Table of Contents

Bitcoin ETFs have proven to be one of the hottest products ever produced in the financial world.

BlackRock's IBIT, one of the strongest Bitcoin ETF offerings, broke records earlier this month by reaching $10 billion faster than any US ETF in history. The fund reached the milestone in under two months from 11 January when the SEC greenlit Bitcoin ETFs. Invesco QQQ previously held the record of just over a year.

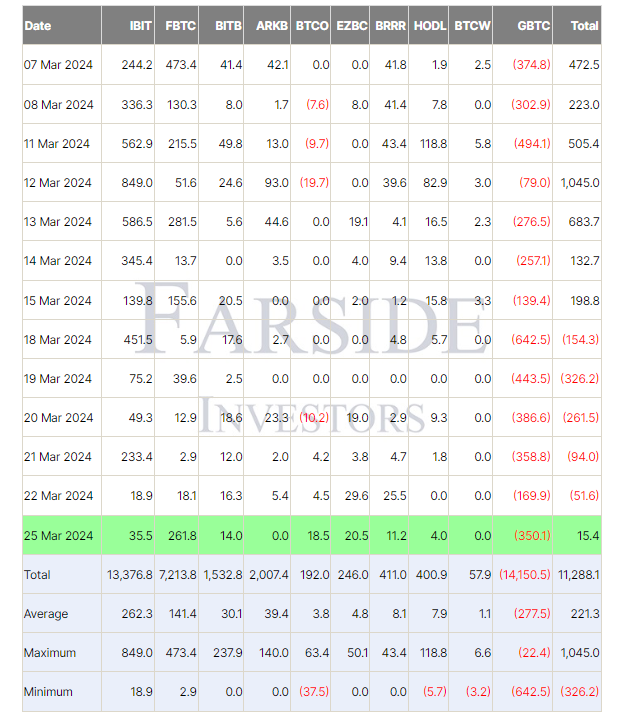

IBIT also set another record by smashing through its daily trading volume, trading 99.3 million shares over the day, amassing $3.9 billion in volume. Its previous record was $3.7 billion on 5 March. The fund also set a net inflow daily record of $849 million on 12 March.

However, recent outflow figures have slightly dampened the market's spirit. Last week, the Grayscale Bitcoin Trust (GBTC) recorded $1.9 billion in outflows, resulting in an overall net outflow for the combined market.

Inflows were less sizeable last week due to Bitcoin's relatively weaker price performance and thus were not enough to offset GBTC's gargantuan outflows. Even the mighty IBIT only drew in $828.3 million last week compared to the $2.48 billion the week before.

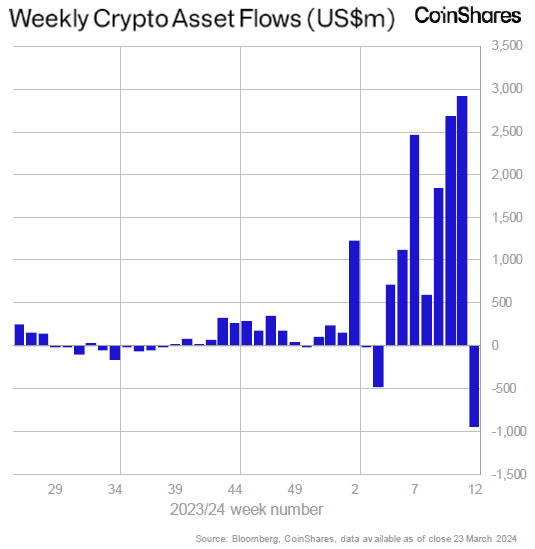

Investors reportedly pulled out $942 million last week, a new record, according to Coinshares.

“The recent price correction led to hesitancy from investors, leading to much lower inflows into new ETF issuers in the US,” said James Butterfill, head of research at CoinShares.

However, the outflow streak might just be over. On Monday, Bitcoin ETFs accumulated over $15 million. GBTC still saw outflows of $350 million but the market's overall strength resulted in net inflows.

After 5 days outflows we finally got an inflow number yday into BTC ETFs.

— OSF (@osf_rekt) March 26, 2024

The bad news is GBTC still dumping, the good news is FBTC put in a big number.

We must be thru a chunk of the Genesis BK selling.

Hoping for inflows to pick up this week.

Table from @DegenzNFT pic.twitter.com/cUVIuM5n1M

The figure breaks the five-day streak of outflows and also marked Fidelity's FBTC seeing its highest single-day net inflow of $261 million.