Table of Contents

TIA, the native token of the Celestia ecosystem has underwhelmed in recent times. An analysis of the altcoin in May shows that the token is down by 16%. Zooming out into its 2024 performance showed that TIA is down by almost 60%.

Despite the bearish price action, TIA still looks like a good hold for the long term based on staking rewards and potential airdrops. However, its current price action offers opportunities for short-term trades.

Capital Keeps Rotating In & Out of $TIA

Capital inflows have been a challenge for $TIA over the past two months where it has recorded the most significant price drops of 2024. A look at the Chaikin Money Flow (CMF) indicator shows that capital inflows have been more negative than positive.

This could be a strong hint to the outlook of short-term investors, with trading capital flowing into tokens with other larger capitalization altcoins.

The current price rejection at the $9 resistance level offers shorting opportunities in the near term. With the Relative Strength Index (RSI) flipping bearish and capital inflows remaining negative, the target level for the short position will be at $8 for 13% gains.

Futures Market Remained Bearish

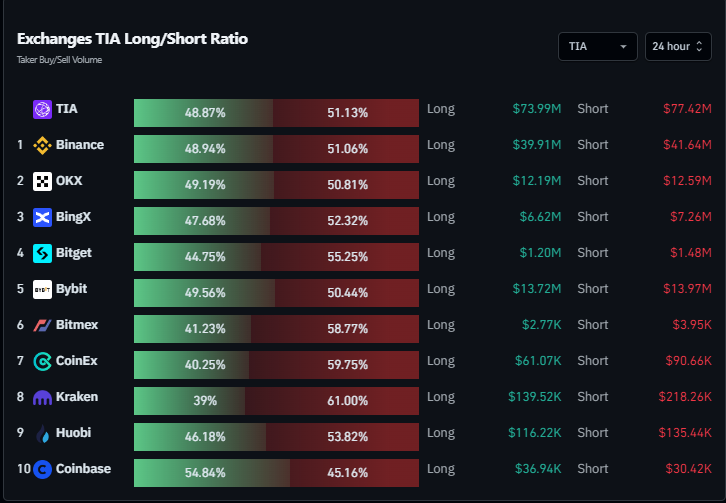

The bearish sentiment on $TIA extended to the Futures market with shorts dominating the long/short ratio. This was according to data from Coinglass on $TIA contract positions over the past 24 hours.

Short positions held a 51.13% share of the contract positions, amounting to $77.42 Million.

With $TIA hitting a price brickwall on the spots market and selling pressure from the futures market, traders can expect to hit the short term target before any significant price reversal.

Disclaimer: This article does not constitute trading, investment, financial, or other types of advice. It is solely the writer’s opinion. Please conduct your due diligence before making any trading or investment decisions.