Table of Contents

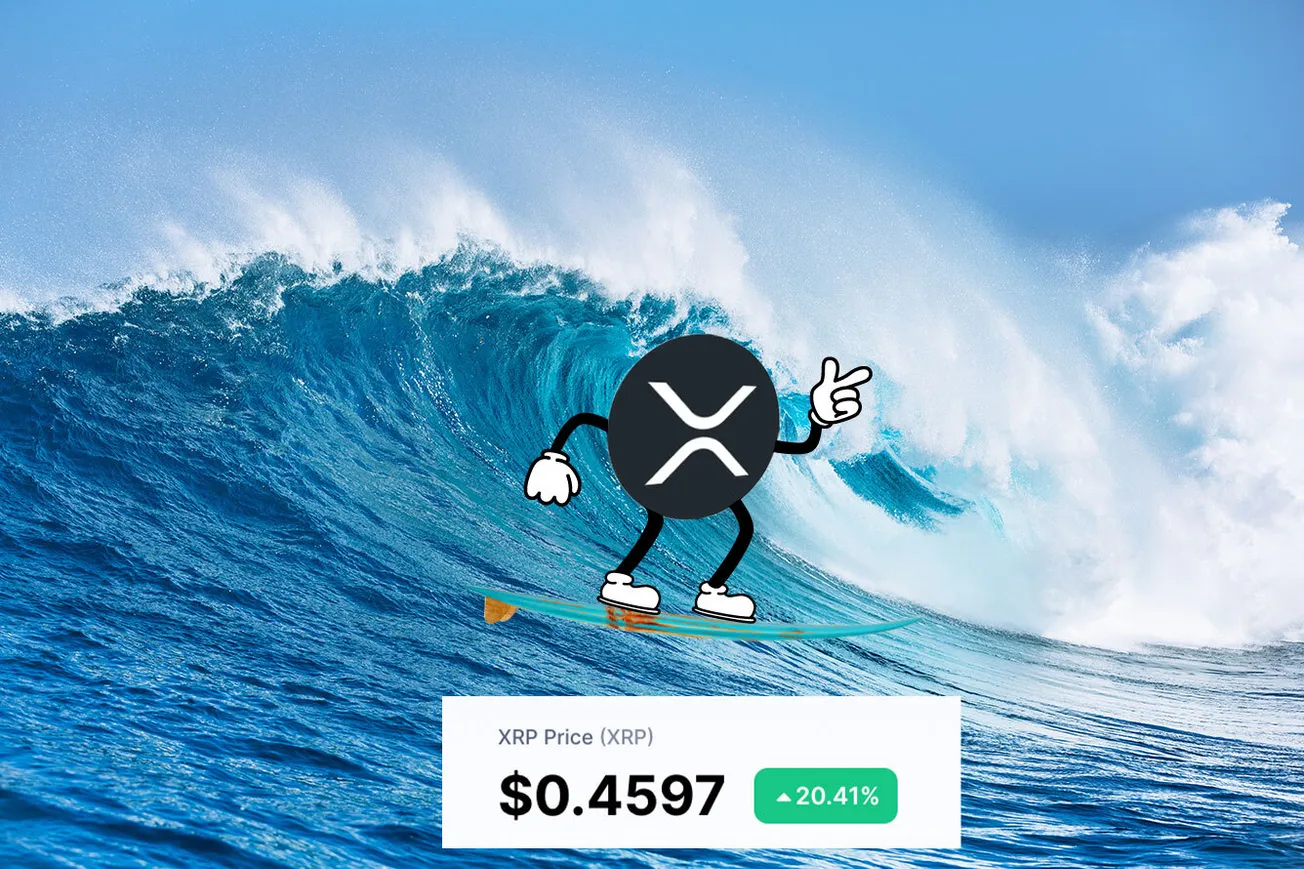

XRP has pumped over 20% in under 24 hours to reach its highest price since November 2022.

The token peaked at $0.4794 but at the time of writing, XRP is sitting at US$0.4597.

Analysts believe the surge is a direct response to bullish to positive anticipate surrounding Ripple's SEC legal battle.

Rhode Island-based lawyer John Deaton, who represents the interests of 75,000 global XRP holders affected by Ripple's ongoing SEC battle, tweeted that the judge will likely rule in favor of Ripple.

I’m hoping Judge Torres was already very aware of the ruling by Judge Wiles of the U.S. Bankruptcy Court for the Southern District of New York (same District as Judge Torres) in the Voyager Bankruptcy. @Ripple offers the ruling in further support of its fair notice defense. https://t.co/31r8ng11GS

— John E Deaton (@JohnEDeaton1) March 20, 2023

Deaton also believes that documents relating to former SEC official William Hinman will be unsealed and revealed to the public, despite the SEC's objections and the judge's decision.

Regarding the Hinman emails and speech drafts: the SEC has requested for them to remain sealed, even after Judge Torres’ ruling on summary judgment. I believe the emails and speech drafts will be made public at some point, regardless of Judge Torres’ decision on whether to seal. https://t.co/BcYTuh9QrW

— John E Deaton (@JohnEDeaton1) March 19, 2023

The documents relate to a speech given by Hinman in June 2018 at the Yahoo Finance All Markets Summit in which he stated Ether was not a security. Ripple considers the speech as evidence against the SEC's claims of Ripple being a security.

SEC vs. Ripple

In December 2020, the SEC filed a lawsuit against Ripple, its CEO Brad Garlinghouse, and co-founder Chris Larsen. The lawsuit alleges that Ripple and its executives violated US securities laws by offering unregistered securities through the sale of XRP tokens. Ripple allegedly raised $1.3 billion through these sales.

The SEC believes XRP should be classified as a security and that Ripple should have therefore registered the offering with the SEC. This would have required Ripple to provide investors with the required disclosures and financial information.

Ripple denied the allegations and argues that XRP is not a security but rather a digital asset like Bitcoin or Ethereum. The company claims that XRP is not controlled by Ripple and that it functions as a decentralized currency that is used for cross-border payments and remittances.

The outcome of the lawsuit could have significant implications for the wider cryptocurrency industry and how digital assets are regulated in the US.

SEC vs. Crypto

The SEC has been hot on the heels of the crypto industry. Last month, the SEC declared that crypto staking services violate security laws.

Its stance forced Kraken to close its staking services. SEC Chair Gary Gensler also argued that Ether's move to proof-of-stake shifts it to being a security.

Enforcement staff at the SEC issued to BUSD issuer Paxos a Wells notice, which the financial watchdog uses to inform companies and individuals of possible enforcement action. Its notice alleges that BUSD is an unregistered security as the SEC declared that crypto staking services violate security laws.

However, in the beginning of March, the Commodity Futures Trading Commission (CFTC) stated that Ether and stablecoins should be treated as commodities.

Read more: Sorry SEC, Stablecoins Are Commodities According to CFTC

CFTC chair Rostin Behnam believes that Ether is a commodity and should be overseen by the CFTC; a view held by the body in its complaint against FTX founder Sam Bankman-Fried in December.

“Notwithstanding a regulatory framework around stablecoins, they’re going to be commodities in my view,” Behnam said. “It was clear to our enforcement team and the commission that Tether, a stablecoin, was a commodity."

The world of Web3 can be quite a whirlwind. Whether it’s crypto news in Singapore, South East Asia or even across the globe, we understand how busy the industry is keeping you, so we kindly send out three newsletters each week:

- BlockBeat for a wrap-up of the week’s digital assets news

- Blockhead Brief for weekend happenings as well as what to look forward to in the week ahead

- Business Bulletin for macroeconomic updates and industry developments.

To avoid FOMO and access member-only features, click here to subscribe for FREE.