Table of Contents

We recognize the interconnectedness of traditional and digital markets, and how global economic data and central bank policy decisions can influence investor sentiment towards cryptocurrencies. brn's Week Ahead column details upcoming macroeconomic events with the potential to impact the crypto market.

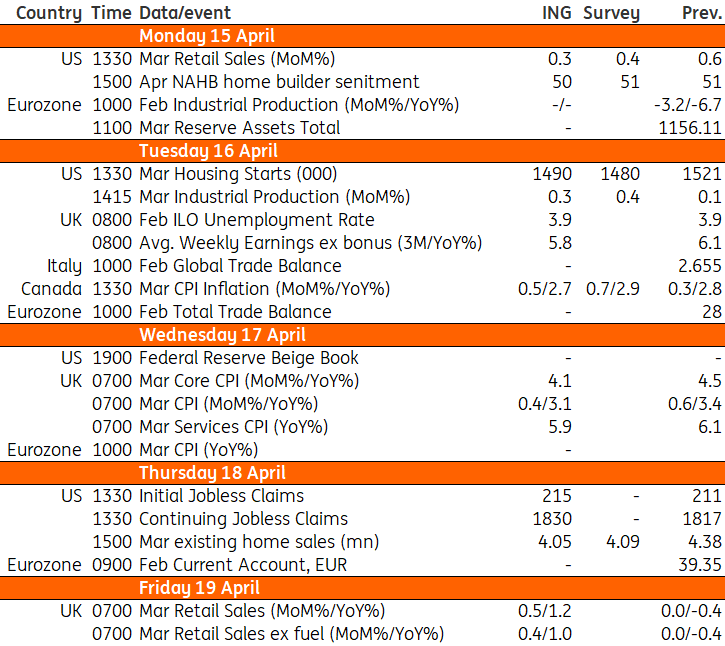

This week, the US will be watching retail sales and production data. This comes after surprisingly high inflation data delayed the expectations for the start of the Fed easing cycle.

The macro data releases due this week in the developed market economies will add to the debate on global central banks' easing pivot bets.

The UK's service inflation and wage growth figures will also be released, which will contribute to the discussion surrounding the timing of the BoE's rate cut—in June or August.

Macro Data Calendar

US: Consumer Spending Trends in Focus After Sticky Inflation Data

With inflation and strong jobs confirming little prospect of an interest rate cut from the Federal Reserve before September, markets expect a calmer period for markets over the coming week from a macro point of view.

The highlights in the US will be retail sales, industrial production and housing data. Retail sales data is a nominal figure, so with inflation running hot the 0.3% month-on-month forecast implies that volumes will remain subdued.

We have already had auto volume figures, which disappointed, while the weekly credit card numbers from the Bureau for Economic Analysis have been subdued and data from Opentable suggests restaurant dining has been weak.

With loan delinquency rates on the rise and an increasing number of people making only the minimum payment on their loans, there is evidence of increased stress and this is likely to get worse in the near term with inflation running hotter than income growth, especially for those on social security.

An improvement in the ISM index suggests we should look for a decent increase in industrial production, but the rise in mortgage rates means that markets expect weakness in housing transaction numbers.

This feeds into retail sales given the strong correlation with home sales and retail activity tied to household appliances, furniture and furnishings and building supplies – when moving home people often want new items in their new property.

UK Inflation and Wage Data in Focus

In contrast to the Federal Reserve, the Bank of England looks like it's still on track for a rate cut either in late spring or summer.

The Bank has said that the timing hinges on the next few releases of services inflation and wage growth, both of which we get this week and are set to show some further limited progress.

Headline inflation should tick lower too, although this will be tempered by the recent rise in fuel prices.

Irrespective of the outcome, markets think May's meeting is too early for a cut.

However, a material downside surprise to this week's data – which is not a base case scenario – might convince the Bank to use that meeting as an opportunity to signal its preference for cutting rates in June.

For the time being though, markets think an August start date is narrowly more likely, and that's because both the March and April services inflation figures could come in a little above BoE forecasts.

Markets' new Fed call for a September rate cut also adds weight to the idea the BoE will wait slightly longer before cutting for the first time.

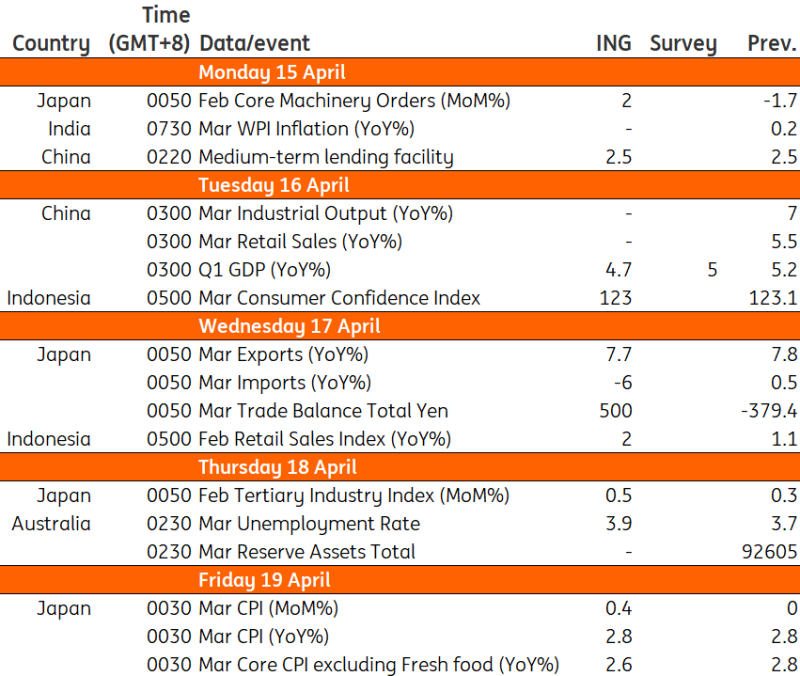

This Week in Asia

Key data releases from China this week alongside Japan’s latest inflation reading will be the focus.

With production ramping up in China, the world's second-largest economy got off to a strong start this year. However, according to analysts, growth will be difficult to sustain in the absence of systemic reform.

To find out if China's economy has recovered from its long post-pandemic downturn, a plethora of official data are due on Tuesday.

Expectations of a 4.8% year-over-year increase in GDP in the first quarter, will lend credence to the idea that the government may achieve its yearly target of about 5%.

Macro Data Calendar

What Are Economists Watching to See if China's Rebound is Real

The first quarter GDP for 2024, important economic activity indicators for March, and housing price data for 70 cities will all be part of a massive data dump that the National Bureau of Statistics will disclose on Tuesday.

Following better-than-expected results in the first two months of the year, growth estimates for the first quarter have been raised, and markets are now expecting GDP growth of 5% year-on-year.

Aggregate finance and new loans are expected to rise from February levels in a usual end-of-quarter jump, according to the credit statistics that will be released in the coming days. In the first three months of this year, total funding may continue to rise at a negative rate year over year.

Markets anticipate that the People's Bank of China will maintain its emphasis on maintaining a stable currency rate when it decides on the 1-year MLF rate next Monday.