Table of Contents

After a year of plummeting crypto values, bankruptcies, and corporate scandals, bitcoin entered a dark midwinter at the turn of the year.

In a matter of months, bitcoin has regained its former glory. It has outperformed other major assets this year, gaining more than 70%, and on Wednesday it was trading around its highest level in nine months.

Bitcoin has seen its share of spectacular price spikes and plunges throughout its 15-year lifespan.

The latest surge in the largest and most popular cryptocurrency is being fueled by interest rates.

Bitcoin and other risky assets are expected to rise in value as the market anticipates that central bank interest rate rises are nearing their peak.

At least the US Federal Reserve is. The Fed sounded close to calling time on interest rate hikes on Wednesday.

Noelle Acheson, an economist who has tracked the crypto sector for seven years said, "the macro narrative is the number one. Bitcoin is not just a risk asset, it is arguably the most sensitive to monetary liquidity out of all of the risk assets."

There are other elements at play, such as the instability in the banking industry and the persistent, but so far unrealized, expectations that bitcoin will become widely used as a means of payment.

For now, though what central banks do is likely to be a significant driver of digital assets.

As predicted, the Fed hiked its benchmark funds rate by 25 basis points, but it changed its rhetoric about the need for "ongoing increases" to the need for "some additional" hikes as it observes the effects of shaky bank confidence on the economy.

Just a 50% possibility of one additional price increase is implied by futures contracts.

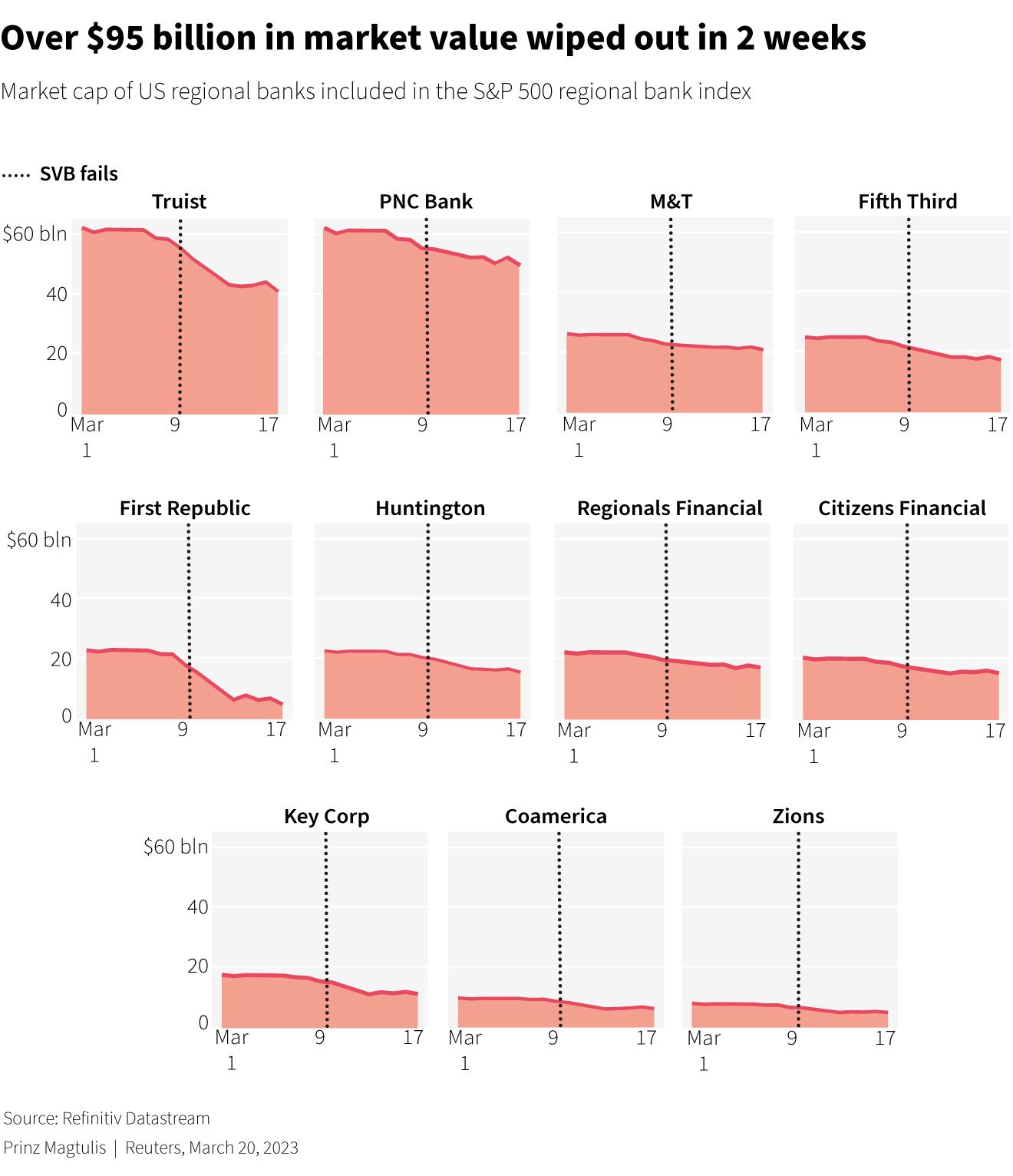

The failure of SVB set off ten days of turmoil in the banking industry, which culminated in the weekend buyout of Credit Suisse by competitor UBS for 3 billion Swiss francs ($3.2 billion).

After the Fed move, Thursday saw the dollar fall to near seven-week lows as US bond rates plummeted.

But, the dollar recovered some of its losses as US Treasury Secretary Janet Yellen told Congress that she hasn't examined or discussed blanket protection for depositors, bank stocks fell and investors became nervous again.

At this time, the majority of banking attention is being directed towards regional banks in the United States, where the risk of a widespread depositor panic remains particularly high.

Federal Reserve Chair Jerome Powell said that deposit flows have stabilised over the past week, and smaller lenders have reported feeling reassured by Yellen's comments that deposit insurance would be considered if there were a contagion risk.

According to Brian Daingerfield, head of G10 FX strategy at NatWest Markets, the shift in tone from the Fed reduces the likelihood that markets would fear that solid economic data will lead to further and further rate rises.

Bitcoin's Moves Ahead

Despite the Fed news, Bitcoin fell on Wednesday, down about 7% from its peak this year of US$28,936 on March 22.

That was largely after a series of US Securities and Exchange Commission lawsuits over crypto promotion put a dampener on digital assets.

But in recent weeks, claims that bitcoin is resistant to hazards in traditional finance have gained traction after the failure of US lenders Silicon Valley Bank and Signature Bank contributed to sparking the purchase of 167-year-old Credit Suisse by competitor UBS on Sunday.

According to analysts, retail investors from the general public have been the primary force behind bitcoin's price appreciation.

Pension funds and other institutional investors are likely to remain sceptical of a sustainable rebirth for the cryptocurrency bitcoin due to the currency's volatility and lack of regulation.

Zhong Yang Chan, head of research at crypto data firm CoinGecko said, "bitcoin's recent bull run looks to be mainly supported by individual investors – ranging from retail to whales – as we have seen evidence of institutions exiting during this rally."

#Bitcoin sucker rally.

— J. Fong (@jfhksar88) March 22, 2023

"Bitcoin's recent bull run looks to be mainly supported by individual investors – ranging from retail to whales – as we have seen evidence of institutions exiting during this rally," said Zhong Yang Chan, head of research at crypto data firm CoinGecko.

Digital asset company CoinShares claims that $113 million was pulled from bitcoin investment products last week as large investors fled the cryptocurrency in search of safety while the banking sector collapsed.

But several financiers argue that recent improvements to bitcoin's core features may now sustain its price.

For instance, Richard Galvin of crypto fund Digital Asset Capital Management mentioned how developments in blockchain technology have made it possible to create new types of non-fungible tokens on the bitcoin network.

The macro scenario is playing out in favour of cryptos even as investors in traditional assets remain doubtful.

Having said that, traditional assets have taken a beating too this year.

So the next few weeks will define the crypto market as it battles fresh regulatory scrutiny as the macro narrative supports its surge.