Table of Contents

Bitcoin's rally has halted as its price takes a dip below $68,000. However, even a slight price drop in BTC can't slow down Bitcoin ETFs.

Collectively, Bitcoin ETFs have exceeded $100 billion in assets under management.

“Total digital asset exchange-traded products passed the $100 billion mark for the first time ever,” CoinShares head of research James Butterfill said.

Total Digital Asset ETPs passed the US$100bn mark for the first time ever. pic.twitter.com/n9if8AB1MT

— James Butterfill (@jbutterfill) March 14, 2024

The milestone was achieved just one day after the products broke the 2021 yearly inflow record in under three months.

"Digital Assets ETFs/ETPs have smashed the 2021 record, with inflows following the last few days now sitting at US$12bn ytd compared to US$10.6bn for the whole of 2021," Butterfill had said.

Digital Assets ETFs/ETPs have smashed the 2021 record, with inflows following the last few days now sitting at US$12bn ytd compared to US$10.6bn for the whole of 2021. pic.twitter.com/QjPvtRCzGH

— James Butterfill (@jbutterfill) March 13, 2024

BlackRock's IBIT, one of the strongest Bitcoin ETF offerings, broke records earlier this week by reaching $10 billion faster than any US ETF in history. The fund reached the milestone in under two months from 11 January when the SEC greenlit Bitcoin ETFs. Invesco QQQ previously held the record of just over a year.

Yesterday, IBIT set another record by smashing through its daily trading volume, trading 99.3 million shares over the day, amassing $3.9 billion in volume. Its previous record was $3.7 billion on 5 March. The fund also set a net inflow daily record of $849 million on 12 March.

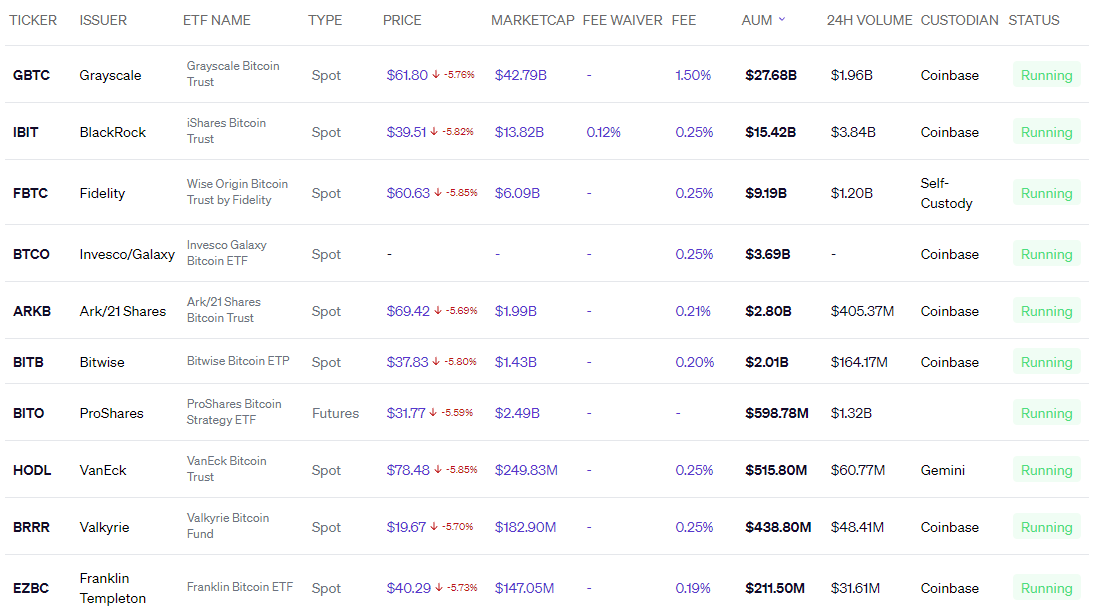

Grayscale still retains the lead in terms of AUM with $27.68 billion. However, its 24-hour volume of under $2 billion falls shy of BlackRock's.