Table of Contents

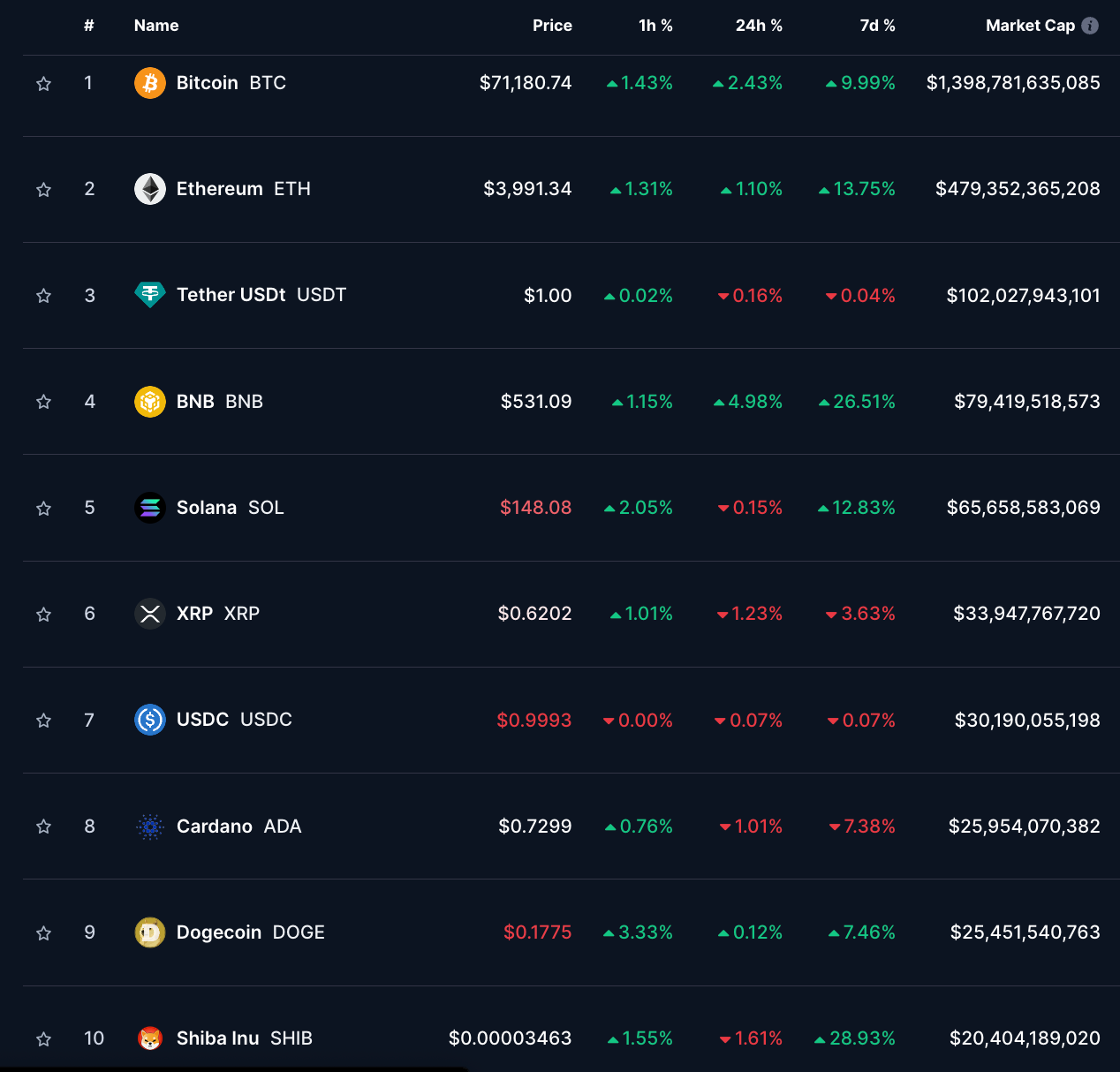

As this Bitcoin-led bull market continues to raise the tide for all cryptocurrencies across the board, it's hard to distinguish the quality tokens from the trash. The overall success of the market is spreading the spotlight too broadly, casting shadows on the strength of genuine projects.

One look at the memecoin market will tell you all you need to know about the power of fundamental-less tokens and their support group.

For the casual investor, an all-inclusive bull market is a good problem to have. After all, who wants to argue against FLOKI's 200% gain this week? But for the serious investor, there bodes a problem: conflating narratives are obfuscating the truth behind many of these projects.

One sector in which this is particularly true is Artificial Intelligence (AI) tokens.

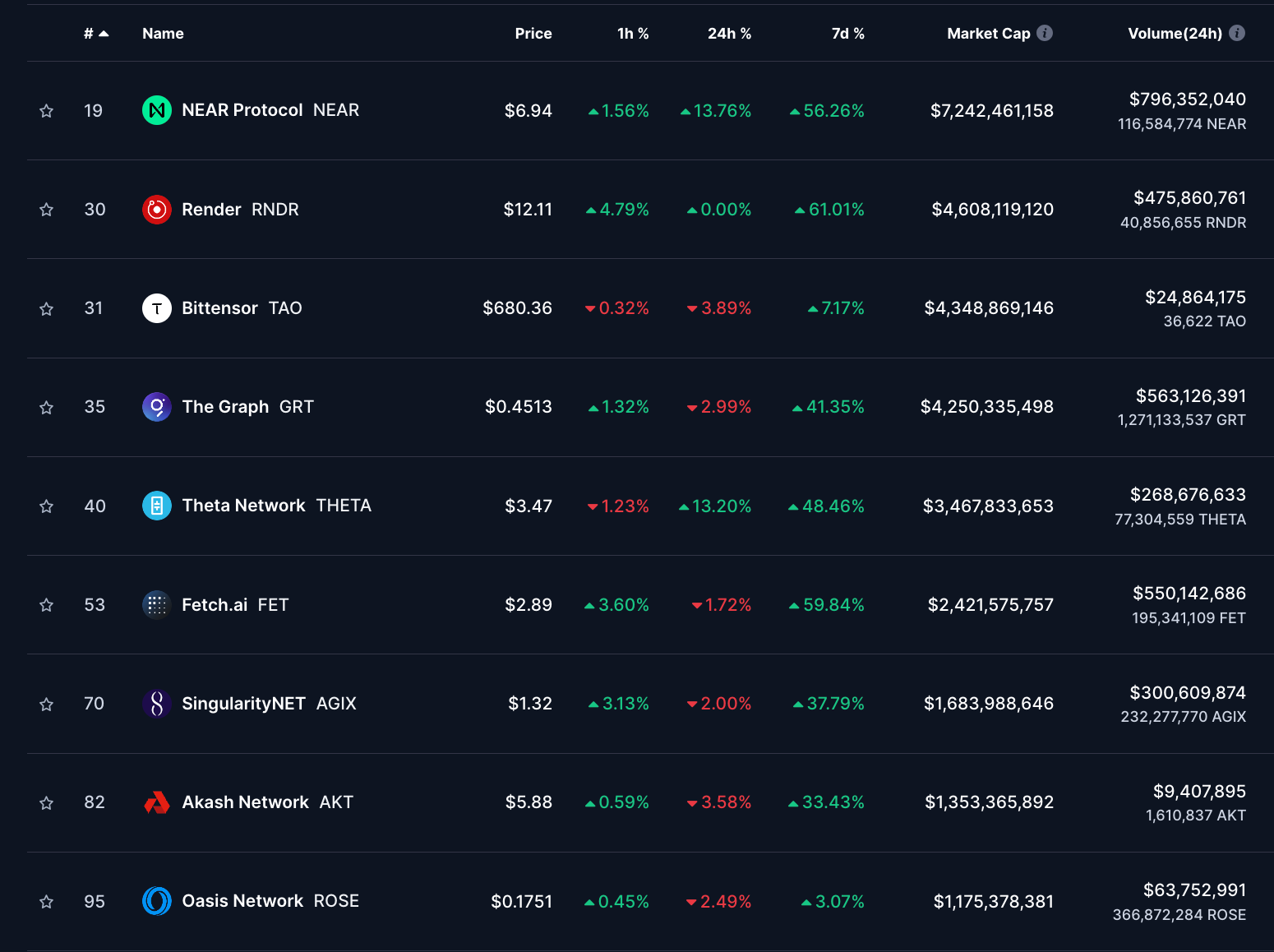

An initial glance at the top AI coins on CoinMarketCap would suggest that the AI crypto market is flourishing. NEAR is up more than 55% over the week, Fetch.ai (FET) is seeing almost 60% returns, and Render's (RNDR) weekly gains are over 61%.

According to CryptoSlate data, AI crypto sector's combined market cap has more than doubled to $25.1 billion in under a month from $9.64 billion on 16 February.

The performance of these AI coins is even stronger than that of the top 10 cryptocurrencies over the week.

AI-n't All Bad

Before you get you sharpen your pitchforks, there are undoubtedly AI benefits for the crypto space. Ethereum founder Vitalik Buterin believes AI's ability to process huge data sets could be utilized through arbitrage bots.

Market participants are often "irrational" and people with the "right knowledge" are not willing to "take the time and bet unless a lot of money is involved," Buterin says.

Introducing AIOmen, Buterin says AI is already being used to predict the market. These AI bots are cost-effective too, working for less than $1 per hour, whilst being armed with an encyclopedic knowledge database.

"If you make a market, and put up a liquidity subsidy of $50, humans will not care enough to bid, but thousands of AIs will easily swarm all over the question and make the best guess they can," Buterin explains.

Security in crypto could also be enhanced with AI's advanced mechanics such as through Metamask's scam detection feature and Rabby's wallet simulation feature.

He suggests that these security tools "could be super-charged with AI," offering a "much richer human-friendly explanation of what kind of dapp you are participating in." AI can help the user understand what exactly they are signing and whether the project is genuine.

Additionally, the likes of Fetch.ai are making considerable strides in the space. Fetch.ai is a decentralized AI platform built on blockchain technology. It aims to enable an ecosystem where autonomous agents, powered by AI, can perform tasks, interact, and transact with one another in a decentralized manner.

Recently, Fetch.ai announced a major collaboration with Deutsche Telekom, Europe’s largest telecommunications provider, and Bosch, a global leader in technology and services.

This partnership aims to integrate AI and blockchain, enhancing industry innovation across various sectors. The announcement had a big impact on FET’s price, with the token jumping by 41% over three days.

AI-n't All Good

AI's relationship with crypto potential certainly has some budding potential. Like a power couple of nerdy tech, AI and Web3 could be the Kim and Kanye that no one asked for but aspired to embrace. But just like Kim and Kanye, this relationship's happy ending isn't guaranteed.

A new report from Coinbase argues that "the intersection between artificial intelligence AI and crypto is wide-ranging and often poorly understood."

"We believe some of the emerging trends in the AI sector could actually make it more difficult for crypto-based innovations to gain adoption in light of broader market competition and regulations," the report stated.

Crypto and web3 are not uniquely positioned to revolutionize and disrupt the industry. Coinbase argues that decentralization "is an insufficient competitive advantage" for an AI product as it believes AI is better at augmenting existing platforms rather than generating new ones.

"Strong user lock-ins or concrete business problems benefit disproportionately from AI integrations," Coinbase explains.

This means that the decentralization dream, which is ironically central to Web3's disruptive capabilities, is less effective for building AI products. "The often touted blanket remedy that “decentralization fixes [insert problem]” as a foregone conclusion is, in our view, premature for such a rapidly innovating field," the report adds.

Blockchain is often presented as a solution for data storage and collection, which are crucial for the development of LLM and AI. "There currently exists no regulatory pathways to host sensitive data on decentralized storage platforms like Filecoin and Arweave," Coinbase argues.

"In fact, many enterprises are still transitioning from on-premise servers to centralized cloud storage providers. At a technical level, the decentralized nature of these networks is also currently incompatible with certain geolocation and physical data silo requirements for sensitive data storage."

With such glaring flaws in Web3's limitations, Coinbase concludes that "the value potential for many AI tokens may be overstated as a result of broad attention on the AI industry."

Unlike NVIDIA (NASDAQ: NVDA), which has seen its stock price skyrocket more than 280% over the year, it is harder to justify the performance of AI cryptocurrencies.

NVIDIA's link to AI is much clearer. The first version of ChatGPT was even trained on a supercomputer with 10,000 NVIDIA graphics cards. The firm itself is even extremely anti-crypto. In an interview with The Guardian, NVIDIA CTO Michael Kagan said AI chatbots such as ChatGPT are more useful than mining crypto.

“All this crypto stuff, it needed parallel processing, and [Nvidia] is the best, so people just programmed it to use for this purpose. They bought a lot of stuff, and then eventually it collapsed, because it doesn’t bring anything useful for society. AI does,” Kagan told the UK broadsheet.

There's clearly a great deal of money to be made in AI crypto tokens but sustainability is less guaranteed. Those looking to invest in long-term AI plays should resist the temptation of these tokens' seductive allure.

Elsewhere