Table of Contents

Ah Monday... Everyone’s favourite day of the week. Whilst you were all living it large this weekend, Blockhead was busy keeping up with the ever tireless world of crypto. Here’s what you missed, and what to look forward to in the week ahead, condensed as Blockhead Brief. As ever, if you’re here from a friend, subscribe now.

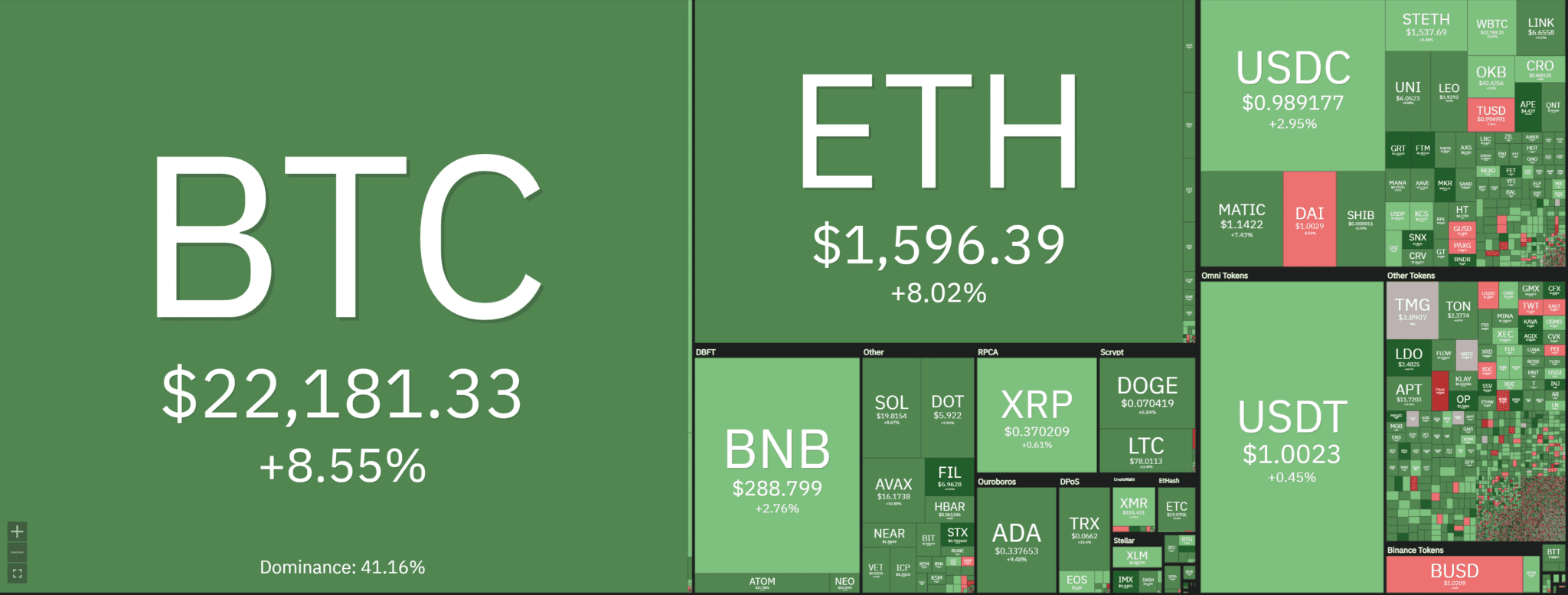

Cryptocurrencies, led by Bitcoin, rallied Sunday after U.S. authorities announced plans to limit the fallout from the collapse of Silicon Valley Bank (SVB). The world's largest cryptocurrency is up over 8% in the past 24 hours to US$23,343, reversing losses over the past week, when it sank by up to 20% to touch US$20,000 as a result of Silvergate bank's collapse.

At the time of writing, Ethereum (ETH) is trading at US$1,598.37 (+7.76% in 24 h). Major altcoins such as Cardano (+10%), MATIC (+6.72%), and Solana (+8.32%) have also been trading in green within the same period.

Yellen Triggers Bull Run

Bitcoin, Ethereum and other cryptocurrencies rallied following the joint announcement by U.S. Treasury Secretary Janet Yellen and U.S. prudential regulators, who said that all depositors with Silicon Valley Bank and Signature Bank, which was closed by regulators over the weekend, will be made whole.

On Friday, USDC depegged from the US dollar, falling as far as $0.882, after issuer Circle admitting to having heavy exposure to Silicon Valley Bank. The firm had a US$3.3 billion deposit held at SVB, or about 8% of the total $40 billion assets held as reserves for USDC.

The news of the US$25 billion Bank Term Funding Program, which essentially places a backstop on contagion, triggered a wave of buy signals. The program provides loans with terms of up to one year to “banks, savings associations, credit unions, and other qualified depository institutions.”

Some US$183 million in shorts, or bets against price rises, were liquidated, and may have contribted to the price surges, according to Coindesk.

Bottom line is that SVB and Signature bank depositors will be paid back. Rumor is that 50% of depositors money will be paid back today or tomorrow, and the balance within 3-6 months.

Circle said its USDC's reserves are safe and will be transferred from SVB to BNY Mellon, and that its deposit at SVB will be fully available when U.S. banks open on Monday morning. It also ntoed that no USDC cash reserves were held at Signature Bank.

Related: One More Setback for Crypto as Signature Bank Closes

Crypto Firms Reveal Silvergate, SVB Exposure

Paxos has said it holds $250 million with Signature Bank. The crypto brokerage firm added that its insurance for private deposits is in excess of Paxos’s balance at Signature Bank. Funds are set to be available today (Monday), when Signature Bank reopens, according to Paxos.

Meanwhile, Coinbase revealed it has a corporate cash balance of $240 million with Signature Bank, but expects to fully recover the funds. On Saturday, Coinbase temporarily suspended USDC conversions following USDC issuer Circle’s disclosure of $3.3 billion in exposure to Silicon Valley Bank (SVB). USDC’s total backing is around $40 billion. Coinbase’s stock price fell 8.0% on Friday.

BlockFi, Ripple, Pantera and Avalanche have all revealed exposure to SVB. BlockFi has $227 million in funds held at SVB whilst Avalanche has "a little over" $1.6 million in exposure. Ripple and Pantera have undisclosed figures.

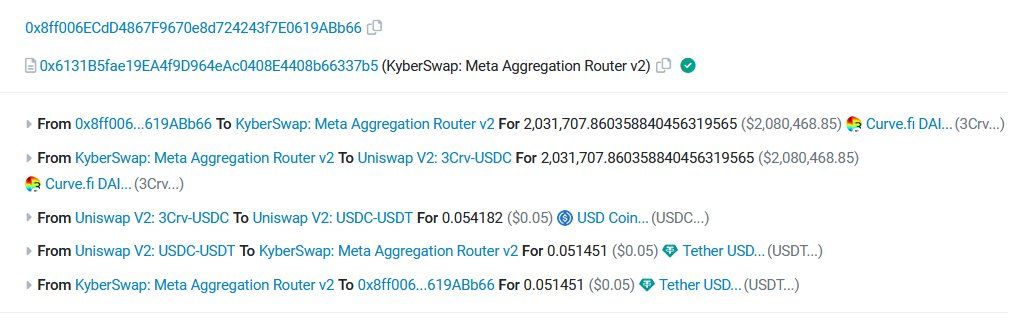

Trader Turns US$2 million into 5 cents

Fears over the weekend over a possible USDC insolvency ran rampant, and users fled to safety in other stablecoins. In a panic-triggered trade, one unlucky user paid $2,080,468.85 only to receive $0.05 of USDT.

Explaining what happened, Kyber Network said the user tried to trade 3CRV, a Curve LP token containing USDC-USDT-DAI on the DeFi market maker.

"This is atypical as one would withdraw LP tokens from a pool, not trade it. This made it possible to create a deviation seen in this swap, as 0x routed into an almost empty pool," Kyber Network explained, noting that since the market was undergoing a volatile period, all routes failed at estimating gas.

"The rate strongly fluctuated & only 0x’s route was successful but with a very poor rate… We displayed 0x’s rate to the user in a pop up. However, the user proceeded with the swap without noticing the low return trade. The user signed with the corresponding new data by clicking Confirm Swap, and the swap was executed via 0x."

Twitter user BowTiedPickle pointed out that the UniswapV2 pool 0x7d36fbd3, pairing 3CRV/USDC, contained about $2 in liquidity, and had sat idle for the last 251 days.

So 2 million 3CRV entered the pool, and was swapped out with 54182 units of USDC, worth about 5 cents. A MEV bot then restored the balance by exchanging 1.45 USDC for the 2M 3CRV in the pool.

While it's not Kyber fault, the platform has since updated its UI to display a new warning to users when the new price is worst than the one initially quoted. It said it is also contacting the bot creator, bot user and Coinbase to assist with funds recovery.

FBI Issues Warning About Crypto Theft in Play-To-Earn Games

The FBI has issued a warning about how criminals are using play-to-earn games to steal cryptocurrency from gamers.

In a PSA, the FBI said that criminals are creating “fake gaming apps” to steal millions of dollars in crypto. These apps are advertised as play-to-earn games that offer financial rewards to players.

According to the FBI, criminals contact victims online and establish a relationship with them over time.

Victims are then introduced to mobile games which supposedly earn the player crypto in exchange for engaging in various activities in the game. The FBI gives the example of “growing crops on an animated farm.”

Players are told to create a cryptocurrency wallet, purchase crypto and to join the apps created by the criminals. They are then led to believe that the more money held in their wallets, the more rewards they will earn.

However, the rewards seen by victims on the app are fake. Criminals drain the victims’ wallets when they stop topping up funds, telling them that their funds will be restored by paying additional fees, which is false.

To protect gamers from these criminals, the FBI advises to “create a unique wallet to use,” “use a third-party blockchain explorer,” and to “periodically use a third-party token allowance checker.

Trading Volume

According to data from CoinMarketCap, the global crypto market cap stands at US$1.02 trillion, a 7.14% increase since yesterday, and roughly the same as the week before.

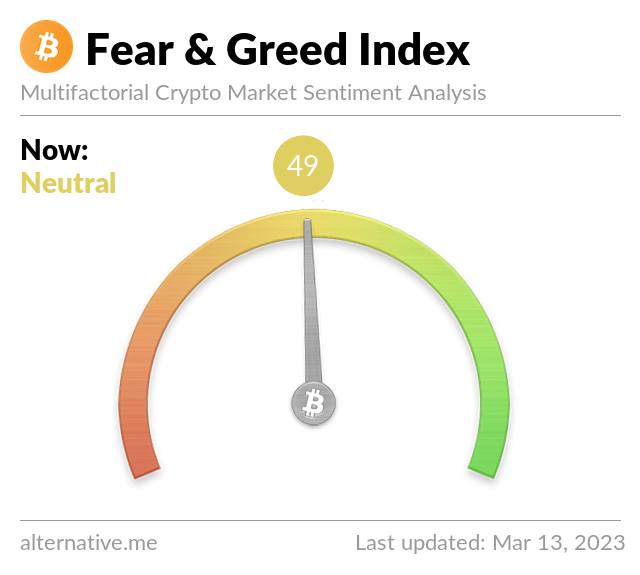

Sentiment

Risk appetites in crypto are still relatively subdued– the index currently stands at a "neutral" 49 – the same as the week before, though we're expecting it to fall as the week progresses. Since late January, sentiment has hovered in the 40s to 60s, following 4 straight months of being in the 20s.

The Crypto Fear and Greed Index uses 5-6 measurements to assess the current sentiment of the market and then rates that level of emotion on a scale of 1-100 – 1 is extreme fear and 100 is extreme greed.

Hey! We’re Blockhead, a digital assets-focused media platform that’s also Asia-led and global in scope. We cover the most important industry trends and developments happening right now. We also publish a weekly industry-focused newsletter that covers macroeconomic news and data.

If you’ve read this far and are hungry for more, check out our website for even juicier crypto content. For questions and feedback, feel free to email us here.