Table of Contents

Data storage continues to evolve over the years. From physical data centers filled with racks of servers to cloud storage, technology has tried to keep up with the unending demand for more storage space.

Recently, DePin (Decentralized Physical Infrastructure Networks) are gaining massive traction in the crypto ecosystem. DePins are blockchain applications and protocols that aim to provide real world services.

One of the leading use cases of DePin is the Filecoin Network. Leveraging decentralization, Filecoin provides a cost-effective alternative to traditional services such as AWS (Amazon Web Services). This is done through a reliable, secure, and scalable storage solution that empowers users and reduces dependence on centralized storage providers.

Filecoin: The DePin of Data Storage

Filecoin is a decentralized peer-to-peer network tailored for file storage. It stands as a decentralized alternative to conventional cloud storage providers, which are estimated to have an annual growth rate of approximately 35%.

Since its mainnet launch in late 2020, Filecoin has gained widespread adoption. The network currently boasts over 3,000 storage provider systems globally who have contributed 7.8 ExaBytes of raw storage capacity to the network, with an additional 2.1 ExaBytes of raw data added.

Thriving on openess and accessibility, Filecoin is available to all - storage provider, developer, or data user.

As an open-source cloud storage network, it synergizes with the InterPlanetary File System (IPFS), a pioneering decentralized web protocol aimed at replacing traditional HTTP.

Unlike HTTP, which relies on location-based data identification (such as a webpage's URL), IPFS identifies data based on content, enhancing security, accessibility, and transparency across the Filecoin network.

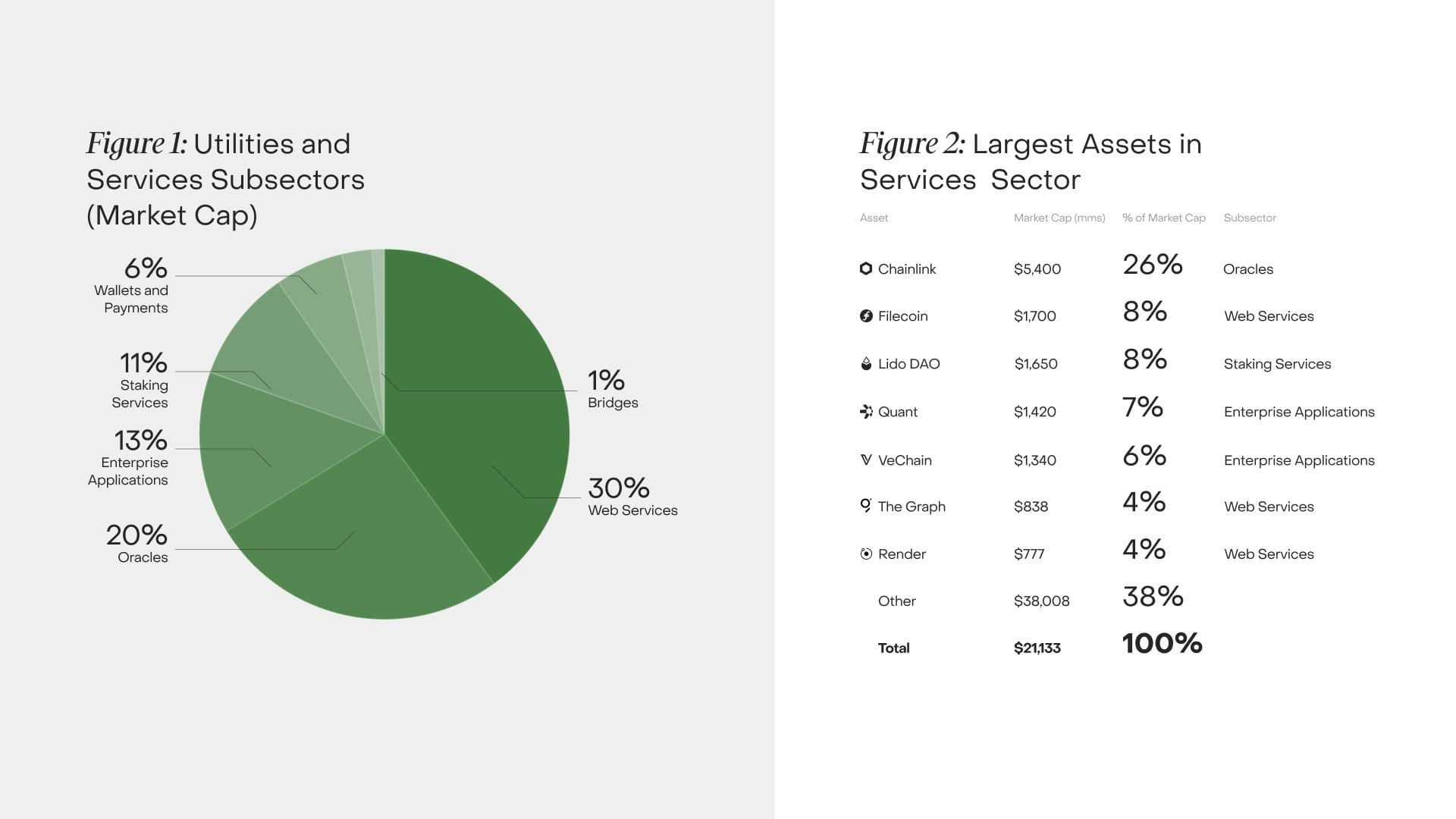

A recent report by Grayscale listed Filecoin as one of their top picks in the "Crypto Utilities and Services" sector for developers building in the crypto ecosystem.

How does Filecoin Work?

Filecoin facilitates the efficient use of storage resources through a marketplace for unused storage capacity.

Filecoin utilizes distinctive consensus mechanisms known as proof-of-replication (PoRep) and proof-of-spacetime (PoSt) to guarantee the secure storage and accessibility of files throughout the network.

PoRep serves as cryptographic evidence that a miner has replicated a client's data entirely, while PoSt validates that the data has been consistently stored for a predetermined period. These consensus mechanisms play a pivotal role in upholding the integrity and availability of the stored data.

The Filecoin community thrives on constant innovation, developing novel features for enhancing the network's capabilities and security. Notably, the introduction of the Filecoin Virtual Machine in 2023 ushered in smart contract programmability and compatibility with the Ethereum Virtual Machine (EVM), marking a significant advancement for the network.

Role of FIL in Filecoin’s Ecosystem

FIL is the native token for Filecoin and the network's incentivized participation model motivates storage providers to earn FIL through data storage and retrieval activities.

This strategy drives network expansion, resulting in increased storage capacity and competitive storage prices.

Participating in the network as a storage miner entails staking a certain amount of FIL tokens as collateral with the exact amount depending on the miner's storage capacity and network parameters. Miners can offer storage and retrieval services to clients, earning FIL token rewards based on their contributions to the network.

With a maximum token supply of 2 billion and a circulating supply of approximately 403 million tokens, 70% is allocated for mining rewards, which are proportional to the network's adoption.

Additionally, the rate of new token issuance will gradually decrease over time as the network matures, ensuring its long-term sustainability. This creates a demand pattern for FIL tokens which could impact its price action in the long term.

FIL’s Price Action

A look at FIL's price action showed that the token continued its bullish rebound from the $7.60 support level by crossing the bearish hurdle at $10. Over the past 24 hours, FIL fell to $8.33 and has risen to $8.67.

The short-term outlook for FIL could see it reach $12, although a key selling resistance still exists at this price level. Furthermore, the long-term outlook has an ambitious target of $20, if the $12 price level is established as a solid support.

The Relative Strength Index (RSI) suggests an oversold outlook with a reading of 35.41.