Table of Contents

Internet Computer (ICP) rebounded at a key price level with bulls leveraging the buying strength at the $11.4 support level. Before this price reversal, ICP had been on a steady dip from $16 before finding a buying floor at $11.

According to Coinmarketcap, ICP registered a 56.1% increase in volume over the past day, resulting in a 2.4% increase in its marketcap.

With key indicators indicating a return in bullish sentiment, buyers would be looking to ride the momentum in the short to medium term.

Can Returning Demand for ICP Lead to 31% Pump?

The growing bullish sentiment was evidenced by ICP’s Relative Strength Index pulling a sharp reversal from the oversold zone and moving toward the neutral 50 on the four-hour timeframe.

With the RSI serving as a key indicator for measuring the trend of a token’s price action, it suggests an accumulation could be in progress in anticipation of a bullish trend in the short term.

Likewise, the Chaikin Money Flow (CMF) crawled above the zero mark to give capital inflows a slight edge over outflows.

A bullish candle close on the four-hour timeframe presents a bullish opportunity for traders to open long positions. A short term profit level would be at $13.7 for 20% gains while a medium term profit level would be at $15 for 31% gains.

Futures Market Priced In

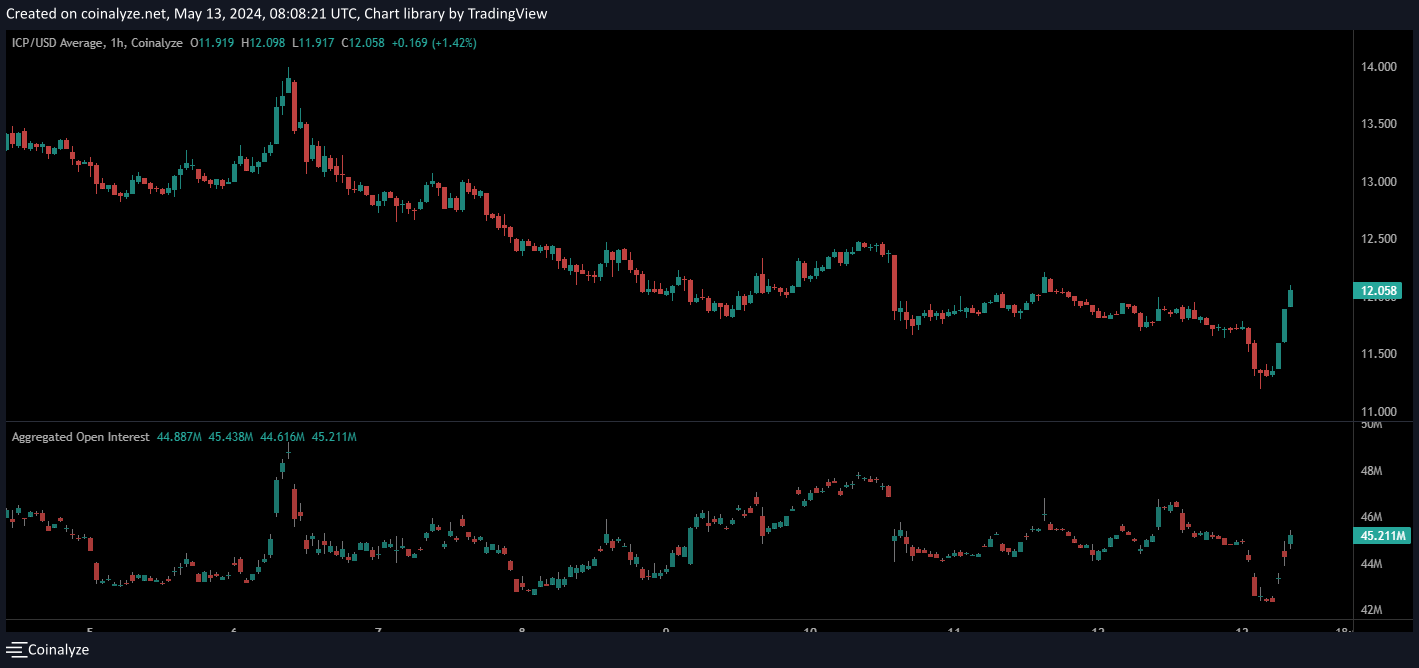

ICP’s Open Interest (OI) grew by $3.2 million over the past 12 hours, per Coinalyze. This signaled at market participants opening new contract positions to maximize the bullish sentiment.

A mix of bullish moves in the spot and futures market is a perfect setup for intraday traders to take advantage for double digit gains.

Disclaimer: This article does not constitute trading, investment, financial, or other types of advice. It is solely the writer’s opinion. Please conduct your due diligence before making any trading or investment decisions.