Table of Contents

Ethereum (ETH) buyers held the price floor at the $2.9k support level, as selling pressure continued to persist. Over the past month, ETH has traded between a broad price range with $3.2k serving as the range high and $2.9k serving as the range low.

With ETH trading just above the $2.9k support level, it has presented buyers with an opportunity to leverage the price zone for a possible reversal.

Price Range Offers Long Opportunity

ETH’s latest price rejection came at the range high of $3.2k on May 6. This brought another wave of selling pressure that saw the altcoin retest the range low of $2.9k. However, it also presented an opportunity for buyers to rally.

Analyzing the previous price action in the trading range showed that ETH had successfully achieved bullish rebounds thrice from the support level. This makes it a solid price zone for buyers with the tendency for a repeat of the price movement.

A look at the chart indicators indicated bullish movement. Capital inflows rose to +0.08 as indicated by the Chaikin Money Flow (CMF). Yet, the selling pressure kept the Relative Strength Index (RSI) under the neutral 50 mark. Bulls will need the RSI to flip bullish for a sustained upward rally.

Buyers can consider entries at the current market price of $2.9k with a target zone of $3.1k to $3.2k. However, a bearish candle close below the $2.9k support level would invalidate the bullish thesis and interested buyers would have to consider the $2.7k support level for new entries.

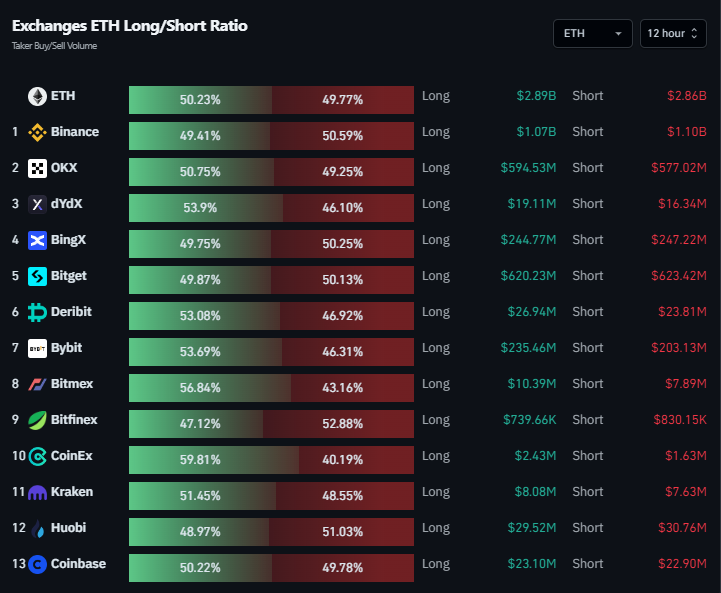

Traders in the futures market leaned slightly bullish on the higher timeframes which could serve as encouragement for spot traders. However, the tight margins mean the trades could easily swing either way and open long positions should be managed properly to avoid getting caught out by sharp price drops.

Disclaimer: This article does not constitute trading, investment, financial, or other types of advice. It is solely the writer’s opinion. Please conduct your due diligence before making any trading or investment decisions.