Table of Contents

Investors are showing increased interest in risk assets, while the dollar's value has weakened due to the Federal Reserve's laser-focused focus on rate cuts.

This shift in market sentiment comes after Wednesday's FOMC meeting, where the Fed strongly intended to lower interest rates despite revising growth forecasts upwards.

After the Fed fired up the soft landing story, risk assets, including cryptos, are bid and will likely stay this way until something pops up to disrupt the easing narrative, even at these lofty levels.

According to the analysis of trading patterns since the FOMC, the market is set up for three rate cuts by the end of 2024.

Therefore, despite slightly better revisions to GDP, inflation, and back-year Fed Dot Plots, the dollar was slightly weaker due to the reiteration of three cuts.

A dovish news conference overshadowed the dollar's recovery attempts while Wall Street stocks hit another record high.

Bitcoin rallied further but was still trading well short of its recent peak.

This suggests more gains ahead for cryptos even as the ETF euphoria seems to be vanishing.

"Two critical points in Chair Powell's Q&A session struck a chord with investors. First, many FOMC members expressed concerns about what they called 'seasonal problems' with January's high inflation print, said the chief investment advisor at a large US fund house in New York.

"Additionally, when asked if the favourable job numbers would cause the Fed to postpone a rate decrease, Chair Powell responded negatively. These form the next catalyst for cryptos and risk assets," added the investment advisor.

According to the Fed, recent high inflation figures at the beginning of the year are not part of a new pattern.

Dollar Weakness in Play

If US price data were to weaken, this could mark the beginning of a significant new trend for the dollar.

As such, a favourable risk environment is likely to maintain a weak position for the dollar.

Bonds were in a good mood on Tuesday, but that changed after the FOMC outcome on Wednesday.

The Fed's dot plot has had an impact. Beyond that, we're still in this inflation pop period that continues to pressure yields higher. It likely won't last, but it's the dominant driver for now.

Consequently, financial markets have responded favourably to the possibility of a soft landing, in which the Fed is inclined to cut rates despite the robust economic situation.

Investors believe this may be the beginning of something significant for asset prices.

"There is a clear bias towards global easing in the year ahead. So, risk assets are the favoured bet even if they appear expensive," said a fund manager at a large investment management firm in London.

"More importantly, the run-up seems to have factored in the global rate cuts. But based on my discussions with other asset managers, there is still a lot of cash sitting on the sidelines that will find its way into stocks and cryptos," added the find manager.

Curve Steepening

Fears of a higher median Fed estimate for 2024 did not materialise, leading to a steepening of the UST curve bullish despite longer dots nudging higher.

Once core PCE reaches a certain temperature, yields will likely remain stable or rise soon.

As expected, the FOMC has remained true to its story and is waiting for further data before cutting rates.

Importantly, while the 2024 dot plot remained unchanged, the median for 2025 had one fewer cut, and ten bps raised the long-term estimate to 2.6%.

The market's reaction caused the 2Y rally to steepen the 2s10s Treasury curve by seven basis points (bps).

In contrast to the small increase in 30-year rates, the 10-year yield closed marginally lower at 4.27%.

With a 21 bps discount compared to as low as 15 bps earlier in the week, the market's estimated chance of a June reduction increased to almost 80%.

The annual discount re-entered the 80-base-point range.

Rates are now expected to be closely watched in anticipation of next week's core PCE deflator, which will play a crucial role in shaping the Fed's future policies.

BoE Sits Tight, More Convergence With Peers Further Down the Road

Inflation data ahead of Thursday's Bank of England meeting moved in the right direction.

The closely watched services component was very much in line with the BoE's projections of 6.1% year-on-year for February.

The central bank projects a further decline to 5% by early summer.

On the back of this, the BoE sat tight, sticking to the script by keeping rates on hold and staying mum on the rate path.

Following the CPI report and the BoE meeting, market pricing has moved toward somewhat greater rate cut probabilities, with the likelihood of a June cut now just over 50%.

With the market expecting 70 basis points of easing this year, a reduction is thus considered completely discounted for August.

It is up from 60 bps at the beginning of the month.

There has also been a marked decrease in easing bets compared to competitors like the European Central Bank.

Because of this, investors believe that spreads like 10y Gilt over Bunds could converge towards 135 bps later this year and that this trend will continue structurally as inflation expectations and macro backdrops converge.

We have seen that the premium above the 10-year gilt FV model, which includes UST and Bund peers, has significantly decreased from double digits at the beginning of the month.

European Central Bank to Move First?

The ECB is still prepared to lower rates based on the market discount.

Consistent with broad predictions, the market price of ECB reduction this year is around 85 bps, which is close to the US price.

The ECB has greater justification to lower interest rates right now. Policymakers have come around to a first drop before summer vacation.

However, the eurozone's growth dynamics have hit rock bottom, and economists are projecting only a slight rebound.

With this macro background in place, it should be able to ease its policy stance gradually.

However, while the road to rate reduction is more firmly planted in the eurozone, the effect should be mitigated.

Still, euro rates will feel the market impact of the FOMC meeting conclusions.

SNB Unexpectedly Kicks Off the Rate-Cutting Cycle

The Swiss National Bank is the first major central bank in the developed world to cut rates in this cycle, lowering its main key rate from 1.75% to 1.50%. This came as a surprise, as the status quo was expected by the consensus.

Authorities are taking stronger measures to prevent the currency from appreciating, so the Swiss franc is expected to remain under pressure.

Note that the SNB's policy statement contained two crucial references to the Swiss franc's strength.

In a January address, Chairman of the Governing Board Thomas Jordan said that this had appreciated 7% year-over-year and reduced inflation.

In 2022 and 2023, the SNB aggressively pursued a higher nominal Swiss franc to battle inflation, but that was the exception.

For decades, the central bank has fought franc strength. In 2022 and 2023, it sold CHF22 billion and CHF133 billion of FX to boost nominal CHF.

That may have altered this year, and 2024's first quarter FX intervention statistics may show the SNB buying FX again in late June.

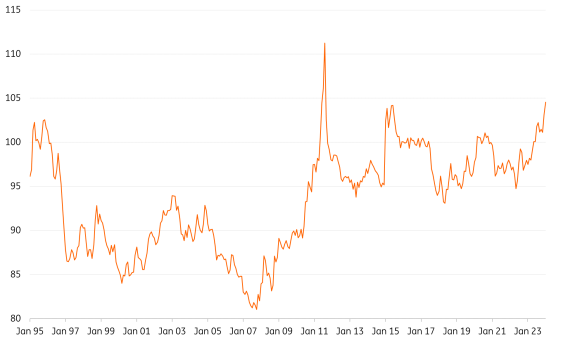

Real trade-weighted CHF testing multi-year highs

EUR/CHF rose after the unexpected cut. But it is uncertain how much higher it needs to move from 0.97/98 as the focus will now turn to the ECB and how soon it follows suit.

The market is pricing over 90 bps in ECB rate reduction this year, whereas our team expects 75 bps.

The two-year EUR:CHF swap spread, which has driven EUR/CHF since October, may grow further.

A further increase to last October's 222 bps might boost EUR/CHF by several significant digits.