Table of Contents

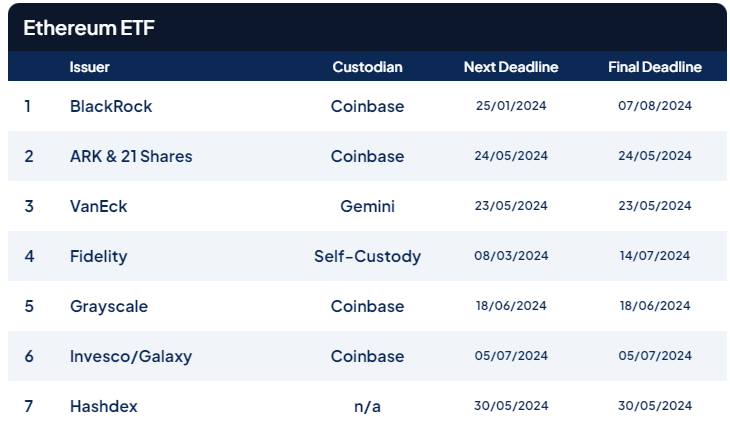

We're still in the midst of digesting spot Bitcoin ETFs but there's already talk of when Ethereum ETFs will be approved.

Last week, Steven McClurg, chief investment officer at Valkyrie, hinted at the possibility of an Ethereum and XRP ETF. “I think we’re going to see a lot of filings come out for Ethereum," he said. "I even think we might see something for Ripple given the recent progress.”

In a filing yesterday, the SEC revealed it is delaying its decision timeline on BlackRock's proposal for an Ethereum ETF from 25 January to 10 March.

"The Commission finds it appropriate to designate a longer period within which to take action on the proposed rule change so that it has sufficient time to consider the proposed rule change and the issues raised therein," according to Wednesday's filing.

Bloomberg Intelligence ETF analyst James Seyffart said delays for Ethereum ETFs are likely to continue.

"Spot Ethereum ETF Delays will continue to happen sporadically over the next few months. Next date that matters is May 23rd," Seyffart tweeted following the SEC's announcement.

Spot Ethereum ETF Delays will continue to happen sporadically over the next few months. Next date that matters is May 23rd https://t.co/2zBBvHkrVk

— James Seyffart (@JSeyff) January 24, 2024

23 May is the SEC's earliest final deadline for all applicants. Other deadlines range from 23 May to 3 August.

Hype 2.0

The Bitcoin ETF hype was one hell of a ride for investors. The industry's Ross and Rachel, will they won't they, relationship with the SEC had both TradFi and crypto investors holding their breath. Of course, in hindsight, there was no doubt that the SEC would eventually come to and approve the assets.

Now that Bitcoin has crossed the line, punters have their sight on Ethereum. But at this point, Ethereum ETFs seem inevitable.

Once again, BlackRock, Fidelity, and Grayscale have returned to the race, vying for the first Ethereum spot ETF. And once again, the SEC is playing hardball, asserting its power by playing with the industry's feelings. And once again, JP Morgan is living in living in crypto disbelief, declaring that the chances of approval of Ethereum ETFs by May this year is “not higher than 50%.”

It all feels like deja vu and ultimately, will the outcome be any different? Unlikely.

"Bitcoin and Ethereum are both listed and regulated futures on CME, and are likely considered pretty equal in the eyes of the SEC," Philippe Bekhazi, founder and CEO of XBTO said.

"Additionally, if market conditions remain strong, further pressure will be applied to make the asset accessible to institutions. Approval is definitely a question of when, not a question of if."

Matt Kunke, research analyst at GSR, gives a 75% likelihood that ETH ETFs will be approved in May, whilst Seyffart puts it at around 60-65%.

In any case, Ethereum ETF approvals are only a matter of time, and therefore probably not deserved of the same hype Bitcoin ETFs experienced.

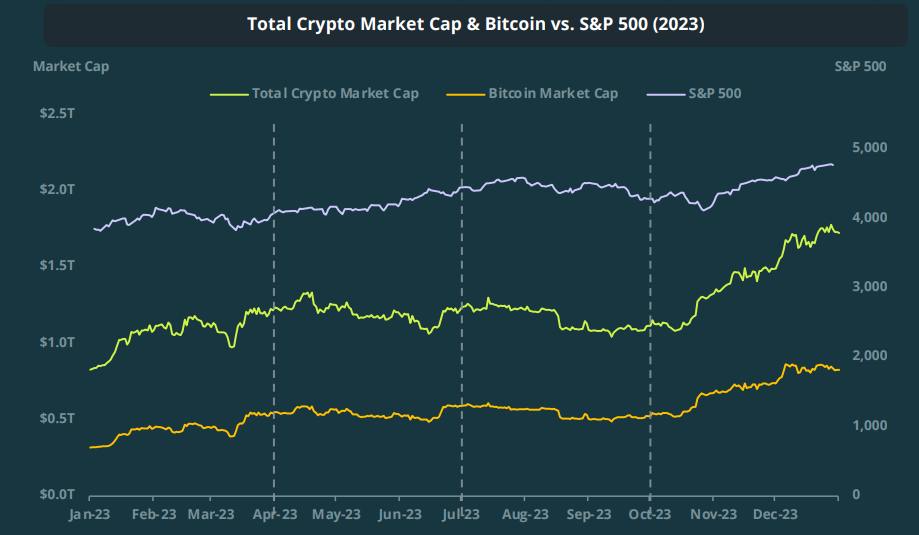

Perhaps a more interesting discussion would be how Ethereum will behave post-ETF approval. Since the SEC's Bitcoin ETF greenlight, BTC gas become highly correlated to the S&P500.

How this correlation will unfold in 2024 is yet to be seen. As institutions ape into Bitcoin, the world's largest cryptocurrency could experience a similar ride as its TradFi counterparts.

The crypto industry, which is seemingly less correlated with its biggest crypto, could likewise have its own journey. Which path will ETH follow?