Table of Contents

Breaking news: insider trading even occurs in the world of NFTs. No, it's a tale as old as the industry itself. This time, insider trading allegations have surfaced in BAYC parent Yuga Labs's acquisition of Moonbirds startup Proof Collective.

Yuga Labs acquired all of Proof's properties including Moonbirds, Oddities, Mythics, and Grails. It even plans to integrate Moonbirds into its highly anticipated metaverse game, Otherside.

Speaking to Decrypt, Yuga Labs CEO Daniel Alegre said there were industry concerns about what would happen with Moonbirds, which spurred Yuga to engage in a discussion with Proof.

“We had a meeting of the minds and we said, ‘You know what? Let's do this, let’s have Proof become a part of the Yuga family,’” said Alegre. “And then it all worked out. It was actually pretty quick too.”

Alegre added that he believes Moonbirds art looks like it was “actually created for Otherside” and in a statement, said it has "many unifying brand elements with Otherside."

At its peak, Moonbirds reached $500 million in trading volume in April 2022 whilst BAYC NFTs surpassed over $200 million in monthly sales volume on multiple occasions.

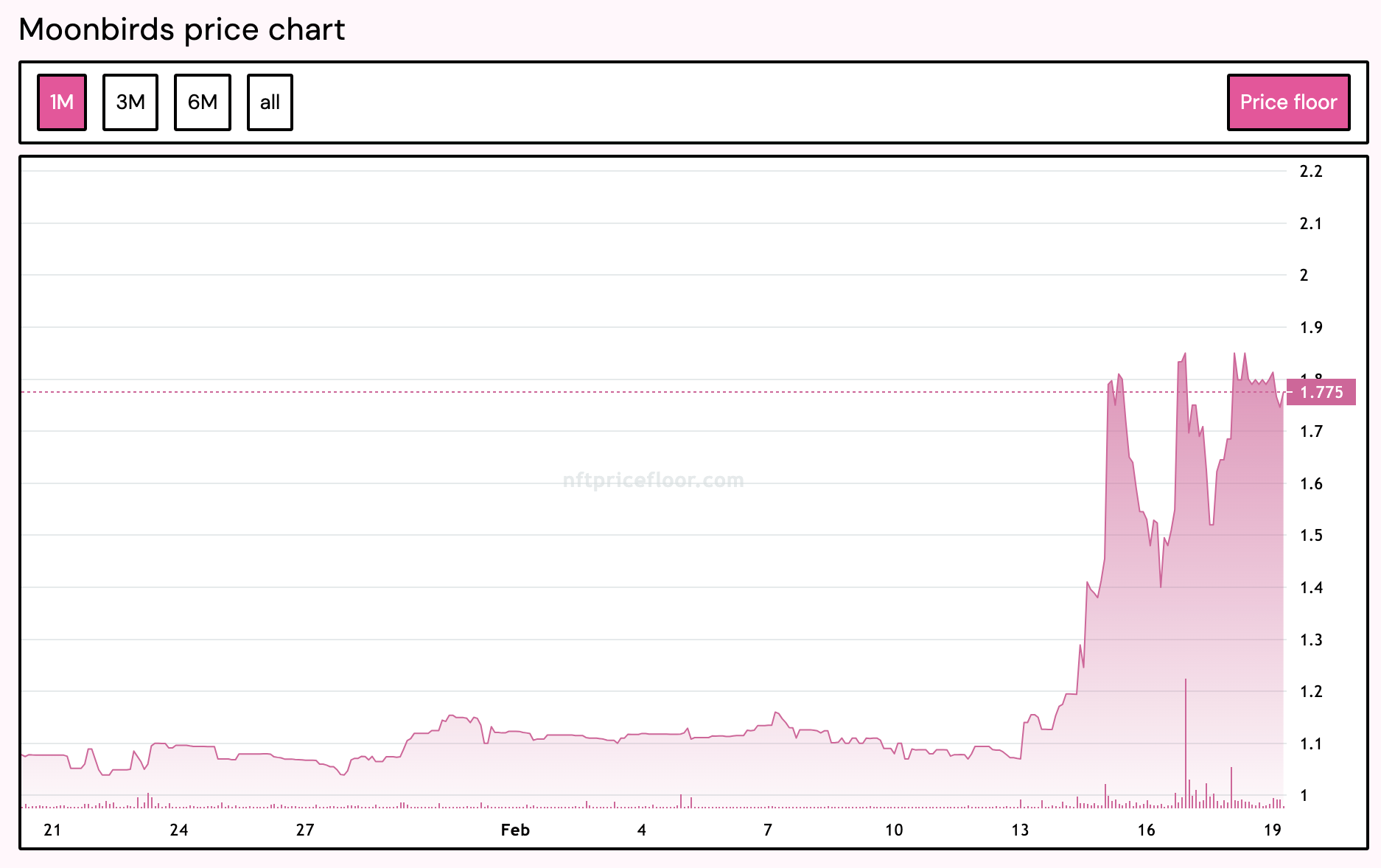

Since its heyday, prices and trading volumes of Moonbirds NFTs have fallen drastically but significant activity was recorded in the days ahead of BAYC's official announcement

The acquisition was announced on 16 February but on 14 February, sales volumes reportedly increased fivefold from the previous day to $460,000. Transactions surged four times the previous amount too. On 15 February, sales volumes hovered around $330,000, before skyrocketing after the announcement to about $3.1 million.

The floor price of Moonbirds also shot up ahead of the announcement from sub-1ETH to highs of almost 1.8ETH.

As there was no significant driver for the price surge between 13 and 15 February, Crypto Twitter is now calling out traders for insider trading.

Moonbirds chart before the Yuga acquisition tweet.

— cygaar (@0xCygaar) February 16, 2024

Nope, definitely no insider trading here. pic.twitter.com/UqV0DeXUr8

“Moonbirds chart before the Yuga acquisition tweet. Nope, definitely no insider trading here,” blockchain developer, cygaar, tweeted.

"Found Nancy Pelosis NFT wallet. 80 Moonbirds, 71 Moonbird Mythics, 28 Oddities, and 13 Mythic eggs bought in the last 7 days. Sitting on a couple hundred thousand in profit after the Yuga news," crypto influencer, Cirrus, jibed.

Found Nancy Pelosis NFT wallet

— Cirrus (@CirrusNFT) February 16, 2024

80 Moonbirds, 71 Moonbird Mythics, 28 Oddities, and 13 Mythic eggs bought in the last 7 days

Sitting on a couple hundred thousand in profit after the Yuga news pic.twitter.com/VqImNT77tA

Although NFTs are far from regarded as securities, and thereby do not fall under the SEC's legal framework surrounding insider trading, US courts have taken disciplinary action against insider NFT trading in the past.

In 2022, former senior OpenSea employee Nate Chastain was arrested in the US government’s first case of digital asset insider trading.

Chastain allegedly bought at least 45 NFTs in 2021 ahead of OpenSea featuring them on its homepage. He then sold the NFTs for 2x to 5x the price he had originally paid for them.

In 2023, Chastain was sentenced to three months in prison and ordered to forfeit 15.98 ETH and pay a $50,000 fine.

U.S. Attorney Damian Williams said, “Nathanial Chastain faced justice today for violating the trust that his employer placed in him by using OpenSea’s confidential information for his own profit. Today’s sentence should serve as a warning to other corporate insiders that insider trading – in any marketplace – will not be tolerated.”

Nevertheless, the NFT market remains highly unregulated with faceless digital identities making anonymous high-volume trades. Other than high-profile cases such as Chastain, the sheer nature of the NFT scene makes policing insider trading extremely difficult work.