Table of Contents

Across markets, prices seem to be in limbo at the moment, the Dollar Index is just hovering around threatening to drop, but not quite managing to do so.. SPX and gold are threatening to bottom but aren’t quite making it either.

It’s a flaccid, low energy, directionless period we find ourselves in. The best thing to do at times like this, unless you happen to have a particularly high conviction view and don’t mind waiting with risk in the position, is just hold off until a meaningful rotation starts to present itself.

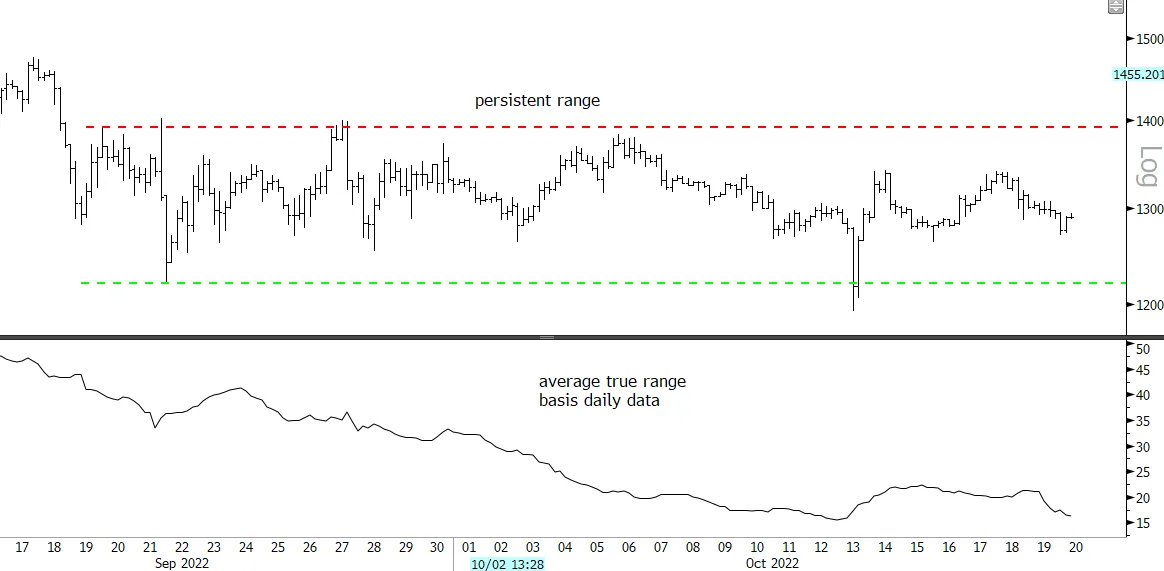

We are looking at Ethereum today basis 240-minute data. On this timeframe, it has been more or less untradeable since 19 September when it entered the long-range shown, so better to watch from sidelines until price breaks higher through US$1,400 and this becomes a support shelf for a move higher.. Or see a drop through US$1,200 and wait out the collapse.

This range is actually 13 trading days so far, so I did a quick analysis of previous long ranges in ETH. The longest was 16 days from 13 November 2018; the next longest was 15 days from 2 April 2019. That’s not enough data points to make an assessment of what happens next and in any case two conflicting results over five days from the end of each range -27% and +14%.

For now, wait is all, there is nothing to do at the moment.