Table of Contents

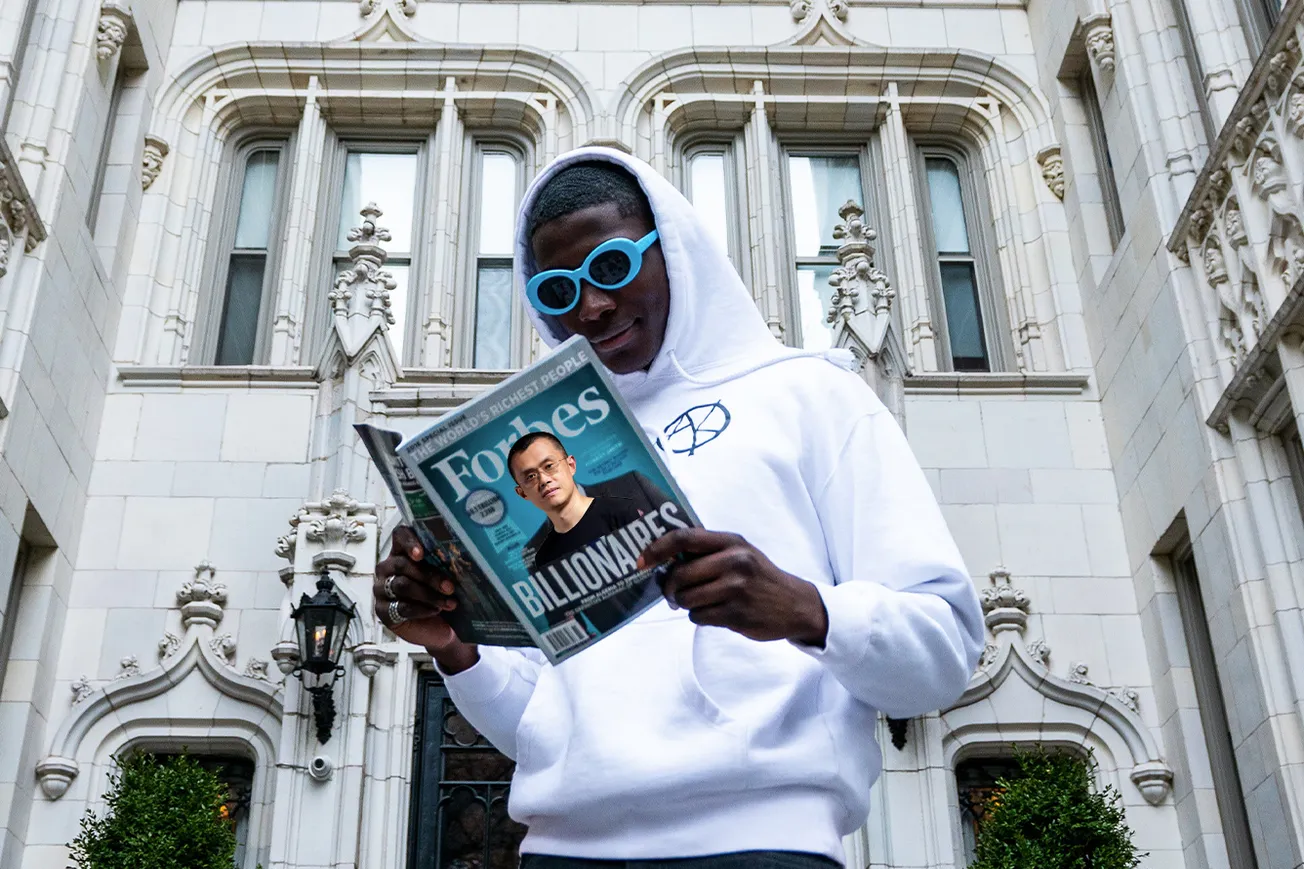

Binance CEO Changpeng Zhao has taken a swing at Forbes, one year after taking a US$200 million majority stake in the media powerhouse.

On Monday, Forbes published an article titled "Binance’s Asset Shuffling Eerily Similar To Maneuvers By FTX."

"When you’re the world’s largest crypto exchange in a largely unregulated market, it is easy to make up the rules as you go," Forbes wrote. 'In its latest backroom maneuver, Binance transferred $1.8 billion in stablecoin collateral to hedge funds, including Alameda and Cumberland/DRW, leaving its other investors exposed."

One day later, Zhao took to Twitter to slam the article for spreading FUD. "They seem to not understand the basics of how an exchange works. Our users are free to withdraw their assets any time they want," Zhao tweeted.

"The article tries hard to categorize Binance and FTX together, including the choice of the article title. We are different," he continued.

I am reluctantly spending time on FUD again (4). Forbes wrote another FUD article with lots of accusatory questions, with negative spins, intentionally misconstruing facts. They referred to some old blockchain transactions that our clients have done. 1/9

— CZ 🔶 Binance (@cz_binance) February 28, 2023

Binance took a US$200 million majority stake in Forbes on 10 February 2022 but in June of that year, Zhao said the deal was "changing" after the publication's deal to go public via a SPAC fell through.

Binance on the defensive

The world's largest crypto exchange has been under scrutiny as of recent. Last month, the US Securities and Exchange Commission (SEC) opposed Binance's $1 billion deal to purchase Voyager Digital's assets, citing concern over how Binance plans to repay Voyager’s former customers.

Read more: Binance Rekt by SEC Again as $1B Voyager Deal Opposed

A week prior, the crypto exchange made headlines this week for moving over US$400 million to a trading firm managed by Zhao, which was referenced in the Forbes article.

On Tuesday US cryptocurrency exchange Coinbase has announced that it will be suspending the trade of BUSD (Binance USD) on 13 March.

Read more: Coinbase Delists Binance USD Amid Troubles at Paxos

It has certainly been a challenging time for Binance, but stringent scrutiny and tighter regulation is perhaps what's required to prevent another 2022 catastrophe.

The world of Web3 can be quite a whirlwind. Here at Blockhead, we understand how busy crypto is keeping you, so we kindly send out two newsletters each week: BlockBeat for a wrap-up of the week’s news and Blockhead Brief for weekend happenings as well as what to look forward to in the week ahead. To avoid FOMO and access member-only features, click here to subscribe.