Table of Contents

Some investors believe that the second-largest digital asset, Ethereum, will be the focus of the next wave of US spot crypto exchange-traded funds (ETFs), leading to higher investor demand and resulting in the Ether token outperforming Bitcoin.

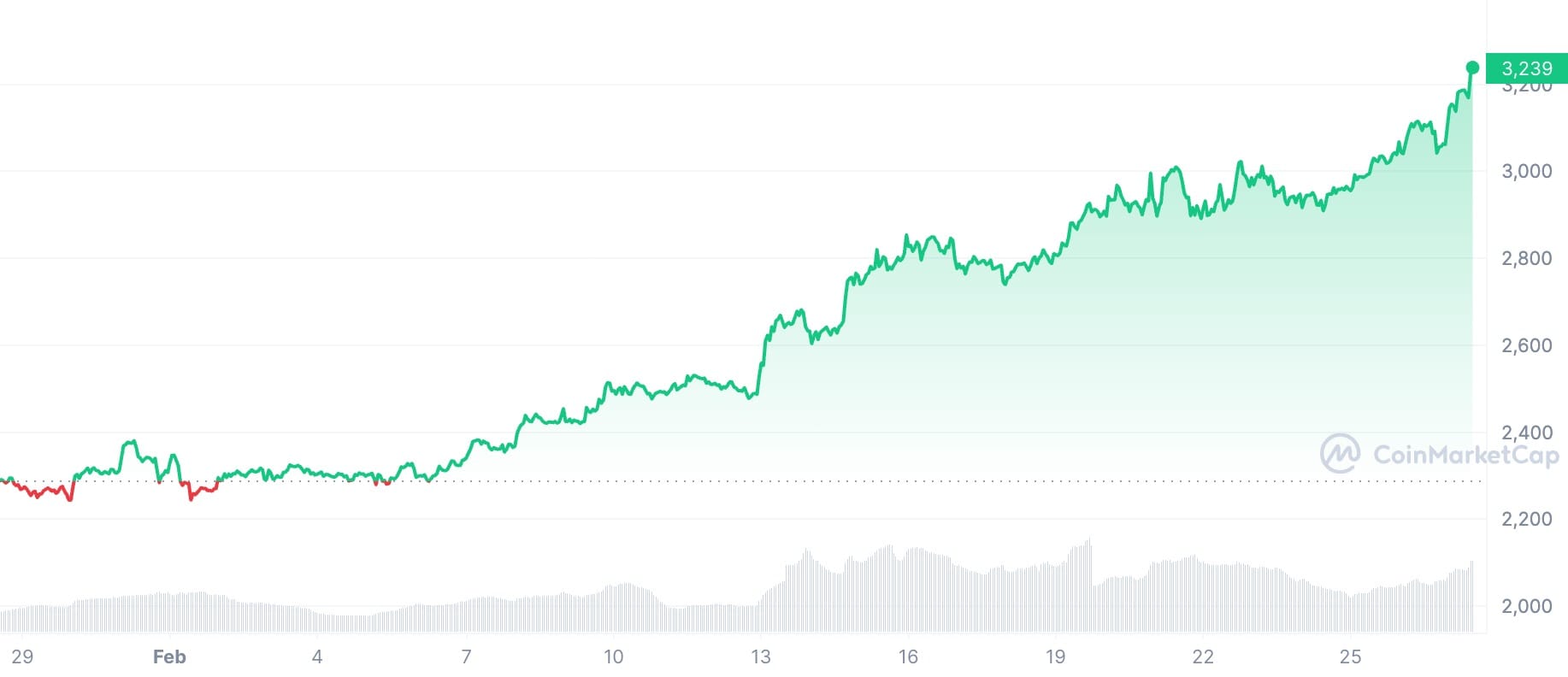

In contrast to 2023, when Bitcoin soared to the top of the crypto market, Ether has soared over 40% so far this year. Ether was trading over $3,300, close to its highest since April 2022, while Bitcoin was trading over $56,000 - up nearly 33% for the year.

Following a court setback last year in January, cautious US authorities allowed the country's first spot Bitcoin ETFs. A net inflow of $5.2 billion has been drawn to the group's ten portfolios since they went online on January 11th.

Some crypto enthusiasts see the funds as a step in the right direction towards Ether ETFs. In contrast, others are pessimistic about the willingness of officials to comply and foresee further legal turmoil.

S&P Global warns that the potential legalisation of Ether ETFs in the US might worsen the concentration issue in the Ethereum ecosystem by centralising staked tokens within a small number of providers.

Investors are waiting for Ethereum's native token to be approved for ETF status after the January approval of Bitcoin ETFs.

Ark Investment Management's and Franklin Templeton's Ether ETF applications, among others, are thinking of integrating staking. Ark and Franklin Templeton have shown interest in investing in the assets through third-party suppliers.

Experts state that the effect of ETFs on concentration depends on issuers spreading their holdings across many custodians. To participate, Ethereum token holders must lock their tokens on the network to validate transactions and gain additional incentives.

The derivatives market for Ether futures at CME Group is now seeing close to all-time high open interest levels. Institutional investors are increasingly interested in gaining exposure to Ether, as seen by the rise in outstanding contracts.

From a commercial standpoint, Ethereum tokenised as "ether," is the most significant blockchain in the cryptocurrency market.

Staking involves investors committing Ether to support the operation of the digital ledger in return for rewards. The staking returns have reached a fresh peak of 25% annually.