Capital. Sotheby's also launched its own NFT platform, Sotheby's Metaverse, in October 2021, which allows for the sale of digital art and other collectibles in a virtual environment.

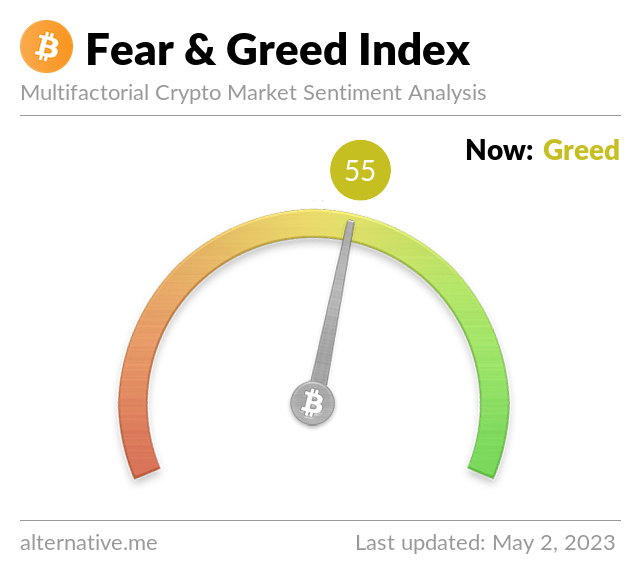

Fear & Greed Index

The Crypto Fear and Greed Index uses 5-6 measurements to assess the current sentiment of the market and then rates that level of emotion on a scale of 1-100 – 1 is extreme fear and 100 is extreme greed.

Risk appetites in crypto have intensified since last week, moving from "neutral" to "greed." Since late January, sentiment had hovered in the 40s to 60s, following four straight months of being in the 20s.

SUMMIT X 2023

TechStorm is hosting SUMMIT X - APAC's iconic, power-packed business conference for global thought leaders, billion-makers, innovators, esports & tech start founders. Attendees from regional businesses, enterprises across Deep tech, innovation, Web 3, Metaverse, blockchain, Esports, Sports 3.0, finance and fintech, are expected.

Founders are welcome to meet and pitch to qualified investors with more than US$1 Billion asset-under-management (AUM) already committed in attendance. Meet the financiers behind the region’s SPAC listings, IPOs in Singapore SGX, US NASDAQ and NYSE and Australia ASX.

When: 8:30am to 7pm on Thursday, 27 April 2023

Where: Pan Pacific Singapore 7 Raffles Boulevard Singapore, 039595

More info: Summit X 2023

Fireside chat on web3 security and market performance of tokens

Featuring Liz Steininger, CEO of Least Authority, and professor David Lee, chairman of Global Fintech Institute, the talk will focus on security improvements and help developers to take corrective measures to generally improve the applications (dApps) and blockchain networks beyond the security of their users' funds and data.

When: 6-8:30pm on Wednesday, 3 May 2023

Where: 80RR Fintech Hub SG 80 Robinson Road #08-01 Singapore, 068898

More info: Security and Its Impact on the Market Performance of Tokens

Others

Pitch! Regtech

Pitch! Regtech, held in Singapore on 25 May, will bring together the Regtech community, from practitioners looking for the latest tech to investors that bring the capital to take innovators to the next level. This event will provide insights to risk and compliance professionals in financial services firms (banks, asset managers, exchanges) on the types of Regtech solutions available, from the recently incubated to the well-established.

Members from financial institutions, trading firms, exchanges, regulators, market infrastructures, industry bodies, and academia can attend for free. However, due to limited seating, tickets will be by application. Please submit your details here.

For more information, please visit event website HERE.

Blockhead is a media partner to the event.