Table of Contents

Stocks, bonds, and the dollar were little changed as traders prepared for significant economic data and comments from Federal Reserve officials that will influence the interest rate forecast.

This week, the economy is again a major focus, as the Fed's preferred inflation measure is anticipated to reveal the most significant increase in a year on Thursday.

The core personal consumption expenditures price index illustrates the central bank's challenges in reaching its 2% objective.

This implies that data should confirm recent statements from Fed officials, emphasising that they are quick to adjust monetary policy.

Traders will carefully monitor the bond market's reaction to major Treasury and corporate developments as they position for the end of the month.

Following the biggest sales surge in almost two years, the US investment-grade bond market is gearing up for robust issuance.

This week, syndicates anticipate more than $35 billion in additional bond sales. As companies scramble to meet robust investor demand, they are well on matching last year's record of $150 billion in February.

The S&P 500 stayed put near 5,100. The 10-year Treasury rates stayed at 4.26%, and the dollar versus most major currencies changed hands almost unchanged from Friday.

Warren Buffett's company, Berkshire Hathaway, had its stock price surge after its weekend earnings report, putting it on track for a market value closer to $1 trillion.

The Stoxx 600 index in Europe fell from its record level on Friday, weighed down by miners. After the chief antitrust regulator in Britain launched an inquiry into possible information sharing between firms, shares of UK homebuilders fell.

Hedge funds are dumping tech stocks at a seven-month high after buying them up in the weeks leading up to Nvidia's earnings.

Following Nvidia's earnings announcement, Thursday was one of four consecutive sessions last week in which professional managers offloaded their shares.

Based on the figures, traders are cashing out their tech bets following a six-week buying spree and reinvesting the winnings in consumer staples and other less risky equities.

On Monday, Asian trading saw no change to MSCI's Asia Pacific index.

This was because the mainland benchmark CSI 300 Index in China ended its longest winning run since 2018, while ongoing gains in Japanese shares offset losses in China.

After Warren Buffett claimed in his annual Berkshire Hathaway shareholder letter that Japanese trading houses adopt investor-friendly practices that are "much superior" to US enterprises, the Nikkei-225 Stock Average extended record highs, with shares in Japanese trading houses soaring.

A New Era for the Record-High Nikkei?

As international investors flood back into the Japanese stock market, the recent run that sent the Nikkei 225 Stock Average soaring beyond a 30-year high appears poised to continue.

That's the consensus among market watchers and investors looking for a possible expansion of equity gains that might propel the broader Topix index to a record high this year. According to traders, there is room for billions of yen to return to Japan's stock market.

Some experts are projecting gains of over 10% for the Nikkei because Japan's deflationary period appears to be over, Japanese firms display sustained profit growth, and the Tokyo Stock Exchange actively advocates for shareholder interests.

Also, the Topix is still around 8% behind its all-time high from 1989.

More money might come in from outside, according to historical data. Japanese equities received ¥15 trillion ($99.5 billion) in foreign inflows in 2013 when former Prime Minister Shinzo Abe's economic policies known as "Abenomics" were initiated.

However, foreign investors quickly changed their minds: from 2006 to 2022, they sold ¥15 trillion worth of shares, a net of ¥15 trillion, as their money poured out of Japanese stocks.

There is still space for more capital to flow back into Japan's equities market since less than ¥6 trillion has entered the market since the start of 2023.

Global investors are moving their allocations to Japan out of concern about China's economic decline and Beijing's market manipulation.

Certain concerns might temporarily derail the upward trajectory of Japanese stocks.

There are technical indications of overheating in the Nikkei's relative strength index for the past 14 days.

If China's economy shows indications of stability and development again, funds might flow back into the country at the same rate they came in.

Many are worried that the yen's recent depreciation has gone too far and will soon begin to rise again, particularly because the Bank of Japan is likely to lift its negative interest rate policy. Exporters may feel the pinch if the currency were to recover.

Dollar's Bull Run in 2024 Hit

After Nvidia's impressive earnings boosted global growth and risk sentiment, the dollar's 2024 bull run had its first weekly setback.

Following seven consecutive weeks of increases amounting to 2.6% until February 16th, the dollar index declined. The ICE dollar index declined last week, marking its worst performance in two months.

Despite US Treasury rates being close to their highest levels of the year, they did not succeed in boosting demand for the US currency. Most of the G-10 currencies gained against the greenback.

The dollar, franc, and yen depreciation was caused by data showing a milder economic slowdown in the US and a more positive growth outlook in Europe.

Economic growth in the euro area's private sector reached an eight-month peak due to a strong rise in service. The euro strengthened against the US dollar for seven consecutive sessions until Thursday, marking its longest winning streak since July.

Increased demand for high-risk assets caused currencies to come under pressure as stock indexes in the US, Europe, and Japan hit all-time highs, propelled by a surge in Nvidia stock that pushed the company's worth beyond $2 trillion.

Investors' enthusiasm for artificial intelligence, especially Nvidia, also impacted more stable currencies. However, several Wall Street analysts predict a stronger short-term trajectory for the US dollar due to a different growth forecast than other Group-of-10 countries. Traders are observing technical indications from US Treasuries, focusing on two-year rates.

Treasury Yields Retract From 2024 Peaks Ahead of Issuance

This week, bond investors are bracing for the effects of significant issuance by the Treasury and corporations as they position for the end of the year, with rates across the curve off their year-to-date highs.

Additionally, there is a jam-packed schedule of economic data and Fed speakers.

Treasuries declined from year-to-date peaks as investors focused on the upcoming supply and demand situation.

The yield on US 30-year bonds decreased, reaching its lowest level since February 13, driven by long-maturity tenors.

On Thursday, it peaked at its highest level since December 1, increasing by almost 4.50% due to investors allocating capital into US stocks and corporate bonds that offer better returns.

Rebalancing bond indices at the end of the month might benefit long-dated Treasuries this week.

Short-term debt is removed from the index when it matures in less than a year, while debt maturing during the month is added. The index adjustment that takes place at the end of each month may encourage passive investors to make a buy.

This week's Treasury auction calendar includes record sales of two- and five-year notes on Monday and a seven-year note sale on Tuesday.

The auctions, typically spanning three days starting on a Tuesday, have been condensed and moved earlier to ensure they are settled by February 29 with one extra day available.

Longer-term rates experienced sharper drops, bringing them closer to shorter-term yields, which have been under upward pressure due to diminishing expectations of Federal Reserve interest-rate reductions.

For the second day in a row, large block trades involving two-year notes and long-maturity Ultra Bond contracts fortified the flattening of the yield curve in Treasury futures.

Coupled deals suggest a wager that long-term cash returns would fall more steeply than short-term ones.

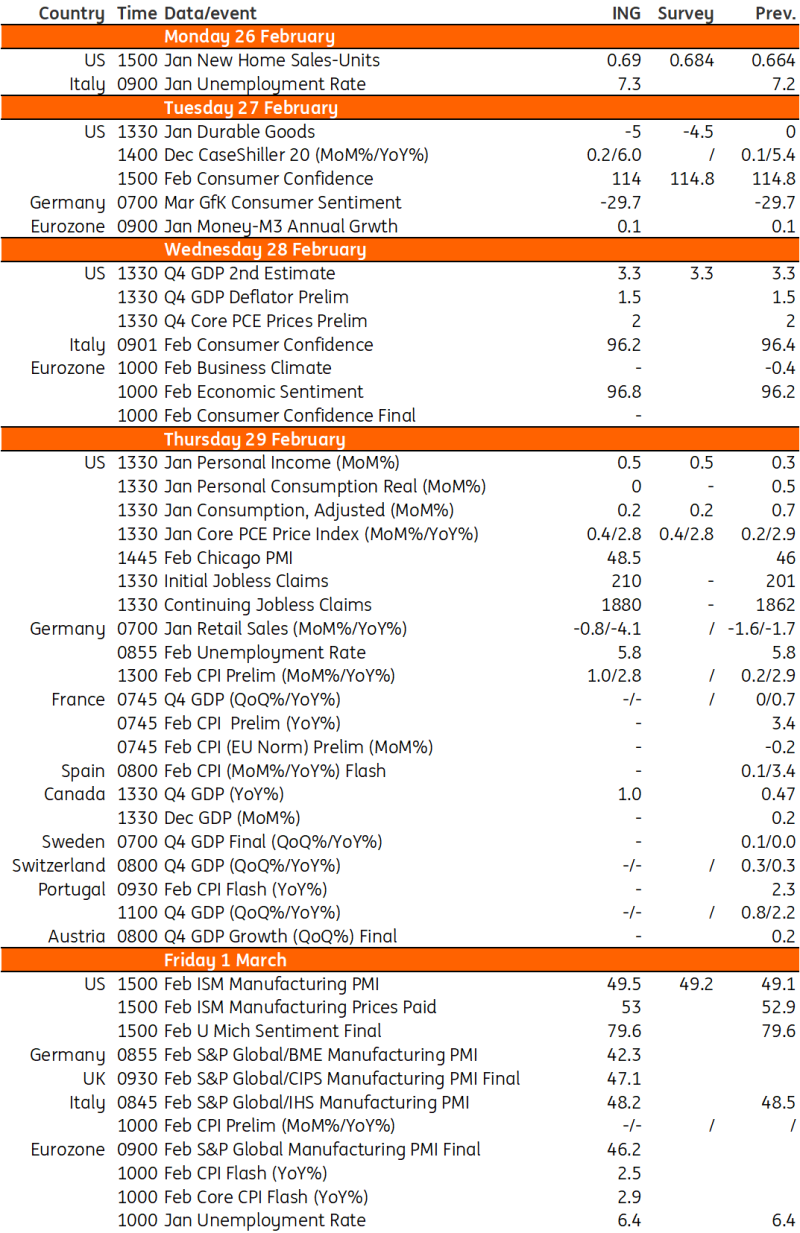

THE WEEK AHEAD

In the US, we will get the Fed's favoured measure of inflation, the core PCE deflator, which markets expect to rise by 0.4% month-on-month.

The key data points in the euro zone, including inflation and unemployment, will give the ECB an idea of whether rates can be cut later this year.

Macro Data Calendar

US: Fed's Favored Inflation Gauge Seen Rising Most in a Year

Financial markets have moved back to pricing 75-100bp of Federal Reserve interest rate cuts this year having favoured 150-175bp just a few weeks ago.

The strong growth, jobs and inflation numbers suggest that an imminent move is unlikely with the data needing to show more benign inflation prints as a bare minimum before the Fed will contemplate policy easing.

In January, the core US inflation likely increased the highest in a year, based on the Federal Reserve's preferred measure, indicating the challenging journey to controlling price increases.

The core personal consumption expenditures price index, excluding food and energy expenses, is expected to increase by 0.4% compared to the previous month. The gauge has decreased over the last two years, but it now shows a second consecutive monthly increase.

When annualizing the statistics over three or six months, both would recover to above 2% after falling below the Federal Reserve's objective in December.

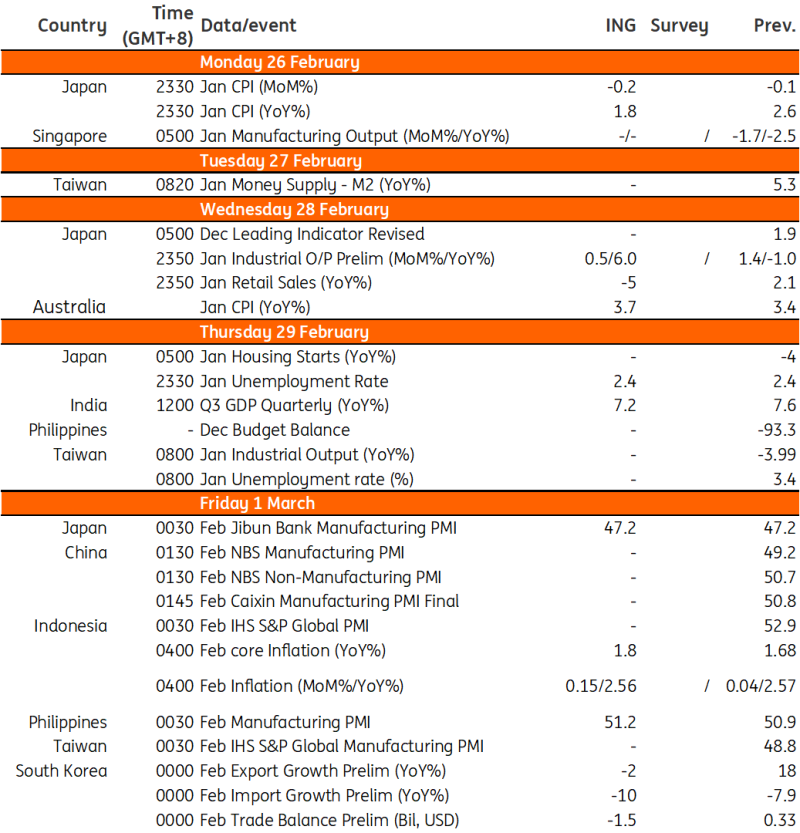

Asia Week Ahead

This week features several economies across the region reporting inflation and trade numbers. Meanwhile, China also reports its latest PMI readings and India releases GDP figures.

Macro Data Calendar

China’s PMI Likely in Contraction Territory

China's February PMI will be published on Friday. Markets expect the manufacturing PMI to remain broadly stable, dipping slightly from 49.2 to 49.1.

The Lunar New Year effect could act as a drag on the February data as factories shut down for the break. This year’s eight-day holiday is also a day longer than normal.

The PMI will likely come in below the critical 50 threshold for the fifth consecutive month, but the non-manufacturing PMI on the other hand should paint a more favourable picture.

A strong recovery in travel and tourism over the Lunar New Year period bodes well for services sectors, and analysts expect an uptick from 50.7 to 51.0.

Key Focus Events This Week

Tuesday:

- Japan Inflation

- Bank of England Governor Andrew Bailey Speaks

- US Conference Board Consumer Confidence & Durable Goods

Wednesday:

- Reserve Bank of New Zealand Rate Decision

- Eurozone Economic & Consumer Confidence

- FTSE 100 Index Review

- US GDP

- G-20 Finance Ministers & Central Bank Chiefs Meet

- Fed Speakers: Atlanta Fed President Raphael Bostic, Boston Fed President Susan Collins & New York Fed John Williams

Thursday:

- Australia Retail Sales

- France, Germany & Spain Inflation

- US PCE Deflator

- MSCI Index Changes: including the removal of 66 Chinese firms from the MSCI China Index

- Fed Speakers: Chicago Fed President Austan Goolsbee, Atlanta Fed President Raphael Bostic & Cleveland Fed President Loretta Mester

Friday:

- China's official PMI, Caixin manufacturing PMI,

- Eurozone Inflation

- US ISM Manufacturing & University of Michigan Consumer Sentiment

- US House Funding Bill Deadline

- Fed Speakers: Atlanta Fed President Raphael Bostic & San Francisco Fed President Mary Daly