Table of Contents

Traders woke up Tuesday to a bloodbath, with both Bitcoin and Ethereum crashing through multiple layers of support. Bitcoin now is now staring at a key psychological level of US$30,000 – more than 50% down from its 2021 highs.

Bitcoin is now 8% higher on the day at US$32,500, after falling nearly 15% overnight. Over the past week, it has suffered a 16% dip in price.

Bitcoin and Ethereum are currently in a strong bearish structure in the short to mid-term. But nobody knows what’s coming next.

“I have been watching the technical picture for some time, and the price action still remains bearish, even given today’s rally. The failure of support at US$33,400 saw the failure of a large triangle formation, with an initial target of US$33,000 the approximate 2022 low. That failure overnight suggests Bitcoin could fall by the full extent of the triangle to US$17,000. Bitcoin needs to close above US$33,000 tonight to cause this scenario to be reassessed,” Jeffrey Halley, senior market analyst, Asia Pacific, Oanda, told Blockhead.

Read More: Blocksmith Says: Stay on Sidelines as BTC Looks to Dip Under 2021’s Low

The global crypto market cap currently stands at its YTD low of US$1.45 trillion – down 5.14% over the past 24 hours, according to CoinMarketCap data.

Still an inflation hedge?

Bitcoin’s status as a store of value and inflation hedge is being challenged, with the crypto market moving in lockstep with the broader equities market of late.

Last week’s FOMC meeting, which announced a 50bps rate hike and the start of quantitative tightening (QT) in June, saw a short-lived bounce in equities. But prices have tanked across the board. The S&P500 index has now seen five straight weeks of red, on fears of further Fed tightening and squeezes.

Added to this are impact of China’s Covid-zero policies on the country’s domestic economy, a higher energy and food price environment, and uncertainty surrounding Russia’s war on Ukraine.

“Bitcoin’s fate probably rests with whether the risk-sentiment rally we are seeing today in Asia continues this week, or is merely a bear market bounce. My feeling is there are quite a few nervous HODL’ers out there, although I have been proven wrong before,” Halley said.

This time is different?

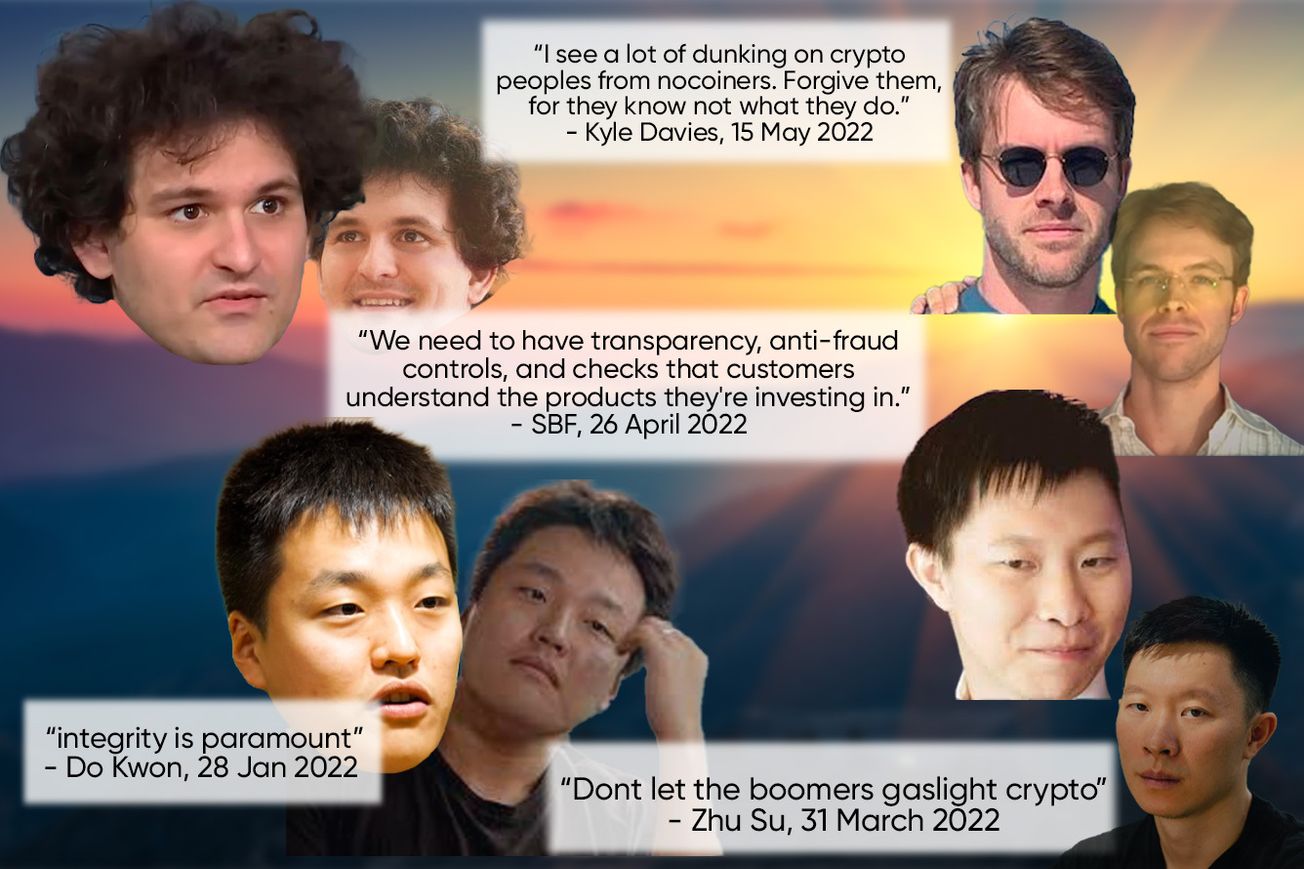

To add to the pain, Luna’s Terra token is down over 50% in the past day, briefly touching the US$24 level – or down over 70% in the past week, as Luna Foundation’s stablecoin UST lost its peg to the dollar. The algorithmic stablecoin traded at around US$0.65 overnight.

Luna Foundation Guard, which is in charge of maintaining UST’s peg, drained its US$1.5 billion bitcoin reserve and bought US$850 million more Bitcoin to defend the peg. UST currently stands at US$0.92.

Read More: TerraUSD Just Depegged and Everyone’s Panicking – Should You Be Concerned?

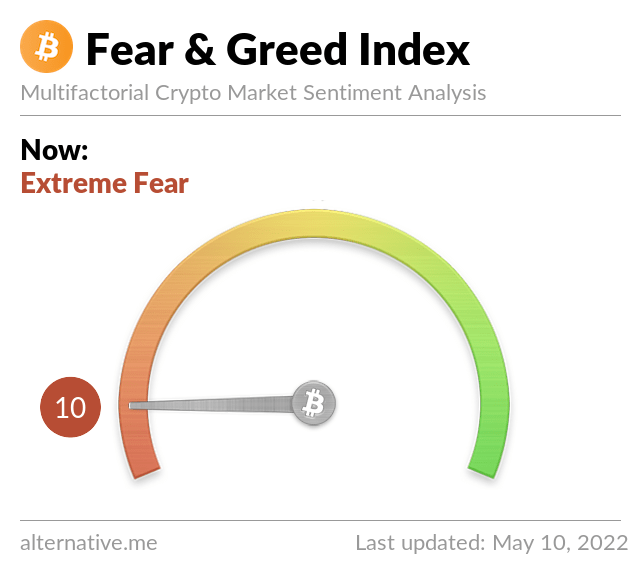

Risk appetites remain sapped – the Crypto Fear and Greed Index currently stands at 10, indicating extreme fear. The index uses 5-6 measurements to assess the current sentiment of the market and then rates that level of emotion on a scale of 1-100 – 1 is extreme fear and 100 is extreme greed.