Table of Contents

Cryptocurrencies, led by bitcoin and ethereum, continued their rally overnight Monday, after US regulators took steps to quell fears and prevent a fallout from recent bank failures.

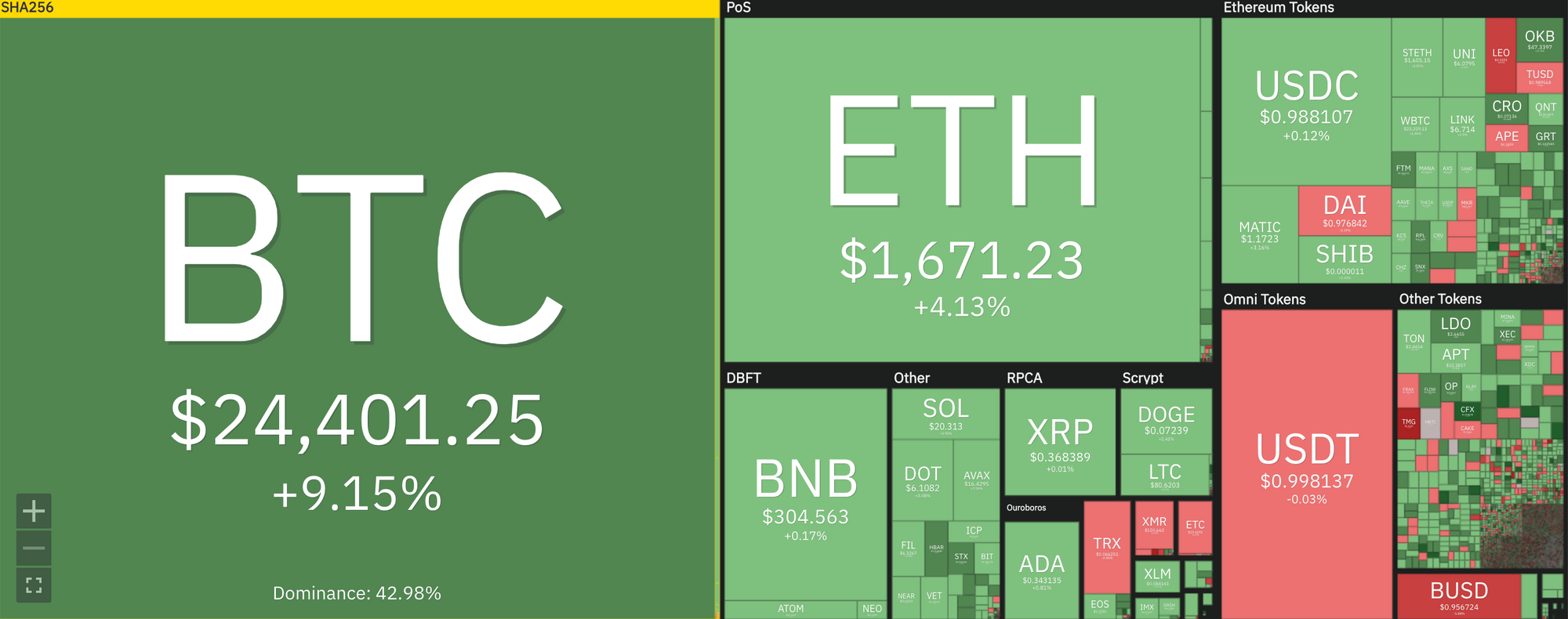

The price of bitcoin now sits at around US$24,500, or up about 18% in the past 24 hours, while Ether is close to the US$1,700 mark.

"It appears that the biggest one-day rise since the FTX turmoil is a sign that some investors believe that DeFi solutions support the case for holding cryptos," Oanda's Edward Moya said in a research note Monday.

Commenting on recent price movements, Bitcoin maximalist Anthony Pompliano said on Twitter, "Very clear signal from the market that a decentralized currency that allows you to become your own bank is valued in light of the recent developments."

Bitcoin is up almost 18% in the last 24 hours.

— Pomp 🌪 (@APompliano) March 13, 2023

Very clear signal from the market that a decentralized currency that allows you to become your own bank is valued in light of the recent developments.

Vulnerable sector

The recent failure of crypto-focused banks, including Silvergate Bank, Signature Bank, and Silicon Valley Bank, in the past week has again exposed the vulnerability of the industry and has led to concerns about the crypto industry being cut off from the regulated US banking system, as these banks were some of the largest digital asset banks in the country.

Related: One More Setback for Crypto as Signature Bank Closes

The market initially responded negatively, with the largest cryptocurrency by market value plunging below $20,000 as customers withdrew their money en masse before the banks' failure.

On Sunday, the Federal Reserve announced a massive injection of liquidity into the banking system, while the SEC and CFTC jointly issued a statement saying that they were closely monitoring the situation and would take appropriate action to ensure stability in the markets.

With US regulators taking steps to contain any possible contagion and boost confidence in the banking sector, the appetite for risky assets is on the rise again. The news of the US$25 billion Bank Term Funding Program that will finance bank assets spurred a rush back into digital assets, sending bitcoin up by more than 10% and ethereum up by more than 15%.

However, it is important to note that despite the recent rally, Bitcoin and Ether's prices are still down about 50% over the last year, indicating that crypto's struggles may not be over just yet.

Related: Stablecoin Demand Grows After Silvergate Exodus

The world of Web3 can be quite a whirlwind. Whether it’s crypto news in Singapore, South East Asia or even across the globe, we understand how busy the industry is keeping you, so we kindly send out three newsletters each week: BlockBeat for a wrap-up of the week’s digital assets news; Blockhead Brief for weekend happenings as well as what to look forward to in the week ahead; and Business Bulletin for macroeconomic updates and industry developments. To avoid FOMO and access member-only features, click here to subscribe.