Table of Contents

We’re learning more about the structure of Three Arrows Capital (3AC) and how the crypto hedge fund conducted its business, as the company goes through a liquidation process ordered by a court in the British Virgin Islands, where 3AC is domiciled.

Founded in 2012 by a pair of ex-Credit Suisse traders in Singapore, the company once managed more than US$10 billion in assets. Its debts have contributed to the insolvency of platforms such as Celsius and Voyager Digital. 3AC founders are now on the run, as legal proceedings continue.

Read more: Celsius Users = Rekt as Platform Joins Voyager in Chapter 11 Club

A leaked court document dated 9 July 2022 – a filing in the Singapore High Court for recognition of the BVI liquidation proceedings, running over 1,100 pages, provides an treasure trove of juicy tidbits into the ongoing case, but among its highlights:

- The total value of claims against 3AC currently stands at over US$3 billion, with Genesis – a subsidiary of Digital Currency Group that owns Grayscale – having the largest exposure at over US$2.3 billion.

- High-profile creditors include DRB Panama – the parent company of crypto exchange Deribit, which lent 1,300 BTC and 15,000 ETH (~US$51 million at current prices), Celsius Network (~US$75 million in USDC), CoinList Services (~US$35 million in USDC) and digital asset trading platform FalconX (US$65 million).

- 3AC co-founder Su Zhu is seeking US$5 million from the company, while Chen Kaili Kelly, wife of other co-founder Kyle Davies, is seeking US$65 million.

- Among the properties owned by the company’s founders are an apartment in Sentosa Cove, a heritage shophouse off Orchard Road on Emerald Hill, Good Class Bungalow in Bukit Timah, a condo in the Balmoral area, and more.

- Su and Davies had been uncooperative, ignoring any attempts by creditors to reach out to the company and continuing to trade cryptocurrency rather than respond to margin calls from its lenders.

- Su allegedly used company proceedings to purchase a US$50 million yacht – “larger than any yacht owned even by Singapore’s richest billionaires” – which is due for delivery next month in Italy. The downpayment for it was made while 3AC was defaulting on its lenders.

- 3AC moved US$31.6 million in stablecoins on 14 June 2022 to the wallet of Tai Ping Shan Limited, a Caymans entity which is indirectly owned by Su and Davies’ wife (as majority shareholders). (According to a CoinDesk article, TPS Capital – a Singapore-registered subsidiary of TPS Limited and Three Lucky Charms Limited – was the OTC trading desk of 3AC).

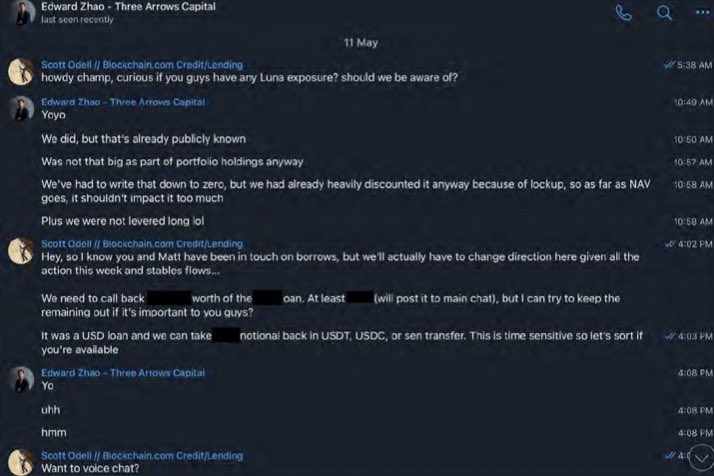

- 3AC had around US$600 million of exposure to Luna – “Yo…uhh … hmm”

As the affidavit shows, the company potentially lied about the extent of its losses to lenders, its leverage and directional market exposure, movement of funds, and did disclose its liquidation to shareholders and creditors.

Read more: Crypto Bros Were Born to Run

A creditors’ meeting was held Monday in BVI, where creditors voted not to seek alternative liquidators. As such, Teneo will remain the liquidators, according to a report by The Block. There will be a creditor committee comprising Digital Currency Group, Voyager Digital, Blockchain Access UK, Matrix Port Technologies, and CoinList Lend, which together represent over 80% of claims currently. It will work with liquidators on recovering assets, which include bank account balances, direct crypto holdings, underlying equity in projects, and NFTs.

More to follow.