Table of Contents

Although cryptocurrency, blockchain and Web3 are making our world even more interconnected, there are decisions made by global actors that remind us how fragmented we really are.

Following a series of far-right victories across Europe, both the UK and the US are facing crucial elections that could see the end of incumbent parties in the coming months.

On the global stage, America's mighty worldwide standing has diminished over the last five decades. Its contribution to global GDP has dropped from 40% in 1960 to about 25% now. When adjusted for purchasing power parity, China's economy is now larger than America's.

Even its friends, like Europe and others, are trying to carve out more independence from Washington in foreign policy and financial affairs, so it's up against a more aggressive Beijing for influence.

In particular, in response to the growing economic and financial sanctions imposed by the United States, other nations have sought to diversify their cross-border payment systems away from the dollar.

Donald Trump might offer more America First policies, which could encourage such behaviour, but he remains crypto's favourite presidential candidate - although neither mentioned it in the first 2024 US presidential debate earlier today.

Less than 30 minutes in and this election is over. Biden brain farts for an uncomfortable eternity and says he killed Medicare.

— Free (@KaladinFree) June 28, 2024

This is over and the Dems are too inept to make the swap.

Well played reaction by Trump. 45 & 47#Debates2024 pic.twitter.com/TPCpI9ZB3s

Meanwhile, the Middle East is becoming a regional favourite for Web3 whilst Hong Kong is bizarrely setting its focus on the metaverse and DeFi, Japan sees half of its investment managers intending to invest in crypto, and Singapore continues to tie money laundering with crypto.

When can we all truly be interoperable?

Even Bitcoin and Ethereum's prices are struggling to decide which direction they want to head. After experiencing its biggest slip in dominance since January following Mt. Gox scares, Bitcoin has ended the week down by 3%. Ethereum suffered a wobble too, echoing its bigger brother's FUD, but ended the week up about 0.23%.

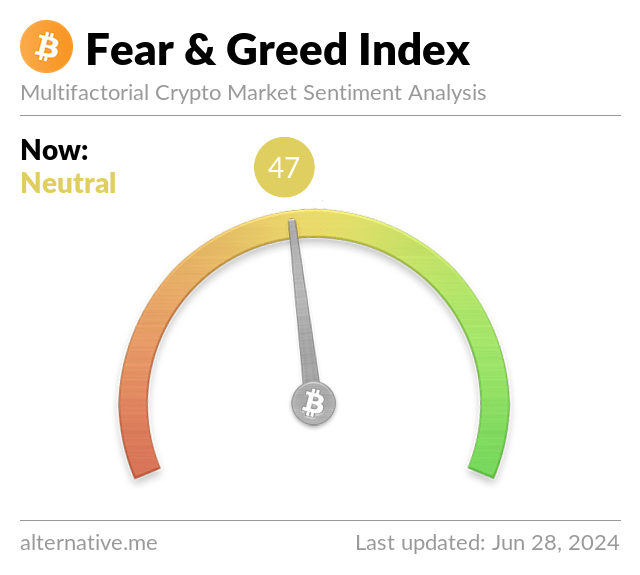

Risk appetites on the Fear & Greed Index have continued to cool even more, from 63 last week, "Greed," to 46, "Neutral."

The Fear & Greed Index uses 5-6 measurements to assess the current sentiment of the market and then rates that level of emotion on a scale of 1-100 – 1 is extreme fear and 100 is extreme greed.

But what happens next? Our fine analysts at brn said:

"As the crypto market recovers and seeks momentum, today's release of June's CPE (Core Price Expenditure) at 8:30 AM NY time is crucial. A lower-than-expected figure would suggest continued inflation decline and potentially boost cryptocurrencies in the coming months."

Are Cryptos & CBDCs Integral to a New Financial World Order?

As the US Dollar becomes increasingly unfavourable among trading partners, do CBDCs offer a more accessible form of trading alternative national currencies?

Geopolitical developments point to a healthy adoption of cryptos and CBDCs in the near future.

Mt. Gox Repayments Trigger Bitcoin Slip - Buy Now?

Mt. Gox-related trepidation has kept the market anxious since the exchange lost 850,000 BTC through its infamous hack in 2014.

With fears that the eventual repayment to disgruntled customers would trigger a wide market sell-off lurking in the back of market participants' minds, the Mt. Gox saga has felt like a ticking time bomb for many.

News has now surfaced that Mt. Gox is planning to distribute 140,000 BTC to hack victims as soon as July.

VanEck's 8-A Filing Suggests ETH ETF Launch is Imminent, But Gensler Says No

VanEck has just filed its 8-A form for its spot Ethereum ETF, leading many to regard the move as a signal that the products could be launching soon.

The 8-A form is a registration document that companies file with the Securities and Exchange Commission (SEC) to register a class of securities for trading on a national securities exchange.

Ripple CEO Brad Garlinghouse's 2017 Comments at Center of New Lawsuit

Comments from seven years ago made by Ripple CEO Brad Garlinghouse are coming back to haunt him in a new lawsuit.

According to the lawsuit, which a California federal court judge greenlighted, Garlinghouse allegedly made "misleading statements" in a 2017 interview.

Standard Chartered to Launch Spot Crypto Trading Desk

British multinational banking giant Standard Chartered has announced plans to launch a London-based spot cryptocurrency trading desk, which will be part of its FX trading unit, according to a Bloomberg report citing two people familiar with the matter.

Singapore Deems Crypto as "Higher Risk" in Money Laundering

Singapore has labelled cryptocurrency as a "higher risk" in a new report related to money laundering.

In its Money Laundering National Risk Assessment report, the Monetary Authority of Singapore (MAS) highlighted increased risks in the digital assets sector, pointing to a rise in reported cases and token exploitation.

Singapore's Central Bank Ramps Up Efforts to Lead the Way in Asset Tokenization

The Monetary Authority of Singapore (MAS) has announced a major expansion of its Project Guardian initiative, aiming to accelerate the adoption of asset tokenization across financial services.

Previously focused on collaborations with individual financial institutions, Project Guardian is now welcoming major industry associations like the Global Financial Markets Association (GFMA) and the International Swaps and Derivatives Association (ISDA), according to an announcement on Thursday.

Singapore MP Tin Pei Ling Ventures Into Digital Assets

Singapore Member of Parliament (MP) for MacPherson, Tin Pei Ling, has joined MetaComp, a digital payment token service provider based in Singapore, as co-president.

Announcing the move on LinkedIn this week, Tin said she would be focusing on driving strategic partnerships and corporate development.

Over 50% of Japanese Investment Managers Intend to Invest in Crypto

Crypto appetite among investment managers in Japan is intensifying according to a new report by Nomura.

Titled "Survey on Digital Asset Investment Trends for Institutional Investors 2024," Nomura's survey details how the Japanese market is approaching the crypto market.

Binance Migrates UAE Residents to VASP-Licensed FZE Arm

Binance is moving all of its UAE users to its Dubai VARA-regulated FZE exchange.

All UAE residents currently on Binance's global exchange are required to update their KYC information by submitting documents by 15 December.

South Korean Crypto VC Hashed Expands to Abu Dhabi Via Hub71 Partnership

Hashed Ventures is expanding to Abu Dhabi through a new partnership with the latter's global tech ecosystem Hub71.

The Seoul-based crypto investment giant will bring more Korean startups including those in fintech and digital assets to the UAE, as well as opening an office in Abu Dhabi.

Hong Kong Government Bizarrely Picks Metaverse, DeFi

Thought the Metaverse was dead? Thought institutions and governments didn't like DeFi? We did too... But apparently, Hong Kong doesn't.

According to reports by the Hong Kong Academy of Finance (AoF) and the Hong Kong Institute for Monetary and Financial Research (HKIMR), the city is becoming a proving ground for DeFi and the metaverse.

SOL Surges After VanEck Becomes First in US to File for Solana ETF

VanEck has become the first US asset manager to file for a spot Solana ETF with the US Securities and Exchange Commission (SEC).

Matthew Sigel, VanEck head of digital assets research, explained that the firm filed for the product because "We believe Solana stands out as a powerful and accessible blockchain software."

Coinbase Files SEC Lawsuit, Partners Stripe, Sees Ex-Advisor Join Biden Campaign

It's been a busy week for Coinbase. Not only has the listed cryptocurrency exchange formed a partnership with Stripe but Coinbase has also found the time to file a lawsuit against the mighty US Securities and Exchange Commission (SEC). Additionally, a former Coinbase advisor has joined Joe Biden’s 2024 presidential campaign as a senior adviser.

Events

Coinfest Asia (Bali, 22-23 August)

Get ready to connect with 6,000+ people from 2,000+ companies at the largest Web3 festival in Asia. Get your tickets now with Blockhead's 10% discount code: CA24BLOCKHEAD

Blockhead Wants You!

Are you a university undergraduate who's as passionate about crypto as you are about writing? Blockhead is looking for an Editorial Intern to join our team!

As part of the Blockhead crew, you'll get to:

- Pitch and write editorial features: Craft compelling narratives that unpack the latest trends, innovations, and challenges within the crypto and blockchain space.

- Contribute to the daily news coverage: Break down complex news stories and draft engaging articles that keep our audience informed.

- Conduct interviews: Engage with industry leaders, analysts, and developers to capture insightful perspectives and expert opinions.

- Attend and report on industry events: Immerse yourself in the heart of the Web3 movement by attending conferences, meetups, and panels, and translate those experiences into informative and engaging content.

To apply and find out more info, click here.

It's All Happening on LinkedIn

Did you know you can now receive Blockhead's juicy daily newsletters directly to your LinkedIn? Subscribe to our LinkedIn newsletters for the latest news and insights in the world of Web3!

There also might be the occasional discount code for the industry's hottest events, exclusively for subscribers. So be sure to sign up!