Table of Contents

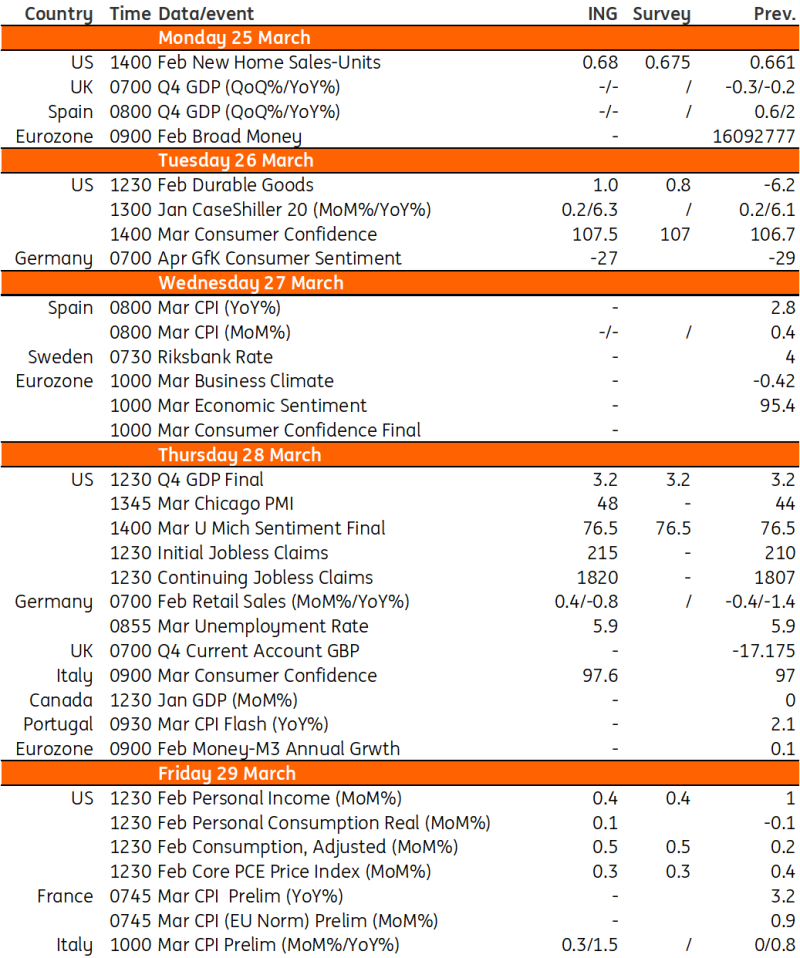

We recognize the interconnectedness of traditional and digital markets, and how global economic data and central bank policy decisions can influence investor sentiment towards cryptocurrencies. brn's Week Ahead column details upcoming macroeconomic events with the potential to impact the crypto market.

This week in the US, the Fed's favoured measure of inflation, the core PCE deflator will be the focus. Markets expect to see a few signs of weakness in real consumer spending.

In terms of data, the main focus will be on the personal spending and income report. This also includes the Fed’s favoured measure of inflation, which is the core personal consumer expenditure deflator.

Other numbers include new home sales and durable goods orders. Mortgage rates dropped in early February, and this has already lifted existing home sales.

Macro Data Calendar

US: Potential for a Second Consecutive Real Consumer Spending Figure

Having started to waver on the back of hotter-than-expected inflation prints, the March FOMC meeting and a relatively dovish assessment from Fed Chair Jerome Powell have reinvigorated the market’s belief that the Fed will deliver meaningful interest rate cuts this year, most likely starting at the June FOMC meeting.

Markets will no doubt hear more from individual FOMC members on how they see the risks surrounding the central case view from the Fed of three 25 bps rate cuts this year and three in 2025.

The report on individual income and expenditure will serve as the primary data point. The core personal consumption expenditure deflator, the preferred inflation indicator of the Fed, is also a part of this.

In January, it rose 0.4% month-on-month, more than double the 0.17% MoM rate we need to consistently hit to bring the annual rate back to 2% over time.

Given the CPI and PPI numbers that have already been released, the consensus is firmly backing a 0.3% outcome, which – while not ideal – is progress, and as this is published on Good Friday when many offices will be closed, thin market conditions could mean outsized market moves on any data surprise.

There is also potential for the report to signal the second consecutive negative MoM reading for real consumer spending.

Home sales and orders for long-lasting products are two other metrics. Sales of previously owned homes have been on the rise since the beginning of February when mortgage rates fell.

This is the pattern economists anticipate for new house sales.

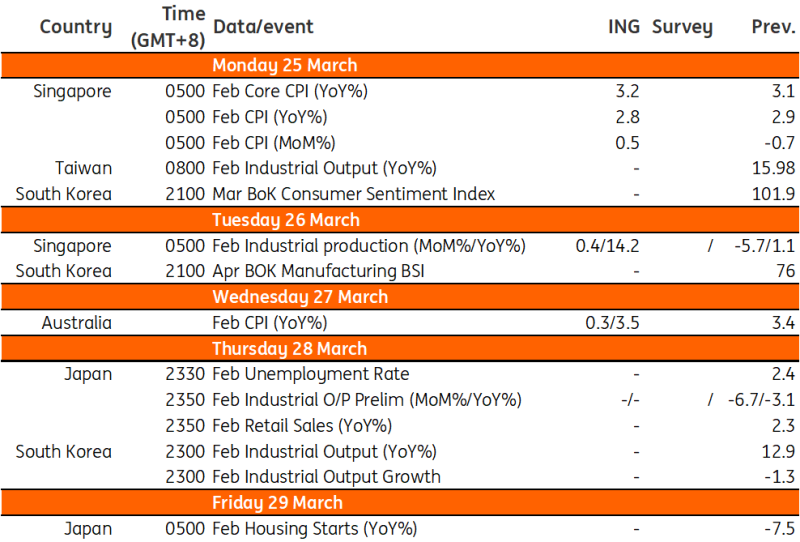

Asia Week Ahead

This week in Asia features activity data from Japan and Korea. Elsewhere, Hong Kong reports trade figures, Taiwan releases industrial production, and Australia reports inflation.

Macro Data Calendar

China's Property Crisis in Focus

The impact of China's property crisis on the world's second-largest economy should be revealed this week by the earnings reports of Country Garden Holdings and China Vanke.

With revenues plummeting, Country Garden is facing an increasingly dire liquidity situation. A petition to wind up the corporation was accepted by a Hong Kong court last month, marking a new chapter in its turmoil.

With China's housing market in a rut, the problems at Vanke could embolden other developers. Fitch Ratings downgraded Vanke's creditworthiness to junk status again this month due to declining sales and restricted access to capital. This happened on Friday.

With consumer confidence dwindling, it's unlikely that property stimulus measures like lower down payment requirements and loosening restrictions on house purchases would be enough to boost sales of newly constructed homes.