Table of Contents

Singapore-based crypto mining company Bitdeer has announced that it is engaged in talks with private credit firms to fuel its Bitcoin mining capacity, alongside rolling out its own Sealminer machines to increase its total has rate.

The US-listed company owned by Chinese billionaire Jihan Wu is working with a financial adviser to secure $100 million in funding, people with knowledge of the matter said, Bloomberg reported on Wednesday.

This move coincides with a recent surge in Bitcoin prices, driven by the positive sentiment surrounding new exchange-traded funds.

Expanding self-mining

However, Bitdeer isn't solely relying on external capital for growth. A day ago, the company also announced a significant internal expansion plan that leverages its own Sealminer A1 machines. This internal expansion will allow Bitdeer to phase out older mining equipment, improving overall efficiency, the company said in an announcement.

As a first step, it intends to install the Sealminer A1s at its mining datacenters in Rockdale, Texas and in Norway in Q3 and Q4 2024 to accomplish an initial 3.4 EH/s expansion. It will also retire older mining rigs and engage in several similar expansions for its mining hash rate in subsequent quarters until the end of 2025 to add a whopping 23 EH/s of hash rate to its operations by the end of 2025 and bring its total hash rate under management to over 46 EH/s.

“We expect our fleet efficiency to greatly improve by using our own miners. We have full faith in the capability of the SEALMINER A1 and are demonstrating this trust by installing it in volume at our own facilities first. We can ensure the quality of our products sold to customers by field testing the mining rigs first in our mining datacenters,” Linghui Kong, chief business officer of Bitdeer, said.

Stock performance

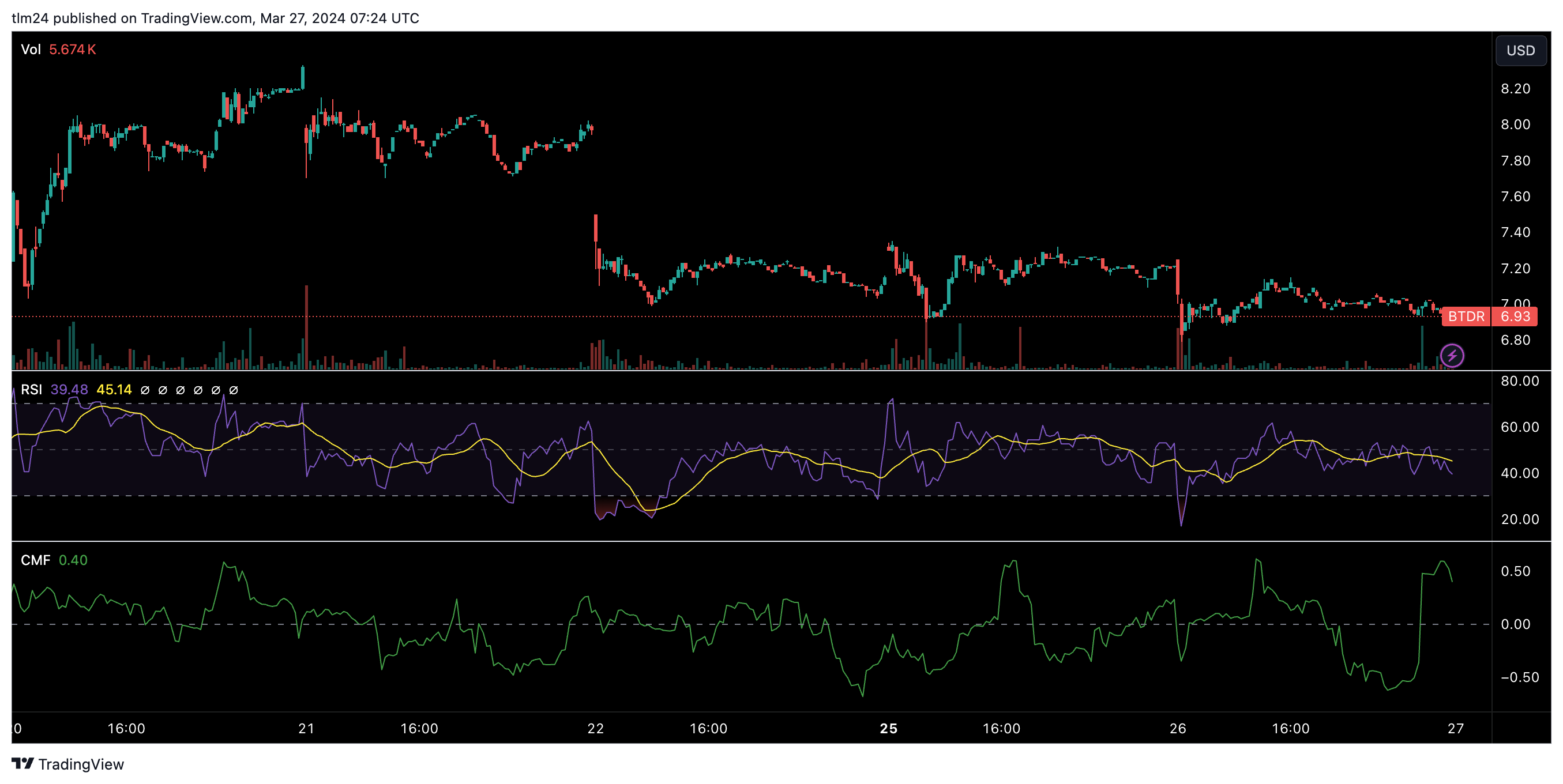

Despite these bullish expansion plans, Bitdeer's stock price on NASDAQ paints a different picture. The stock (BTDR) closed at $6.93 on March 26, 2024, reflecting a 3.88% decline from the opening price. Additionally, the stock's performance has lagged behind the broader market over the past year.

This contrasting scenario suggests that while Bitdeer is confident about its long-term prospects in the booming Bitcoin mining industry, investors might be taking a wait-and-see approach regarding the company's immediate future.

However, a closer look reveals a company with strong underlying fundamentals. Bitdeer recently reported impressive preliminary results for Q4 2023, with revenues up 49% year-over-year and earnings per share swinging positive compared to a loss in the previous year. Additionally, the company boasts a healthy cash balance and is strategically expanding its mining operations to lower-cost regions like Bhutan.

Furthermore, analysts are bullish on Bitdeer's long-term prospects.

“We view the Singapore-based company as differentiated from its publicly traded peers due to its scalable infrastructure with one of the lowest all-in mining costs in the space, diverse revenue streams including self-mining, hash rate sharing, and hosting, and its recent expansion in artificial intelligence (AI)/high-performance computing (HPC) solutions and into the design and manufacture of advanced mining rigs," Mark Palmer, analyst at Benchmark, said to Coindesk, giving it a "buy" rating and a price target of $13