Table of Contents

Hey there! Just a quick note to let you know that this edition of the Blockhead Business Bulletin is brought to you by our sponsor, Franklin Templeton. They're a global investment management organisation with over 75 years of investment experience. Being a California-based company, they offer value by leveraging its Silicon Valley roots and relationships with countless fintech, blockchain, and AI companies to bring insights directly to their clients. So, sit back, relax, and enjoy today's news knowing that it's made possible by our friends at Franklin Templeton.

CAPITAL FLOWS IN GLOBAL MARKETS

The steady decline in Chinese stock prices over the last three years has made the Chinese market the poorest performer globally.

That's why some investment funds actively seek hidden wealth.

Given the slowing economy, uncertain government crackdowns, and continuing property troubles, they see the widespread pessimism about Chinese assets over the last several months as a contrarian signal.

Global funds have cut their exposure to China's stock market to its lowest level since October, creating purchasing opportunities for interested people.

A measure of mainland enterprises trading in Hong Kong has plunged 50% from its all-time high reached in February 2021, making it the poorest performance of 92 global indexes over the last three years.

The MSCI China Index has fallen 55% from its all-time high reached in February 2021.

Selling by international investment funds has been a key factor in the current downward trend.

Offshore money managers, who had been net buyers of mainland shares earlier in the year, dumped a record $12 billion via trading ties with Hong Kong in August and sold another $3.2 billion this month.

Bulls argue that it makes sense to search for value today since the bearish stance creates room for a comeback, and there are indications of stabilisation in some sectors of the economy.

Stocks Struggle on Fed's Higher for Longer Rhetoric

After three Federal Reserve members indicated future rate rises may be required to ensure inflation is kept under control, Treasury prices rallied on Friday while a gauge of global stocks sank, adding to severe sell-offs last week.

The S&P 500 notched its worst week since March.

The tech industry, which took a major hit in the market's recent downturn, really did rather well.

The release of Apple's newest iPhones and watches boosted the company's stock price.

A measure of Chinese stocks traded in the United States rose after hearing that the governments in Washington and Beijing are establishing economic and financial working groups.

Indian markets fell on Friday, with the benchmark Sensex having its worst week in 15 months on concerns about increased global interest rates.

The recent oil surge and the Fed's indication that rates are not going to come down any time soon, and market participants are still quite anxious about inflation and the course of policy.

As the possibility of higher interest rates for a longer period of time boosts the chance of a recession, investors have been selling stocks at a faster clip than they have since December.

Data showed $16.9 billion in global equities fund outflows in the week ended Sept. 20. US stock funds led the exodus; European redemptions reached 28 weeks.

The Nasdaq, S&P 500 and MSCI's global stock gauge posted their biggest weekly percentage declines since early March.

Quant investors who gamble across assets struggled last week as hawkish monetary policy increased.

Risk parity was battered by the synchronised drop in equities, bonds, and commodities after the Federal Reserve meeting.

Ray Dalio's renowned method splits a portfolio by asset risk. It uses government debt to hedge equities drops, so a wide selloff might hurt it.

The $926 million RPAR Risk Parity ETF had its worst day since December and its lowest in 10 months due to cross-asset decreases.

One of the strategy's major metrics dropped significantly this year as rising rates slow economic activity and lower asset values.

Bond Markets in a Catch-22 Situation

With 10-year yields at their highest in almost a decade and the Federal Reserve signalling it's nearly done increasing rates, bond investors confront the key question of how much risk to assume in Treasuries.

Although investors as a whole are stocking up on cash, many portfolio managers are debating how far they should go in the other way.

Rates on two-year notes have been lower since 2006, while rates on 10-year notes surpassed 4.5% on Friday, a level not seen since 2007.

After the Fed decided to leave rates unchanged this week, yields climbed across the curve because investors expect the Fed to keep borrowing prices high until at least 2024 to rein in inflation.

It's a perspective that suggests not even short maturities are safe from risk.

US Treasuries have fallen 1.2% this year, putting them on course for their third consecutive yearly loss.

The front end now is the most desirable.

According to EPFR Global data, until September 20th, roughly $10.3 billion has been invested in US government bond mutual funds and ETFs since the end of July.

There has been $3.25 billion invested in bonds with intermediate maturities and $5.5 billion invested in funds with long-term maturities.

Ghost of Weak Pound is Back

On Friday, the US dollar strengthened against a group of major currencies after several recent economic reports underscoring the United States' preeminent position among the world's leading economies.

On the other hand, a year after the pound hit a record low due to former Prime Minister Liz Truss's expenditure plans, investors are again selling the British currency.

Investors have been pouring in for months to take advantage of the UK's rising interest rate environment.

The Bank of England's (BoE) unexpected decision to maintain its current policy stance on Thursday has redirected the attention of bears back to the country's weak fundamentals, even as the effects of last year's crisis begin to dissipate.

Many investors expect the pound to continue its recent downward trend versus the dollar.

The BoE stopped its rate-hiking cycle because of worsening economic statistics and concerns that higher rates may hasten the onset of a recession.

However, policymakers must consider the many variables that might increase consumer costs.

After leading returns among its Group-of-10 peers over the last year, the pound has slipped to last place in September, and Thursday's decision has sent the currency to its lowest level against the dollar in six months.

Investment firms reduced long bets and switched to shorting the currency.

After reaching a high of 105.78, the US dollar index - which tracks the greenback's value relative to six major rivals - closed higher.

The index rose roughly 0.3% last week, marking its 10th consecutive week of gains. That is the longest winning run for the index in over a decade.

Oil Ends the Week Lower

Although oil prices remained stable on Friday, they ended the week down as investors took profits as the market considered the impact of supply fears related to Russia's fuel export embargo and demand worries related to potential rate rises.

Crude futures have gained almost 10% in the last three weeks as worries over supply have driven up prices.

Investors keep an eye out for the possibility of a hike in energy costs.

Meanwhile, supplies were likely to become tighter due to Russia's temporary embargo on shipments of petrol and diesel to most nations.

On Friday, Transneft stopped sending diesel to Russia's Primorsk and Novorossiysk ports on the Baltic and Black Seas.

Still, demand concerns about the economic impact of higher rates offset supply constraints.

On Friday, the St. Petersburg International Mercantile Exchange saw a drop of over 10% in wholesale petrol prices and a drop of 7.5% in diesel prices in Russia.

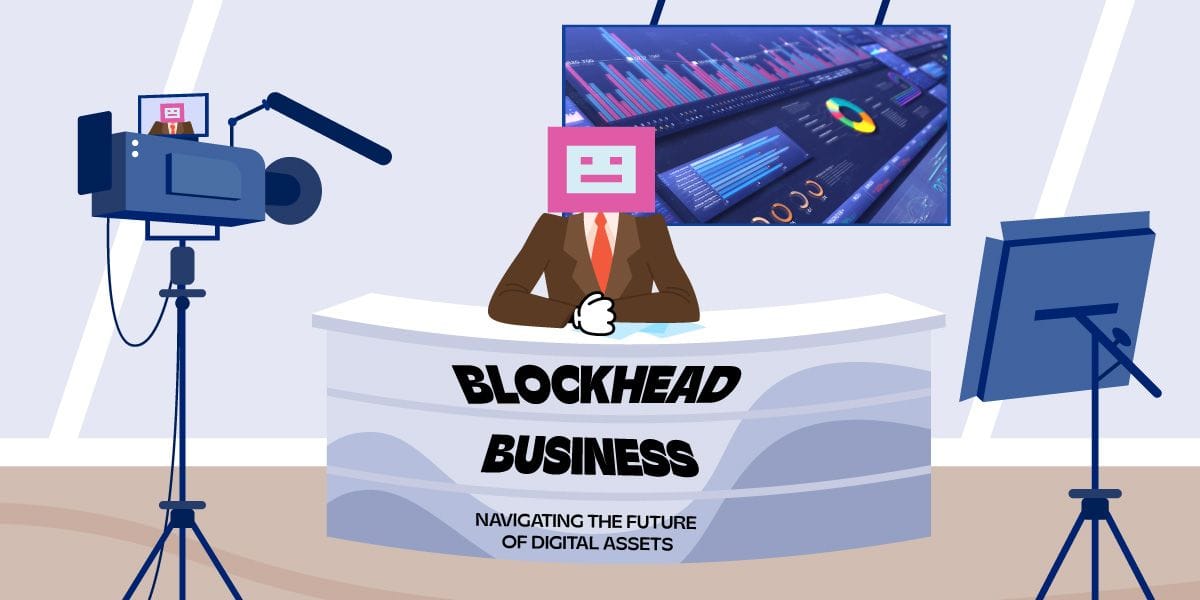

Bitcoin Reverses Rally

After gains which saw Bitcoin rise over US$27,000 to its highest level since August, the largest cryptocurrency reversed that trend.

Last Sunday, the biggest digital coin saw a weekly gain for the first time in five, and by Monday, it had risen as much as 3.7% to $27,418.

But the crypto fell through the week after Fed policymakers hinted at more hikes.

The attractiveness of high-risk investments, like cryptocurrency, decreases when interest rates rise.

Soma analysts say there is no clear catalyst for cryptos to move up, with investors still watching Bitcoin's next level of US$28,800.

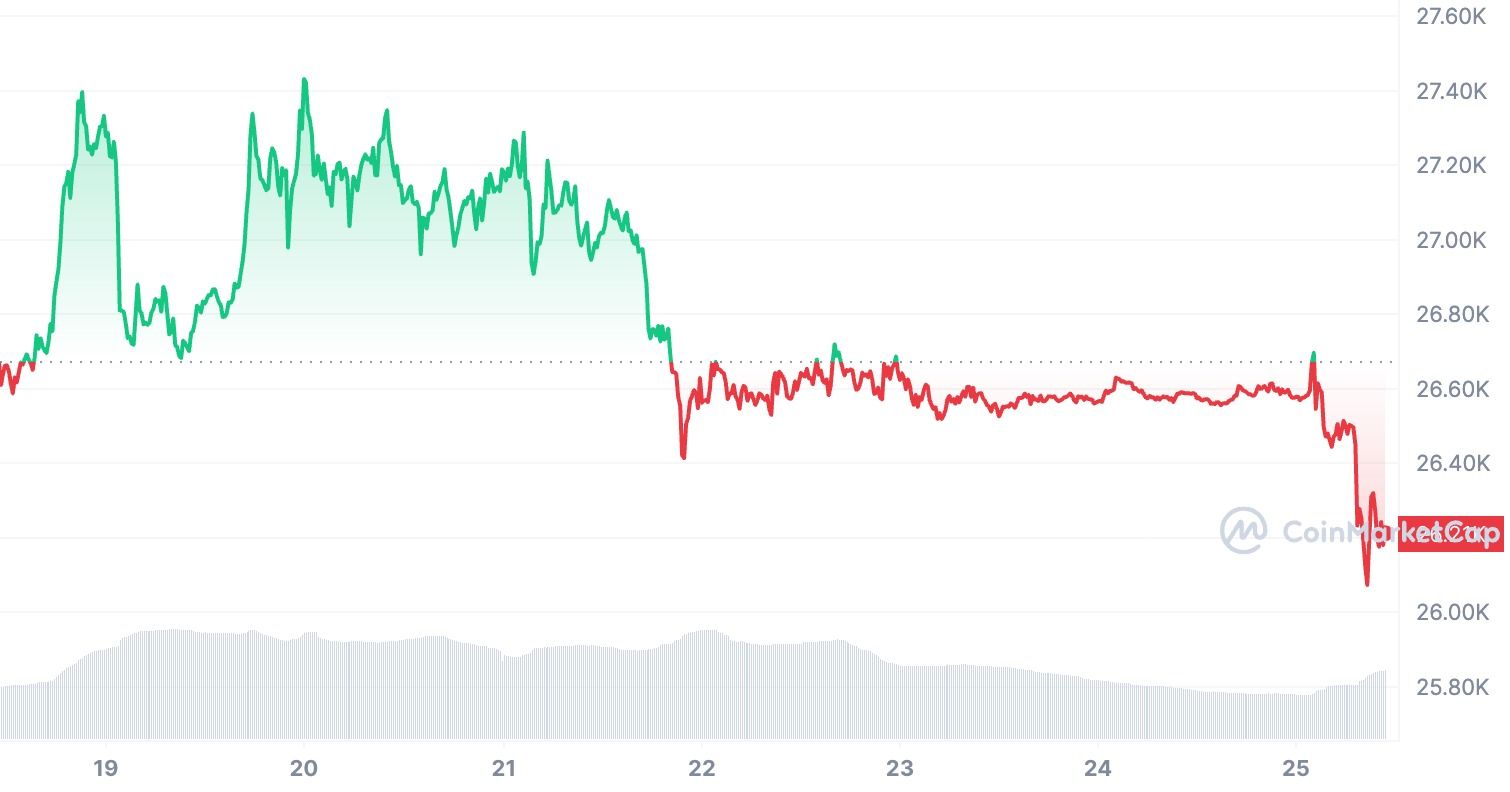

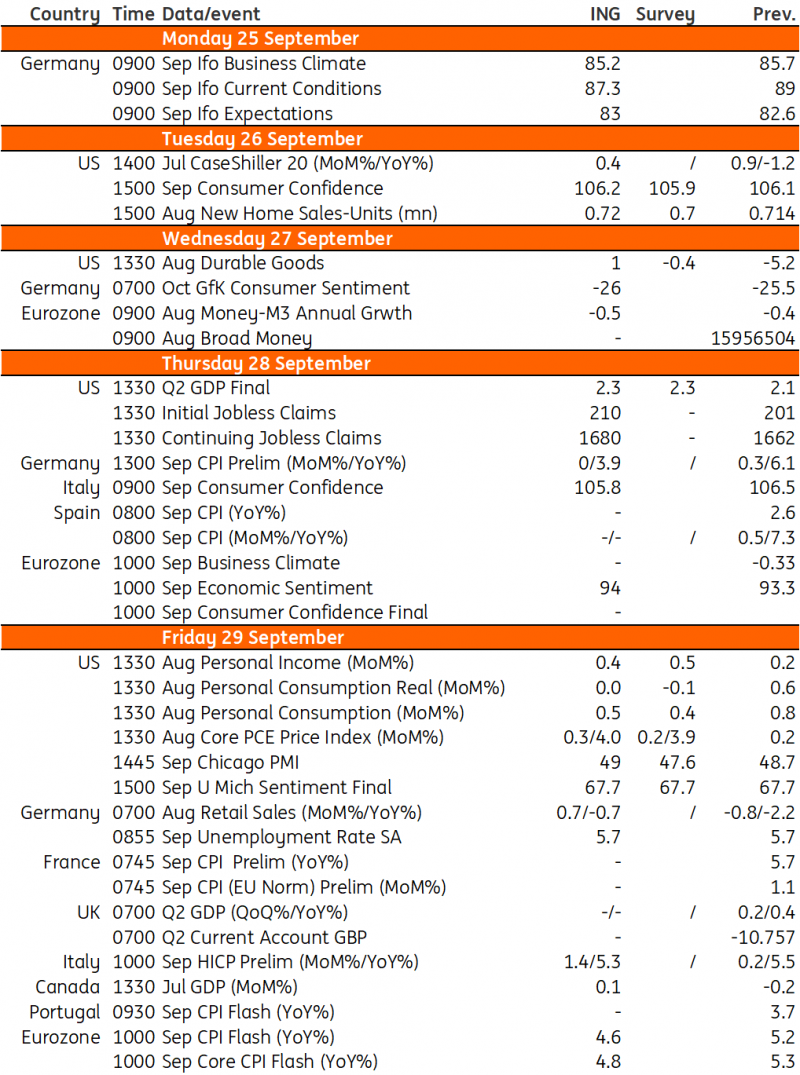

THE WEEK AHEAD

Federal Reserve policymakers' explanations of what they need to see to raise rates again this year will be closely watched. This week is especially significant in the Eurozone, as headline and core inflation data will be made public.

Key Events in Developed Markets

- US: August personal income and spending report release.

- Eurozone: Expect a drop in both headline and core inflation.

Macro Calendar

The Fed’s higher-for-longer interest rate message upgraded growth forecasts and lowered unemployment projections have gained more market traction, with the 10Y Treasury yield up at 4.5% – the highest since 2007 – and the dollar continuing to strengthen.

Asia Week Ahead

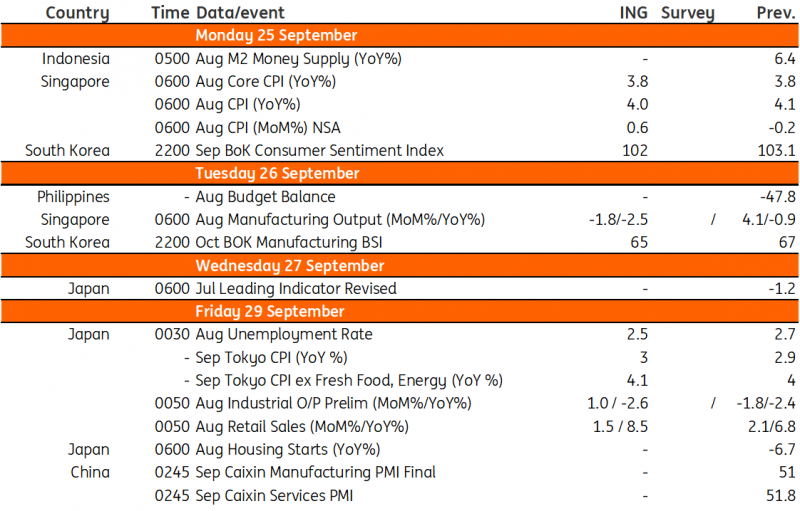

Several reports from Japan and Korea are scheduled for this week's Asian data calendar. At the same time, we'll have Australian and Singaporean inflation figures to consider.

Key Events in Asia:

- Inflation in Australia to accelerate?

- Caxin China PMI

- Flurry of data out from Japan

- Sentiment in Korea likely on the downtrend

- Singapore inflation to edge lower

Macro Calendar

China: Some spots of improvement

While the economy as a whole is still struggling, there were some encouraging signals in the most recent set of data. The housing market, however, remains a sore spot.

Our latest article in conjunction with Franklin Templeton focuses on cryptographic proofs and we take a deep dive into its fundamentals. 🤔 We answer the questions;

👇 Why are cryptographic proofs valuable?

👇 Why does it matter and why should you care?

👇 What are the critical proof strategies and their features?

And most importantly;

👇How can I use cryptographic proofs in the real world?

-