Table of Contents

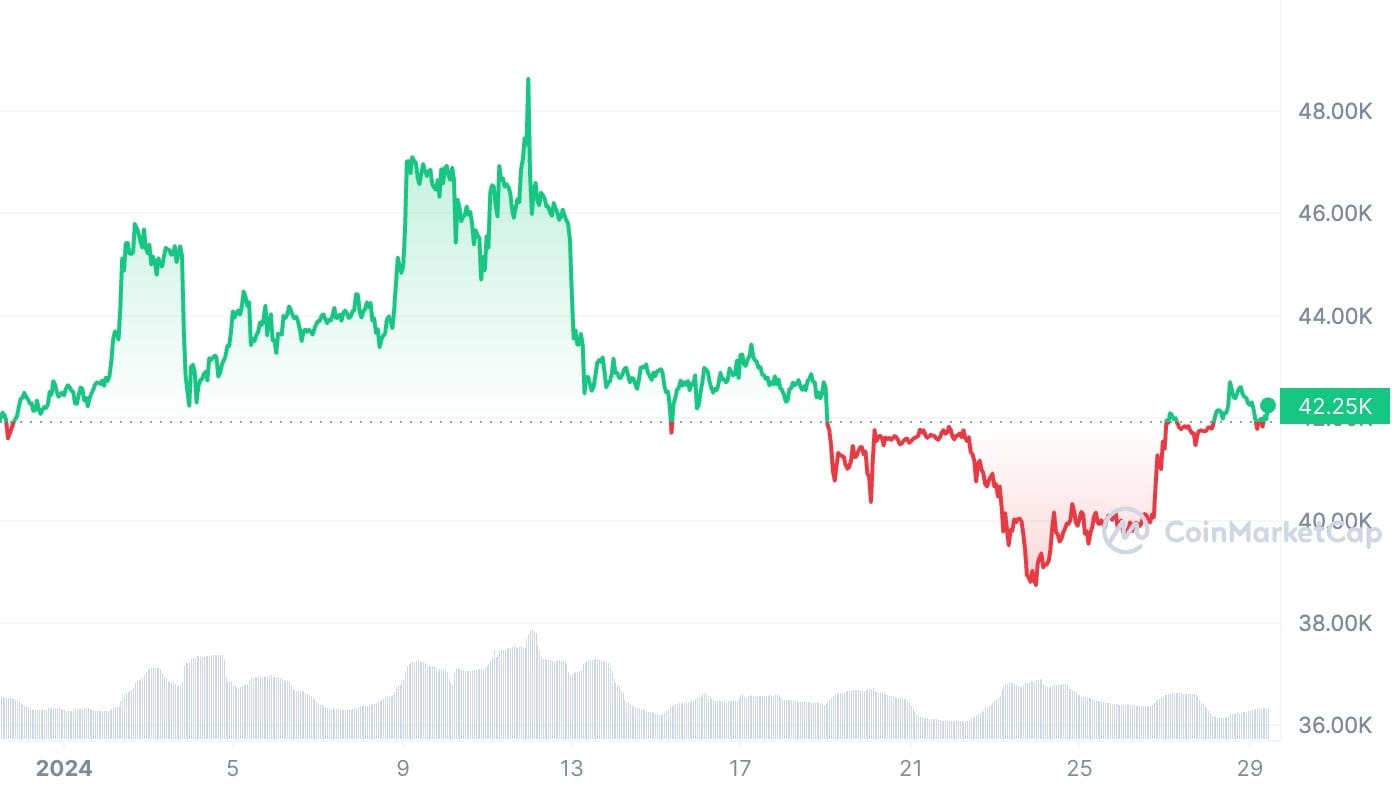

From an intraday peak of $49,021 when the ETFs went online, the world's largest cryptocurrency token has dropped by over 20% to about $42,000 as excitement about the products gives way to doubts about their real level of demand.

Compared to the digital asset's $778 billion market value, the US spot Bitcoin ETF category has received around $1 billion in net inflows thus far.

Will Bitcoin Revive or Ease Further?

Sentiment has cooled following an over $4 billion withdrawal from the largest token portfolio, the Grayscale Bitcoin Trust, which was originally a closed-ended fund before converting to an ETF.

Technical research using chart patterns suggests that $36,000 to $38,000 might serve as a foundation for Bitcoin, and if those levels hold, there may even be a new upswing in price.

According to an Ichimoku Cloud analysis, which employs mathematical algorithms to identify regions of support and resistance, there may be a buffer for Bitcoin around $37,000.

At this point, near-term stabilisation would be a natural development. The most recent 20% decline in the value of Bitcoin is the fourth such event in the previous year or so.

According to Elliott Wave research, market trends tend to replicate themselves.

When the method is applied to Bitcoin, it indicates that the token's base is between $36,000 and $38,000 before a fifth wave sparks the rise that started the previous year.

Experts claimed that the token's two-week decline would halt due to a pause in withdrawals from the $20 billion Gscale Bitcoin Trust.

The fund's conversion from a closed-end structure prompted disposals by the estate of the defunct FTX exchange and allowed investors to finish out a well-liked arbitrage play.

The vehicle, also known as GBTC, saw daily outflows peak at $641 million on January 22 but drop to $394 million on January 25.

The highly anticipated spot Bitcoin ETFs are losing popularity.

Since launch, the $5.2 billion in inflows into the nine new ETFs have more than offset the $4.4 billion outflows from GBTC.

But that equilibrium has shifted in the last several days. Daily net outflows from GBTC are declining, while the nine other ETFs' total inflows are declining more quickly. Inflows net totaled $857 million.

Despite the decline in demand, the group of spot Bitcoin ETFs had the best ETF launch in history based on trading and flow indicators.