Table of Contents

21Shares has announced the launch of new exchange-traded products (ETPs) for four digital asset tokens.

Oracle provider Pyth, decentralized graphics processing protocol Render, RWA platform Ondo Finance, and layer-1 blockchain Near Protocol will each have their own ETPs through 21Shares known as:

- 21Shares NEAR Protocol Staking ETP

- 21Shares Ondon ETP

- 21Shares Pyth Network ETP

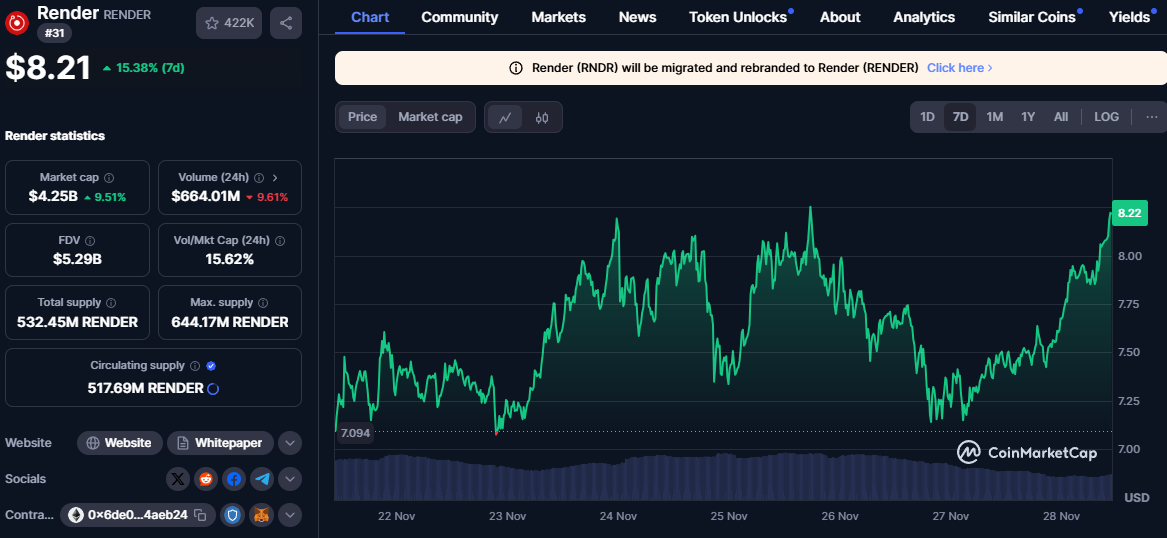

- 21Shares Render ETP

These ETPs aim to offer investors targeted exposure to emerging areas of blockchain technology, oracles, tokenization, decentralized computing, and artificial intelligence.

Describing the products as "game-changing," 21Shares announced the offerings on X.

Big news: Four game-changing ETPs just released! Introducing our newest products focused on oracles (PYTH), tokenization (ONDO), decentralized computing (RNDR), and artificial intelligence (NEAR). Find out more about each product and either of the links below. pic.twitter.com/szwt5LN17W

— 21Shares (@21Shares) November 26, 2024

Each ETP will be physically backed by its corresponding token, ensuring a direct and transparent connection between the product and the underlying asset.

The announcement has bolstered the impressive price performance of each firm's respective token. Over the week, RENDER, ONDO, PYTH and NEAR are up 15.17%, 13.26%, 20.88%, and 26.15% respectively.

Earlier this week, WisdomTree registered an XRP ETF in Delaware, reflecting the increasing appetite for digital asset investment vehicles. The move suggests the company is preparing to file an S-1 registration with the US Securities and Exchange Commission (SEC) to launch an XRP-focused ETF.

WisdomTree follows the likes of Bitwise and Canary Capital, which have also sought SEC approval for spot XRP ETFs.

Bitwise also recently joined the Solana ETF race by submitting its regulatory filings for the product, following in the footsteps of VanEck and 21Shares, which filed theirs in June.

Cboe BZX Exchange has now submitted four 19b-4 filings, which are formal submissions that propose rule changes to the SEC by self-regulatory organizations such as stock exchanges.