Table of Contents

For quite some time now, the US Securities and Exchange Commission has earned itself an increasingly despicable reputation in the crypto industry. Whether it's taking Ripple to court, throwing lawsuits at Coinbase or even claiming jurisdiction over the entire Ethereum ecosystem, the SEC is proving to be no one's friend in Web3.

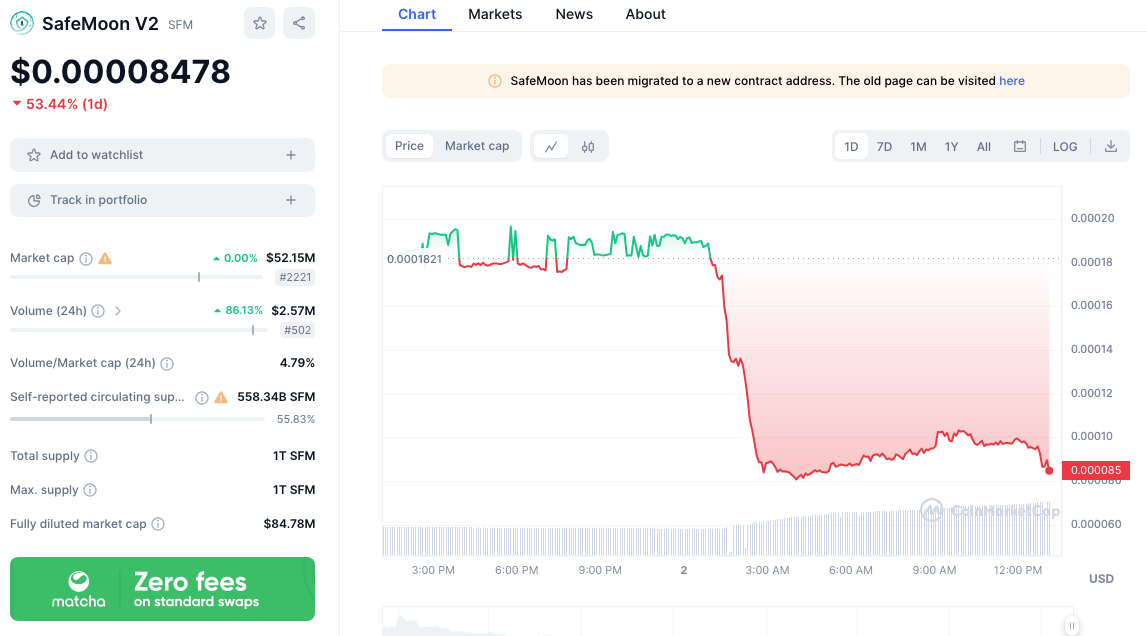

However, in its countless attempts at coddling the industry, the SEC has succeeded in weeding out truly bad actors. Blockchain company SafeMoon, once valued at $8 billion, has been charged by the SEC for fraud and unregistered offering of crypto securities.

SafeMoon creator Kyle Nagy, CEO John Karony, and CTO Thomas Smith are all facing the charges. The SEC alleges that the firm promised to take the price of their token "safely to the moon" but instead of delivering profits, SafeMoon "wiped out billions in market capitalization, withdrew crypto assets worth more than $200 million from the project, and misappropriated investor funds for personal use."

Nagy allegedly assured investors that their funds would not be withdrawn by anyone and were locked safely in SafeMoon's liquidity pool. Instead, much of the funding was used by the firm's executives to purchase luxury cars, homes and other extravagant items.

i bought safemoon 3 days after it launched in 2021

— kmoney (@kmoney_69) November 1, 2023

i held my bag from $3k -> $400k and back down to $30k in 2022

i finally sold when i saw the coffeezilla video after months of having doubts due to all the broken promises and roadmaps

it was a hard pill for me to swallow to…

SafeMoon's price temporarily mooned 55,000% between March and April 2021, reaching a market cap of over $5.7 billion. Its price plummeted by almost 50% towards the end of April that year when it was revealed that SafeMoon's liquidity pool was not locked as the firm had claimed.

Karony and Smith then misappropriated assets to purchase SafeMoon to manipulatively inflate its price. The former also allegedly wash-traded SafeMoon through a separate account.

News of the SEC charge sent SafeMoon's price plummeting over 50%.

To the credit of the SEC's warnings, nefarious characters continue to lurk in the crypto space; its wild west reputation is not exactly unfounded. Uncovering this scandal at SafeMoon might be disastrous for those HODL-ing SFM but it serves as a reminder that the SEC's no-nonsense approach could ultimately strengthen the industry.

Dare we say it, well done, SEC?

Elsewhere:

- Smart Wallet for Solana Arriving Soon on iOS: Fuse, the groundbreaking smart wallet for Solana, is set to launch on iOS, offering a unique self-custody solution. Unlike conventional wallets, Fuse operates with three keys and no seed phrase, providing enhanced security for Solana assets. Designed for retail users seeking a secure savings account for their crypto, Fuse complements existing Solana wallets like Phantom and Solflare, enriching the self-custody experience. Stay tuned for test flight invite codes and Fuse's presentation at Solana Breakpoint for more details.

- Qredo Halves Staff Once More Amid Shrinking Runway: Crypto custody infrastructure provider Qredo, already facing a precarious financial situation, has cut half its staff again, leaving it with about six months of operational runway, The Block reported. Despite being valued at $460 million in February 2022 and raising $80 million in Series A funding, Qredo is grappling with dwindling transactional activity amid a "prolonged crypto winter." Its current headcount stands at 50, down from 200 at the start of the year. The firm is now actively seeking fresh funding and exploring strategic mergers and acquisitions to stay afloat, with support from 10T Holdings, its Series A lead investor.

- Cross-Border Crypto Regulation a Priority – HKMA Chief: In his speech at the Bloomberg Global Regulatory Forum 2023, HKMA Chief Executive Eddie Yue discussed the global regulatory landscape. He mentioned the banking turmoil earlier in the year and emphasized enhancing the banking sector's resilience, highlighting the collaborative efforts of global authorities in addressing challenges like technological changes and customer behavior, alongside focusing on banks' prudential and resolution frameworks, interest rate, and liquidity risks. He stressed the collective effort of global regulators to mitigate vulnerabilities in crypto markets, underscored by recent incidents. He noted the regulatory advancements in Asia concerning crypto-assets, emphasizing the need for globally-consistent regulation due to the borderless nature of crypto service providers, to effectively manage the associated risks.

- UK’s FCA Greenlights PayPal for Crypto Business: The UK's Financial Conduct Authority (FCA) has authorized PayPal UK as an electronic money institution and a consumer credit firm, additionally registering it as a cryptoasset business. This means PayPal can start offering crypto-related services to UK nationals. However, the approval has certain limitations as the FCA has restricted PayPal from engaging in some crypto-related activities like operating crypto ATMs or acting as a crypto lending platform.

- Record Crypto Money Laundering Scheme Busted in Taiwan: Taiwanese authorities have apprehended an individual, identified by surname Qiu, suspected of laundering a record TWD 10.4 billion ($320 million) via digital assets, marking this the largest single case of crypto-related money laundering in Taiwan's history. The case unfolded from an investigation into a fraudulent securities trading app, leading to the tracing of financial transactions tied to Qiu, who allegedly funneled money through various accounts, exchanging them for Tether (USDT), and then back into cash to obscure the funds' origins.