Table of Contents

BlackRock has revealed details about its tokenized fund issued on Ethereum.

In an announcement, BlackRock said the tokenized fund is named the BlackRock USD Institutional Digital Liquidity Fund, or BUIDL for short, and offers investors the opportunity to earn yields through Securitize Markets.

Securitize will act as a transfer agent and will serve as the tokenization platform. BlackRock made a "strategic investment" in Securitize, but the deal terms were not disclosed.

Robert Mitchnick, BlackRock’s head of digital assets, said that the fund represents the "latest progression of [BlackRock's] digital asset strategy" and is part of the firm's initiative to develop "solutions in the digital assets space that help solve real problems for [their] clients."

Tokenization access will offer investors exposure to on-chain offerings and the trading of ownership on the blockchain, the firm added.

“Tokenization of securities could fundamentally transform capital markets. Today’s news demonstrates that traditional financial products are being made more accessible through digitization," explained Securitize co-founder and CEO Carlos Domingo.

BNY Mellon will enable interoperability for the fund between digital and traditional markets, as well as the custodian of the Fund’s assets and its administrator. Anchorage Digital Bank NA, BitGo, Coinbase, and Fireblocks will also participate in the ecosystem. PricewaterhouseCoopers LLP has been appointed as the Fund's auditor,

The fund, which has an initial investment minimum of $5 million, offers a stable value of $1 per token and pays daily accrued dividends to investors as new tokens each month. BUIDL invests 100% of its total assets in cash, U.S. Treasury bills, and repurchase agreements.

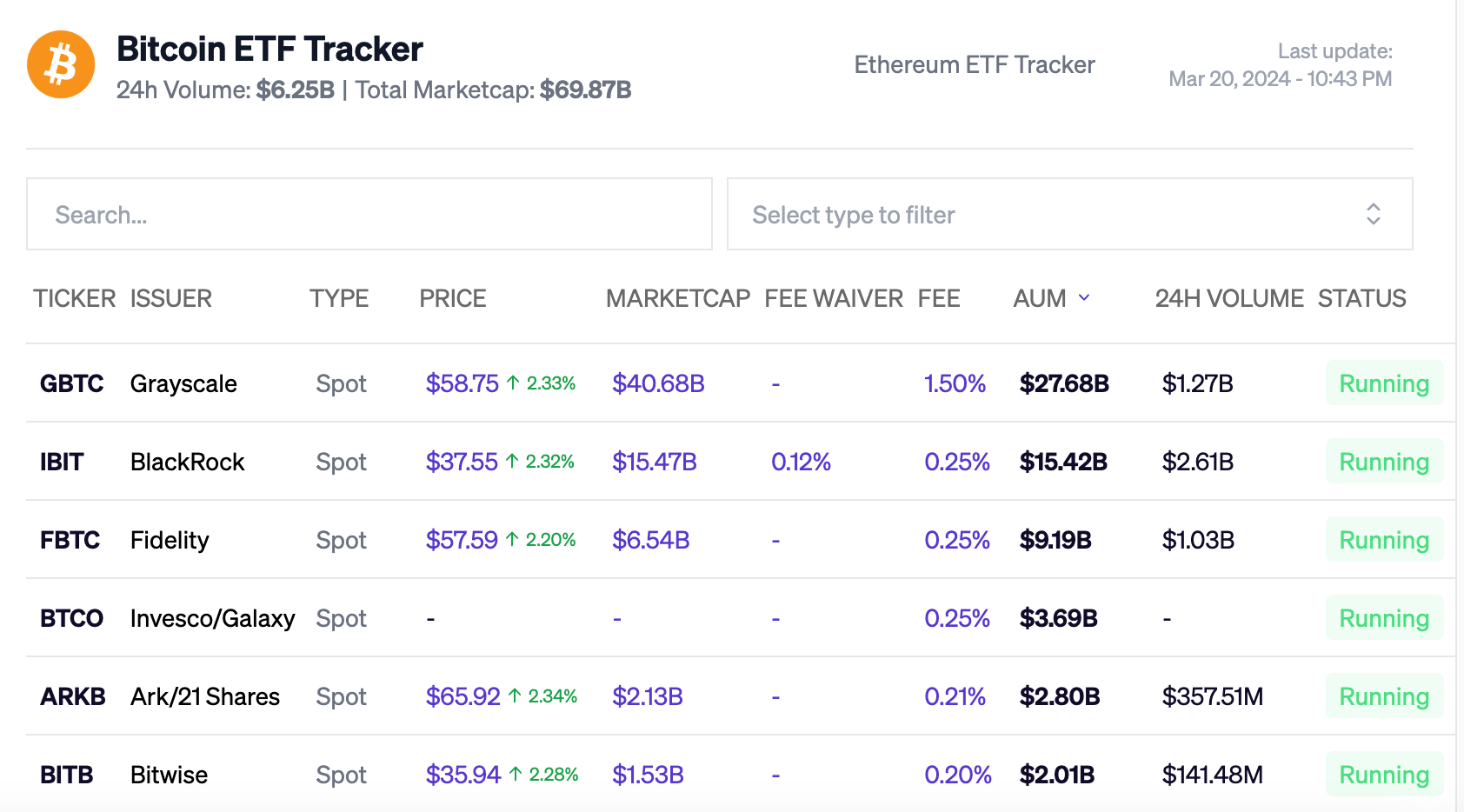

BlackRock's Bitcoin ETF, IBIT, is the second largest in its class. Last week, the fund broke records by reaching $10 billion faster than any US ETF in history. The fund reached the milestone in under two months from 11 January when the SEC greenlit Bitcoin ETFs. Invesco QQQ previously held the record of just over a year.

However, where there are inflows, there are also outflows, apparently. Grayscale, which holds the #1 spot for Bitcoin ETFs, has seen its outflows reach $12 billion.

Grayscale CEO Michael Sonnenshein has responded to the bleed by saying fees for the Grayscale Bitcoin Trust (GBTC) will be reduced in the coming months.