Table of Contents

Layer 2 blockchain Arbitrum’s (ARB) price action on the four-hour timeframe delivered a strong hint that buyers could be returning to the spot market after an extended selling period.

Our earlier coverage of ARB brought to the fore shorting opportunities after multiple price rejections. This played out over March with ARB dropping from $2 to $1.38, a 31% decrease.

However, over the past 48 hours, buyers have shown signs of life with a particular chart indicator suggesting that the buying pressure could grow even stronger in the coming days. Do buyers have sufficient buying power to rebound from the deep retracement?

ARB Bulls Strengthen Buy Positions

The Relative Strength Index (RSI) making a jump from oversold territory to bullish zone over the past two days signalled at a heavy influx of buying pressure for ARB. As of the time of writing, the RSI had a reading of 55, representing a trend shift from bearish to bullish on the four-hour timeframe.

Echoing this trend shift, the Moving Average Convergence Divergence (MACD) posted a bullish crossover with green histogram bars above zero.

Both signals point to short-term rebound moves by buyers. However, buyers will have to surmount quite a number of sell zones to successfully reach $2 again.

The near-term target for this current bullish rebound will be the $1.6 - $1.7 price zone. This would yield modest returns of between 6% - 13%. Alternatively, a resumption of the selling pressure could see ARB dip to a stronger buy zone at the $1.27 support level.

Arbitrum Ecosystem Continues to Record Significant Growth

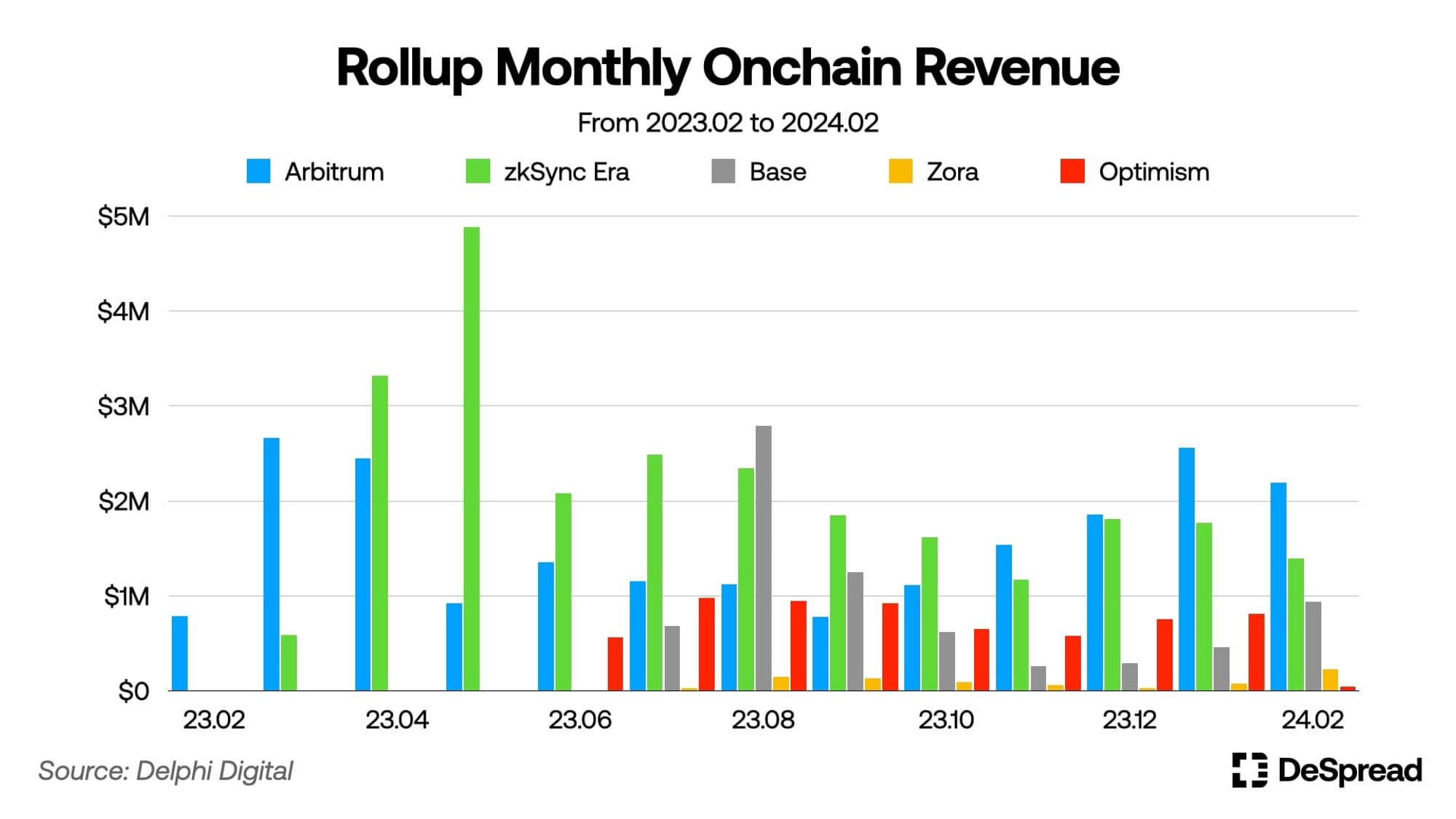

A recent report by Despread highlighted interesting growth metrics for Arbitrum. The Layer 2 blockchain holds more than 42% of the total TVL across all rollups, marking it as the first place.

Arbitrum is also first in the number of dApps onboarded to the network which currently stands at 560. Furthermore, Arbitrum has recorded consistent increase in onchain revenue between Sept 2023 to Jan 2024.

Arbitrum is an optimistic rollup blockchain that powers fast smart contract interactions while reducing transaction costs.

Disclaimer: This article does not constitute trading, investment, financial, or other types of advice. It is solely the writer’s opinion. Please conduct your due diligence before making any trading or investment decisions.