Table of Contents

Boycotts against Vanguard have proven to be futile as the investment giant has strengthened its anti-crypto exchange-traded fund (ETF) stance.

For the past two weeks, the crypto industry has been basking in the embrace of TradFi staples following the approval of their Bitcoin ETF products by the SEC.

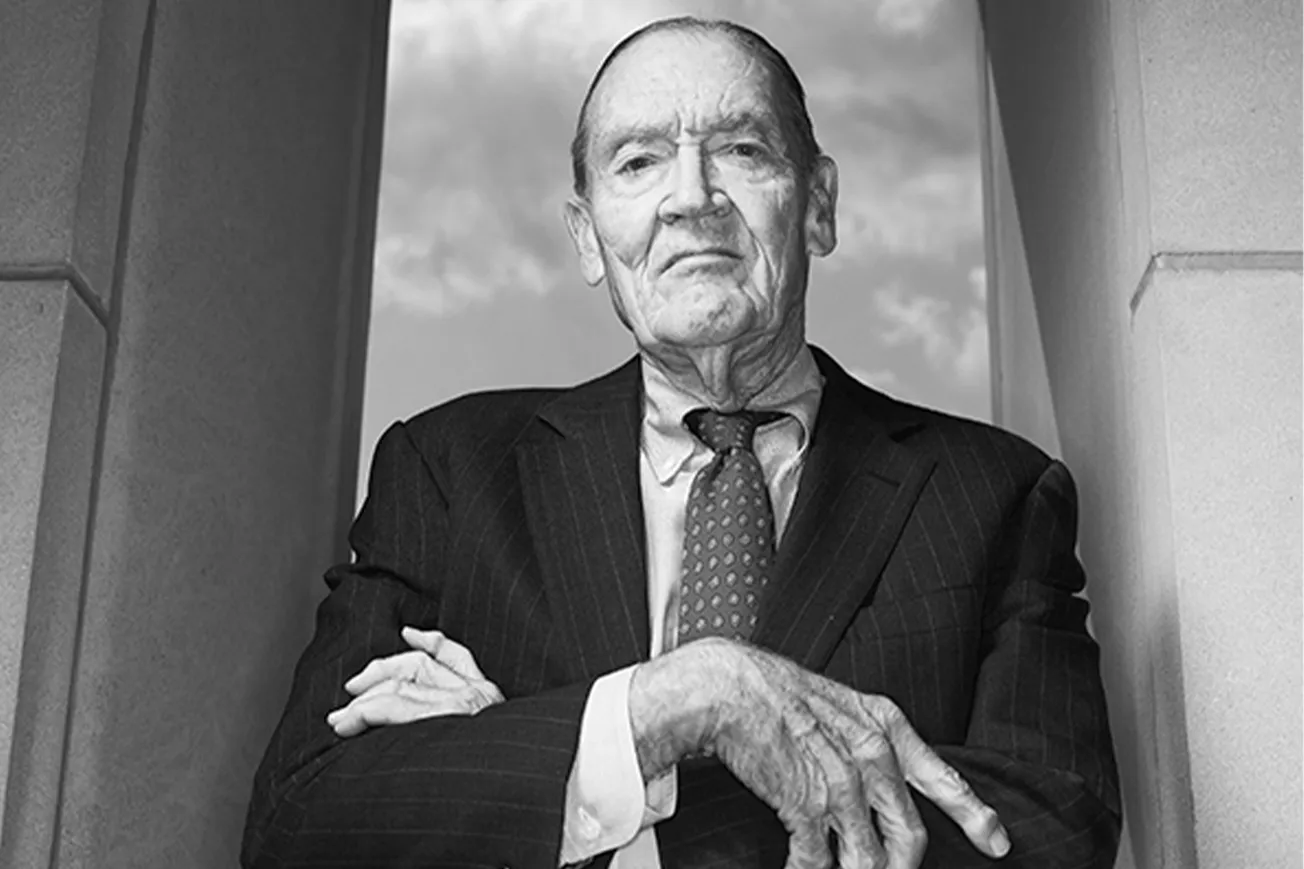

One investment firm refraining from jumping on the bandwagon is Vanguard. Managing $8.6 trillion, Vanguard has adopted the philosophy of its late founder and chief executive, Jack Bogle: “Avoid Bitcoin like the plague.”

As a result, Vanguard has refused to partake in the spot Bitcoin ETF hype, which in turn triggered a backlash on social media. Unable to accept that TradFi firms are still unwilling to accept crypto as a legitimate asset, #BoycottVanguard became a trending hashtag on X.

New Slogan:

— Al (@alcrypto20) January 18, 2024

Fidelity Rocks, Vanguard Sucks. #BITCOIN #BoycottVanguard pic.twitter.com/5QqYJBw1eu

Unsurprisingly, Vanguard was unmoved by the movement and instead opted to double down on its stance.

When Vanguard's decision to shun Bitcoin ETFs came to light, Jeff DeMaso, editor of The Independent Vanguard Advisor, said the move was "very much on brand for Vanguard."

“For example, the firm kicked leveraged ETFs off its platform several years ago. Vanguard also hasn’t touched crypto with a 10-foot pole,” DeMaso wrote to his readers.

At the time, DeMaso revealed he purchased a futures-based Bitcoin ETF in his own Vanguard account titled the ProShares Bitcoin Strategy ETF.

“Simply put, this is contradictory. Bitcoin futures are meant to [and generally have] track bitcoin’s price,” DeMaso said. “If Bitcoin is too volatile or doesn’t have a place in a long-term portfolio [the reasons Vanguard has said it’s not allowing purchases of the new spot ETFs], well, the same should apply to the futures-based bitcoin ETFs.”

However, with criticism mounting online, Vanguard took action to remove futures-backed Bitcoin from its platform too. Essentially ridding itself of any crypto products, Vanguard is now completely clear of the alternative asset.

Vanguard's bold and seemingly controversial move hasn't damaged its intake either. Last week, the firm saw $4.4 billion added to its ETFs, maintaining its top position as a leader in the $8 trillion ETF market.

As bitter as crypto enthusiasts might be about Vanguard's stance, perhaps Bitcoin ETFs aren't the be-all and end-all after all.