Table of Contents

Toncoin’s (TON) prolonged bearish price action in April found a bottom at the $4.77 support level. Over the past 5 days, TON has rallied strongly from the support level, registering gains close to 22%.

This has taken TON to the key $6 resistance level with buyers failing on their first attempt to flip the level. However, the bullish momentum remains strong and another attempt could yield a different result for bulls. A successful break of the selling pressure at $6 would unleash another wave of buying pressure.

Buying Pressure Driving Bullish Momentum

The Relative Strength Index’s (RSI) reading of 61 signaled the strong buying pressure on the four-hour timeframe. With the RSI serving as a market trend indicator, it showed buyers are extending their dominance on TON’s lower timeframe price action with a view for short term gains.

However, the key hurdle for buyers exists at $6 where TON has already experienced one price rejection. Despite the selling pressure at that level, buyers will be confident of breaking the resistance on the second or third attempt.

Intraday traders can anticipate a buy trade with a bullish candle close above $6. Potential profit levels will lie at the $7.5 to $8 price zone which is TON’s current all-time high (ATH) mark.

TON Records Massive Growth on Total Value Locked

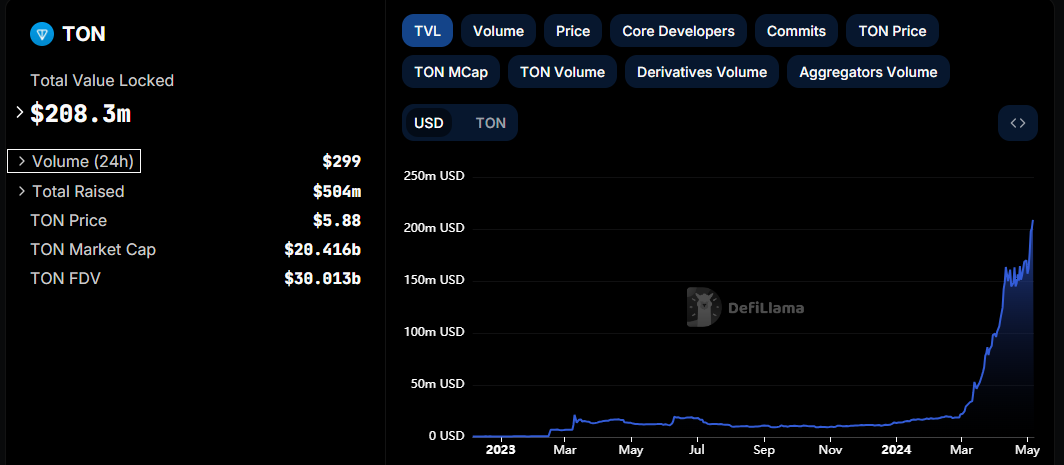

Data from DefiLlama showed that TON witnessed a significant jump in its Total Value Locked (TVL) between March 1 and May 7. As at March 1, its TVL was just $22 million. As of May 7, its TVL had registered almost a 10x rise, sitting at $208 million.

This highlighted the growing interest in one of the world’s fastest blockchain with investors looking to get in early.

Trade Idea:

Entry: $6.2 - $6.4

Target: $7.5 - $8

Stop loss: $5.5

Disclaimer: This article does not constitute trading, investment, financial, or other types of advice. It is solely the writer’s opinion. Please conduct your due diligence before making any trading or investment decisions.