Table of Contents

We recognize the interconnectedness of traditional and digital markets, and how global economic data and central bank policy decisions can influence investor sentiment towards cryptocurrencies. brn's Week Ahead column details upcoming macroeconomic events with the potential to impact the crypto market.

The primary focus in the week ahead in developed markets will be the US consumer price index (CPI) for March, which is expected to continue to run too hot for a return to the crucial 2% objective of the Federal Reserve.

Across the Atlantic, indicators of a first-quarter recovery in the UK's GDP data will also be scrutinised.

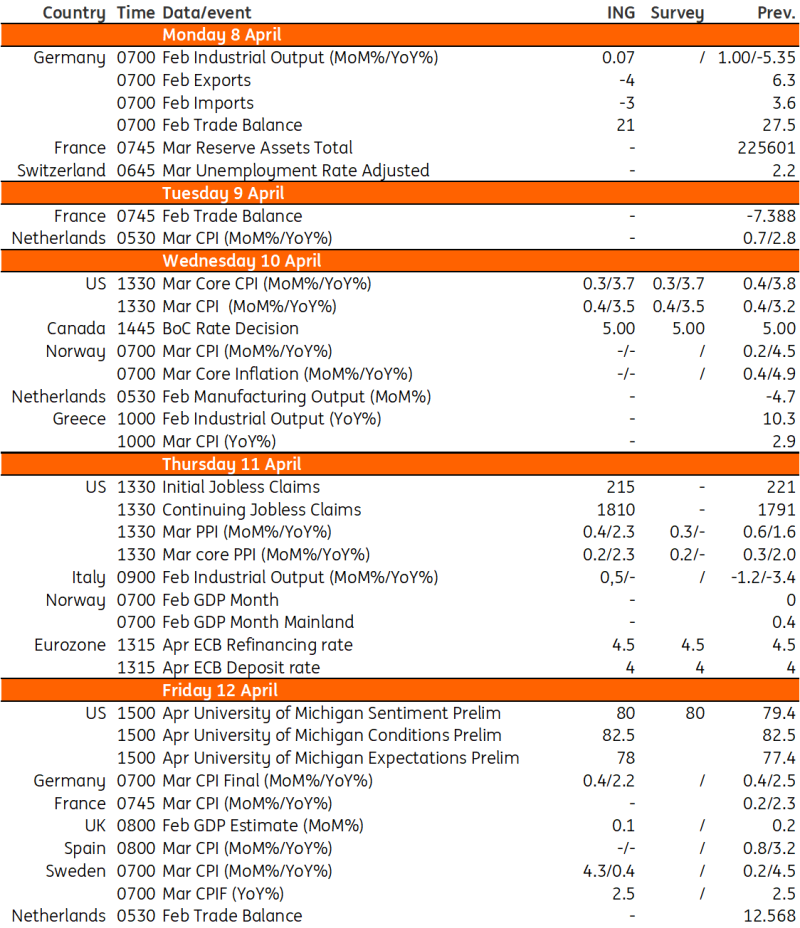

Macro Data Calendar

Investors Eye US Core CPI Print

The most important news in the US this coming week will be the March consumer price inflation figures.

This has been reliably hot in the past few months, with housing components staying especially sticky. Higher insurance costs and portfolio management fees have also added to high super-core readings.

Markets predict the core CPI will show 0.3% month-on-month instead of 0.4% in February. However, this is still more than double the 0.17% MoM rate that would bring the year-over-year rate down to the 2% goal.

There is still a lot of doubt.

The job cost index, the ISM prices paid, and the NFIB prices charged all point to a significant drop in price increases over the course of the year.

The Fed is still worried about "residual seasonality" in some parts, such as yearly increases in insurance prices continuing to drive up prices. Uncertainty about the important parts of housing rent is worsening things.

The BLS changed the weights of the factors in January. Now, single-family houses are more important than apartments, and rents for these are rising faster than rents for flats.

Because of how the index is built and calculated, it might be a few more months before one can see the 0.2% MoM readings that the Fed wants.

Having said that, investors will eye cues for the Fed rate path from these data.

February UK GDP Figures Points to a Rebound

The UK economy officially declined slightly at the end of last year. However, monthly GDP is expected to rise again in January, followed by a small 0.1% rise in February.

This means that the first quarter as a whole will have positive growth.

It's true that these numbers have been pretty unstable lately, but markets do expect a slow rebound in UK output this year.

The debt squeeze has had the biggest effect on the economy. At the same time, rising real wages should encourage people to spend money.

But this differs from what the Bank of England will use to decide when the first rate will go up. That will instead be due to inflation in services and pay growth, which are both coming up later this month.

It's almost between a rate cut in June or August, but markets are leaning more towards August.

This Week in Asia

Asia features several regional inflation reports plus three central bank policy meetings.

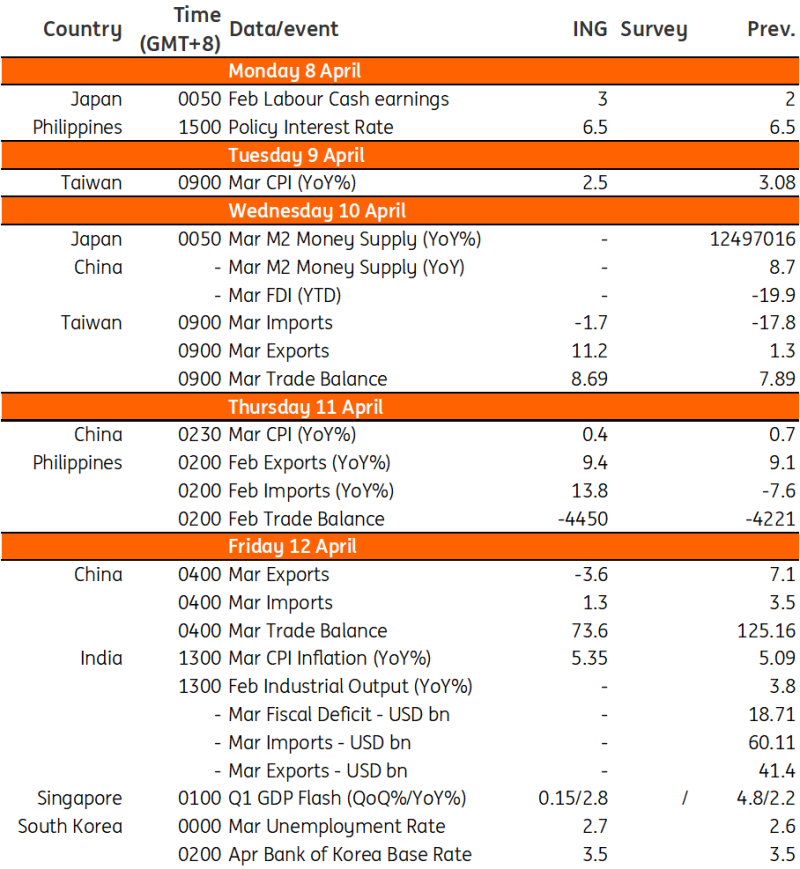

Key events in Asia:

- China's inflation to moderate

- Inflation to tick higher in India

- Taiwan inflation to dip

- Bangko Sentral ng Pilipinas (BSP) expected to extend pause

- Singapore's first quarter GDP and MAS

- BoK on hold again?

- Japan's labour cash earnings could bounce back

Macro Data Calendar

China Deflation Story

China will release its CPI inflation figures next week. Since food prices have decreased since the Chinese New Year, inflation is expected to drop to around 0.4% year over year.

Trade statistics will also be made public on Friday.

Due to normal seasonality, strong momentum from the first few months, and a rise in export orders in the March PMI, growth will likely be solid from one month to the next.

However, year-over-year numbers may look bad because of a strong March 2024, and they may even drop to negative levels again before rising again in the next few months.

The loan data and FDI data will also be due.

In this case, we expect overall lending and RMB loans to rise again after February's weak data due to the holidays. As the first quarter of last year was very strong, YoY growth rates may be flat or even negative.

However, markets are still waiting to see if the 50bp RRR cut in early February will improve loans.