Table of Contents

We're back for another This Week in Crypto - our weekly ICYMI/too lazy to keep up round up. It's been a mixed bag of stories this week, as we veer away from Bitcoin ETF mania. Nonetheless, we'll start with a recap of the world's leading cryptocurrency's performance.

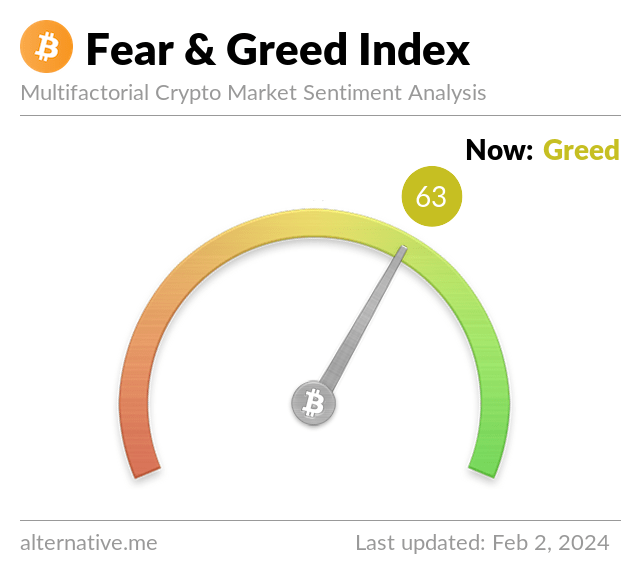

Both Bitcoin and Ethereum have had a relatively mild week, edging up under 3%. Risk appetite on the Fear & Greed Index remains unchanged at 63. The Fear & Greed Index uses 5-6 measurements to assess the current sentiment of the market and then rates that level of emotion on a scale of 1-100 – 1 is extreme fear and 100 is extreme greed.

Rather uneventful in terms of blue chip crypto price movements but there certainly wasn't a lack of other industry events this week. So here are our top six crypto stories this week, in no particular order:

Cathie Wood's ARK Invest Details Bullish Bitcoin Thesis & 2024 Crypto Optimism

It's no secret that ARK Invest is bullish on Bitcoin. With a price target of $650,000 and its own spot Bitcoin ETF, it's clear that Cathie Wood has high expectations for the world's leading cryptocurrency.

In its Big Ideas 2024: Disrupting the Norm, Defining the Future report, ARK Invest detailed its bullish stance on Bitcoin and the risks that come with investing in crypto at an institutional level.

From Bitcoin's unrivaled performance to institutional portfolio allocation to 2024's outlook, ARK reveals its worst kept secrets to the masses.

AI x Blockchain: Understanding Vitalik Buterin's Warnings

As revolutionary as Web3 might be, artificial intelligence (AI) has been unapologetically stealing its thunder. And rightly so. The likes of ChatGPT have seamlessly placed the next-gen text right into the palms of your everyday user. None of that wallet creation, gas fees, and general rabbit hole venturing that comes with stepping into Web3.

But are AI and cryptocurrency mutually exclusive? Ethereum founder Vitalik Buterin says no. In a lengthy blog post, Buterin dissects the intersection between the two disruptive technologies.

Buterin explains how AI can be a player in the game, interface to the game, and rule maker for the game.

You won't want to miss his insights.

Hong Kong Sees First Bitcoin ETF Application as US Fees Slashed

The Hong Kong arm of Chinese asset manager Harvest Fund Management has submitted an application for a spot Bitcoin ETF to the SFC.

The firm hopes to launch Hong Kong's first ETF after the Lunar Year holiday, which is on 10 February.

According to OSL executive director and head of regulatory affairs Gary Tiu, Hong Kong could see its first crypto ETFs within a few months.

Earlier this month, Livio Weng, chief operating officer of Hong Kong crypto exchange HashKey, said that around 10 fund companies have started looking into launching potential spot crypto ETFs in the city.

As Hong Kong regulators mull over approving Bitcoin ETFs while Singapore continues to play hardball, competition continues to heat up in the US.

Invesco Galaxy has reportedly lowered the fee for its Bitcoin ETF, BTCO. Fees have been waived for either the first six months or the first $5 billion of assets, after which a reduced fee from 0.39% to 0.25% will be implemented.

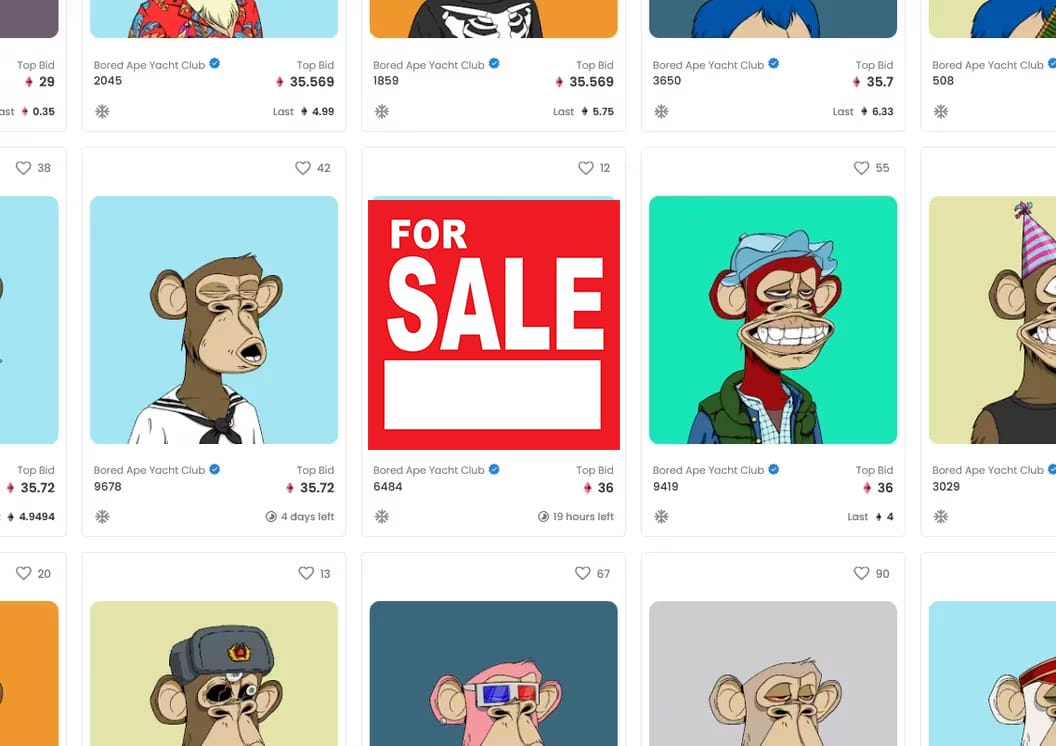

Is OpenSea Even Worth Acquiring?

Instead of buying NFTs on OpenSea, have you ever considered buying OpenSea itself? OpenSea chief executive officer Devin Finzer is planting that idea in the minds of prospective M&A participants.

In an interview with DLNews, Finzer revealed the company could be open to a takeover.

However, with a shrinking NFT market and competition heating up from Blur and even Bitcoin Ordinals, just how valuable is OpenSea?

Half of Singaporeans Own Cryptocurrency But Still No Bitcoin ETF

A new report by Seedly and Coinbase has revealed that more than 1 in 2 Singaporeans own cryptocurrency but regulators aren't caving on crypto ETF pressure anytime soon.

57% of those surveyed said they own cryptocurrency with 56% of crypto owners saying they have US$1,000 to $24,999 in cryptocurrency.

However, less than half (46%) are bullish about cryptocurrency in the next 12 months. Nonetheless, 56% still believe that crypto is the future of finance.

Singaporeans might be developing an appetite for crypto but the Monetary Authority of Singapore (MAS) is yet to fully embrace digital assets for the wider masses.

Despite all the Bitcoin ETF hype in the US, MAS reiterated that digital assets remain an institutional game in Singapore and has not indicated that the products will be greenlit any time soon.

FTX to Repay Customers in Full, Abandons Exchange Relaunch

Sam Bankman-Fried's crypto exchange, FTX, had an estimated $8.7 billion shortfall when it filed for bankruptcy in 2022. Around $6.9 billion has been recovered since.

FTX and Alameda Research have doubled their cash pile from $2.3 billion in October 2023 to $4.4 billion by the end of the year. The firm raised another $1.8 billion by 8 December by selling some of its digital assets.

FTX has now decided to abandon relaunching its exchange and is liquidating all its assets to repay its customers in full.

Restructuring advisers are examining all of the millions of claims that have been filed against FTX to determine their legitimacy.

Elsewhere Today