Table of Contents

We recognize the interconnectedness of traditional and digital markets, and how global economic data and central bank policy decisions can influence investor sentiment towards cryptocurrencies. brn's Week Ahead column details upcoming macroeconomic events with the potential to impact the crypto market.

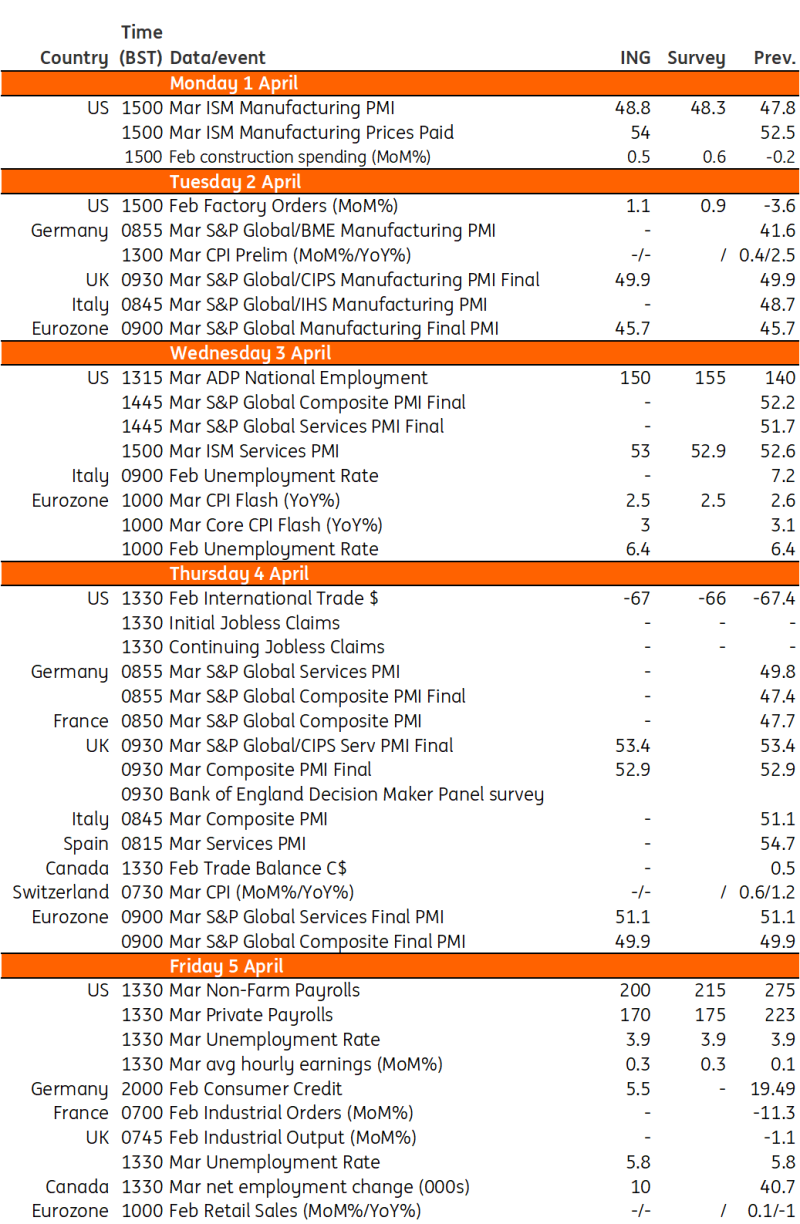

Inflation and labour market data will be in the spotlight in the eurozone this week. Markets expect services inflation to be impacted by the Easter effect and unemployment to remain unchanged.

The US jobs report will also be in focus, with payrolls expected to rise by just under 200k.

In the UK, the BoE's CFO survey will likely show further inflation progress.

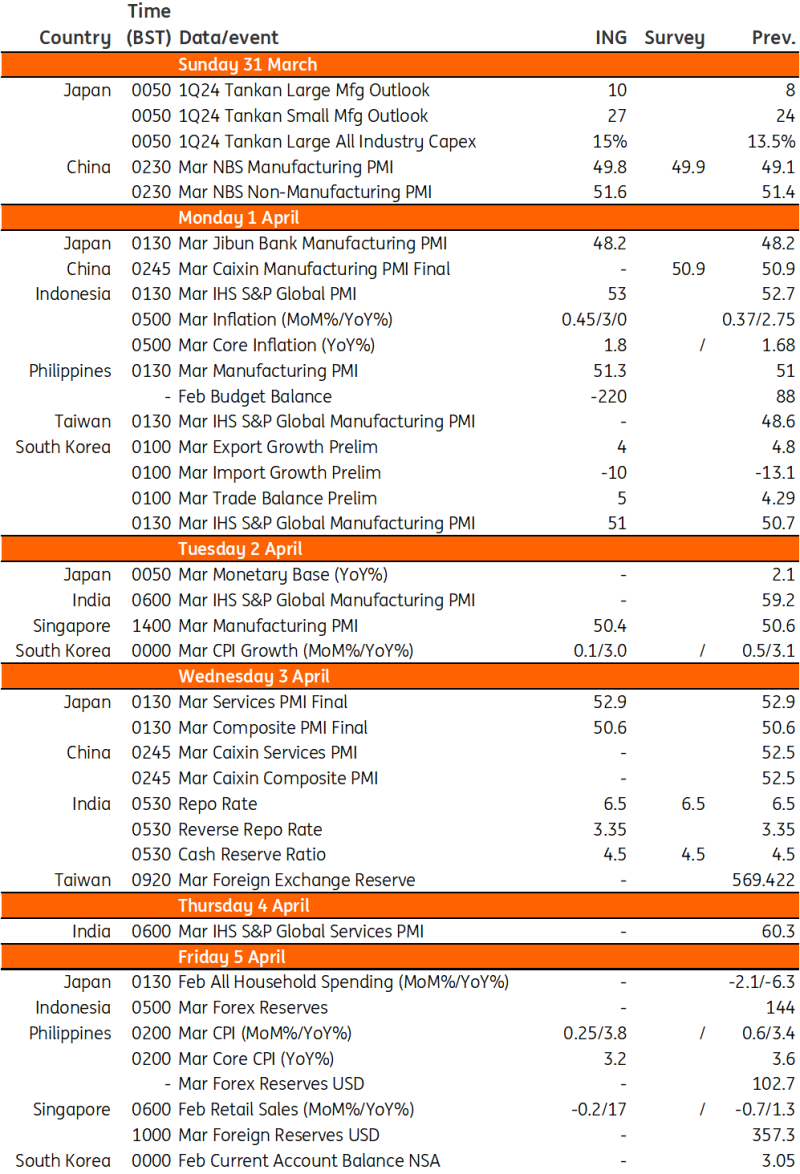

Macro Data Calendar

US Payrolls in Focus

The jobs report will be the main focus in the US this week.

Payrolls are expected to rise by just under 200k, but once again are likely to be concentrated in just three sectors – local government, leisure and hospitality, and private education and healthcare services.

80% of all the jobs added over the past 14 months have come from these sectors and we don’t see much change given that employment surveys have pointed to a slowdown in hiring.

The unemployment rate is expected to remain at 3.9% with wage growth remaining benign. We suspect this will keep market pricing for a June federal reserve interest cut at around 80%.

Expectations will be firmed up ahead of time with ADP payrolls and the ISM surveys released before next Friday’s jobs figures.

This Week in Asia

This week features a policy decision for the Reserve Bank of India, PMI readings from China, plus inflation from regional economies.

Macro Data Calendar