Table of Contents

A Singaporean man recently filed a police report stating he was unaware of being appointed director of Singapore-registered cryptocurrency investment firm InvesableAI.

The firm is facing scrutiny from multiple law enforcement agencies, including the Singapore Police Force, the Federal Bureau of Investigation (FBI) and the Securities and Exchange Commission (SEC).

Lawyers believe the man is unlikely to be held liable for the company's actions if he can prove he was not involved in its operations.

The man reportedly discovered his association with InvestableAI, Pexo, Cintery, and Exby International – all companies listing virtual office addresses – while investigating suspected identity theft.

Investors have alleged that InvesableAI promised unrealistic returns on crypto investments and then froze withdrawals in September 2023. According to reports, over 4,000 people placed their funds onto the platform, and a group of about 150 investors are claiming losses of at least $1.5 million.

Here's a tip - if an investment scheme screams buzzword bingo and has an uninspired name, just look away. But what if you never looked in the first place and were still held accountable?

"Invesing" in InvesableAI Without the Tea

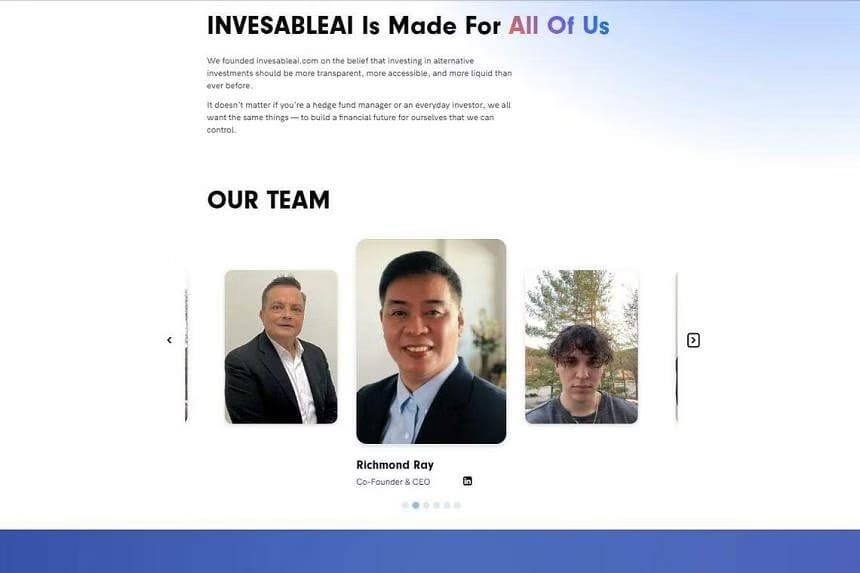

Incorporated in Singapore in June 2023, InvesableAI claimed to be seeking a license from the Monetary Authority of Singapore (MAS) and presented itself as a trustworthy business on its now-defunct website, highlighting its registration in Singapore.

However, according to Accounting and Corporate Regulatory Authority (ACRA) records, InvesableAI is still a "live" company, meaning it's still in operation, The Straits Times reported on Sunday.

A MAS spokesperson clarified that anyone providing payment services in Singapore must hold a license. Those who do not hold a license will be exempted from the Payment Services Act to operate.

The spokesperson said: “InvesableAI is not licensed nor exempted from licensing by MAS.

“Regardless of whether an entity is regulated by MAS, it is an offence to run a fraudulent or deceptive business in Singapore.”

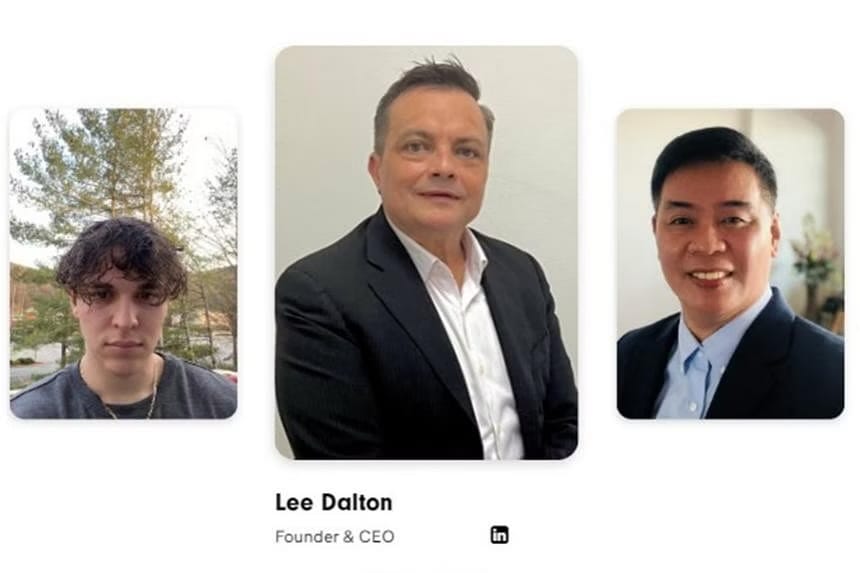

The firm's listed founders, Lee Dalton and Richmond Ray Gonzales, have not commented on the situation.

Investors reportedly poured money into InvesableAI's crypto investment schemes, but haven't received any returns. The details of the specific investment products and the amounts involved haven't been disclosed.

Dalton, a former Australian Navy cadet, was reportedly seen in a video asking people to select a particular package and "just start making money."

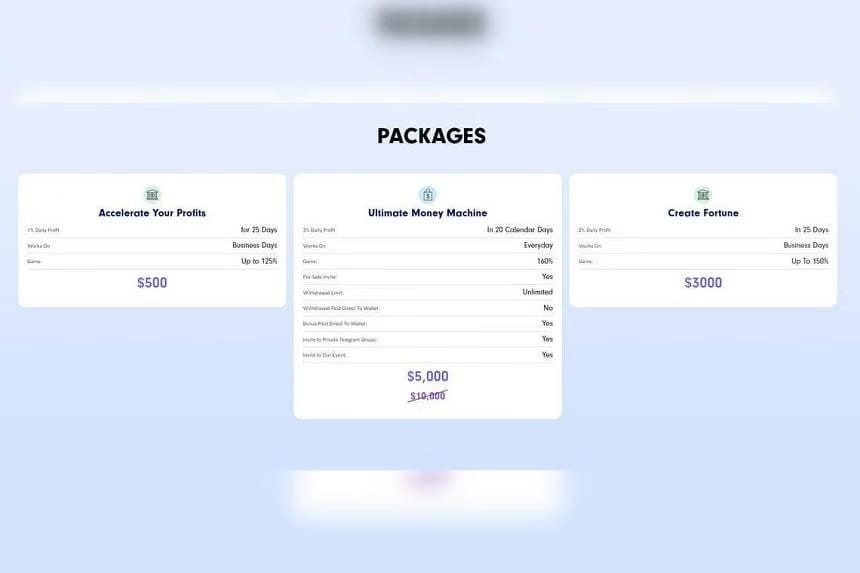

Products sold by InvesableAI include the "Ultimate Money Machine" which offers 160% returns, priced at $5,000, down from $10,000.

Over 150 have allegedly sunk more than $1.5 million into InvesableAI's products but have not been able to withdraw their profits or principals.

Mistaken Identity or Mistaken Ignorance?

The Singaporean man's details surfaced when the Straits Times dug into the firm's ACRA filings. When journalists from the newspaper visited the man's public housing flat, he "had a blank stare when the firm’s name was mentioned."

When presented with the firm's documents, the man was "shocked and scared" to discover that he was named as the director of InvesableAI and at Pexo, Cintery, and Exby International, which are "live" according to ACRA records.

Each of the three companies was registered by foreign directors who provided residential addresses in Texas, yet these addresses are currently inhabited by other individuals.

Confronted with the information, the Singaporean man said his personal information could have been stolen during a holiday in Thailand in 2008 when he lost his identity card.

“If these companies committed crimes, then I will die because my name is there,” the man said.

Lawyer Lim Yun Heng said the Companies Act can protect directors who acted honestly in the circumstances but those who sign up blindly to maintain a facade could be held accountable.

“Without actual knowledge and approval, or at least turning a blind eye to affairs which suggest something is wrong, it is unlikely that the director can be held liable for every criminal offense that the company is implicated in,” Lim explained.

The extent of the man's involvement and knowledge remains undetermined for now. Nonetheless, the verdict of the case could open a Pandora's box for criminals seeking to plead innocence. After all, if directors of companies aren't held accountable for the firm's activities, then who is?

Blockcast

Blockhead's in-house podcast, Blockcast, displays the heady mix of crypto-chaos into delightful sips of TLDR. Straight from Southeast Asia's dynamic digital hub, we dive deep into the blockchain and web3 tapestry, unwinding its knots and narrating its tales, one episode at a time.

Elsewhere