Table of Contents

MarginFi, a Solana-based decentralized finance (DeFi) platform for borrowing and lending cryptocurrencies, is facing a significant crisis after its CEO, Edgar Pavlovsky, abruptly resigned on Thursday.

I resigned from mrgn today. From working on marginfi, from the research arm, from it all.

— edgar ◼️ (@edgarpavlovsky) April 10, 2024

It's a world class team -- it really is -- but I don't agree with the way things have been done internally or externally. I've said it many times and I'll say it again, but those of us who…

"It's a world class team – it really is – but I don't agree with the way things have been done internally or externally," Pavlovsky said.

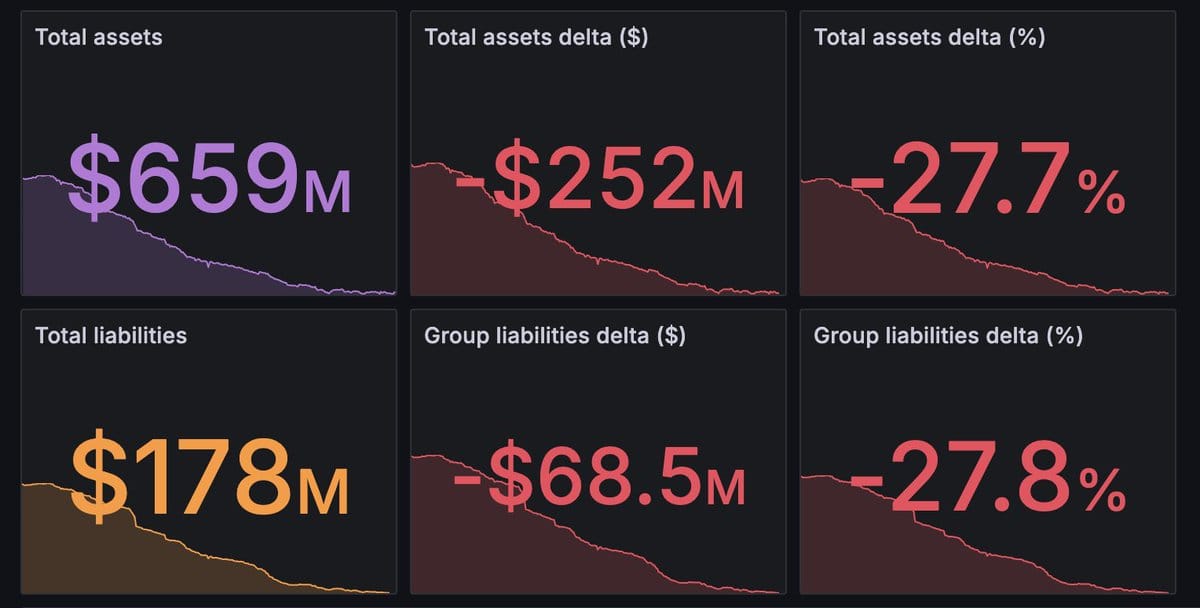

This unexpected departure has triggered a wave of user withdrawals, with drawdowns of about 30%, or about $250 million in a single day.

For the unfamiliar, DeFi platforms like MarginFi allow users to earn interest on their crypto holdings by lending them out to others. Borrowers can also leverage their crypto assets to access additional funds. The platform has received strong interest from airdrop hunter as it doesn't have a token yet but is looking to release a governance token (MRGN) soon, and recently launched a points system where users can earn points for interacting with the platform, leading to speculation that MRGN will be distributed to users based on their level of interaction with the participation.

Loss of Confidence Sparks Exodus

Pavlovsky's resignation has shaken user confidence in MarginFi, which led many users to withdraw their crypto assets from the platform, fearing potential security risks or mismanagement.

The mass exodus has significantly impacted MarginFi's total value locked (TVL), a key metric reflecting the amount of cryptocurrencies deposited on the platform. With users pulling out their funds, the TVL has dropped sharply, raising concerns about the platform's long-term viability.

MarginFi's future remains uncertain and regaining user trust will be crucial for its survival, but the platform has given the matter a positive spin.

"Watching DeFi systems get tested real-time is exciting," it said on Twitter/X, and in "deep dive on everything happening behind the scenes" on Friday, said: "The recent volatility has been a case study for marginfi risk management. At the protocol level, systems operated excellently. Contributors are continuing to push development," Marginfi said.

Pavlovsky also said in a separate message on Friday that "@marginfi is the safest place I know to keep my funds, and that's where they will stay."