Table of Contents

JP Morgan isn't removing its head from the sand any time soon as it takes a swing at Tether, despite its record-breaking profits.

In a report on Thursday, JP Morgan analyst Nikolaos Panigirtzoglou blasted Tether for its lack of "regulatory compliance and transparency," concluding that its 'increasing concentration" is a "negative for the stablecoin universe and the crypto ecosystem more broadly."

Tether has since swung back at the investment firm, with CEO Paolo Ardoino telling The Block, "I'm happy to read that JP Morgan acknowledges the importance of Tether and the stablecoin technology created by our company. But it seems to me a bit hypocritical the talk about concentration coming from JP Morgan, the biggest bank in the world."

"The success of Tether USDT is driven by its financial reliability, strong reserves and its commitment towards emerging markets and developing countries, in which entire communities are using USDT as a lifeline to defend their families from high inflation and the devaluation of their national currency," Ardoino added.

More Profitable Than Goldman Sachs

If Ardoino's words weren't enough to put JP Morgan in its place, Tether's balance sheet just might.

According to Tether's Q4 attestation report, the firm booked a profit of $2.85 billion in the final quarter of last year, amounting to an annual profit of $6.2 billion.

Net operational profit from U.S. T-bill interests alone brought in $1 billion, while $1.85 billion came from gold and Bitcoin holdings.

Tether's earnings even dwarfed Goldman Sach's Q4, which reported net income of $1.867 billion.

Goldman Sachs:

— jay (@0xjaypeg) January 31, 2024

- 45,300 employees

- 1.867B net income in Q4 '23

- 127.8B market cap

Tether:

- 12 employees

- 2.85B net profits in Q4 '23

USDT to $10 https://t.co/tuMnsyV2RX

Tether's assets under management stand at $98.5 billion, comprised of $91.6 billion in USDT and $5.4 billion in excess reserves.

The firm plans to spend $500 million over the next six months to boost the Bitcoin mining industry, with mining facilities to be built in Uruguay, Paraguay and El Salvador.

USDT vs USDC

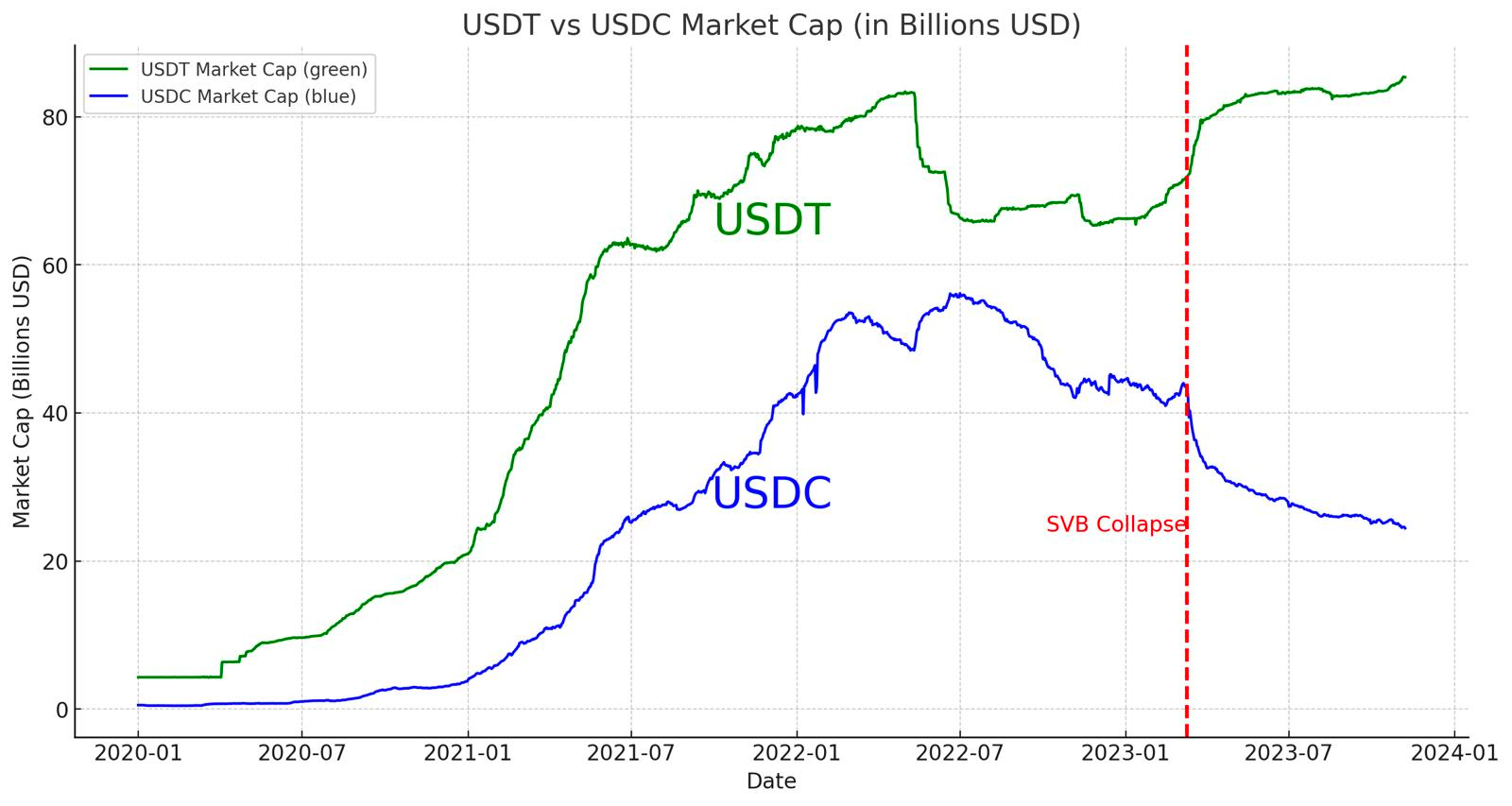

One simply can't mention Tether's dollar-pegged stablecoin, USDT, without mentioning Circle's dollar-pegged stablecoin, USDC. According to a report from OKX Ventures, USDT and USDC dominate the stablecoin market with 90% share; 70% share and 20% share respectively. Despite its overall market dominance, USDC still lags significantly behind USDT.

According to Circle, the number of wallets holding at least $10 worth of USDC grew by 59% in 2023 to a total of 2.7 million. This is even more impressive considering USDC's circulating supply fell from $45 billion to $25 billion in the first 11 months of 2023, a decline of approximately 44%.

Nonetheless, $197 billion in USDC was minted or burned over the year, which strengthens Circle as "the premier bridge between the digital asset economy and traditional finance," the report claims.

According to the report, USDC transaction volumes in the Asia-Pacific region have seen remarkable growth over recent years. $130 billion in remittances entered Asia in 2022, which accounts for 29% of all global digital currency value received. The region dominates, compared to 19% for North America, and 22% for Western Europe.

The competition between USDC and USDT has sparked discussions about stability, transparency, and regulatory compliance within the stablecoin market. With USDC flaunting its regulatory compliance like a shiny new badge, it ate into USDT's market share. But following USDC's de-pegging saga, the gulf between the two giants has grown even wider.

The United Nations (UN) warned that USDT has become one of the most prominent payment methods for money laundering and scams in Southeast Asia.

“Online gambling platforms, especially those operating illegally, have emerged as among the most popular vehicles for cryptocurrency-based money launderers, particularly for those using Tether,” the UN report said, according to the Financial Times.

Circle is also set to launch the stablecoin natively on the Celo blockchain, a move that aims to further the reach and applicability of digital currencies.

This initiative is set to expand the utility of USDC beyond traditional boundaries, integrating it into Celo’s diverse stablecoin applications, such as remittances, savings, lending, and peer-to-peer transactions.