Table of Contents

dYdX's decision to move to Cosmos has been validated as it has now surpassed its Etherum-based counterparts to become the largest decentralized exchange (DEX) by 24-hour trading volume.

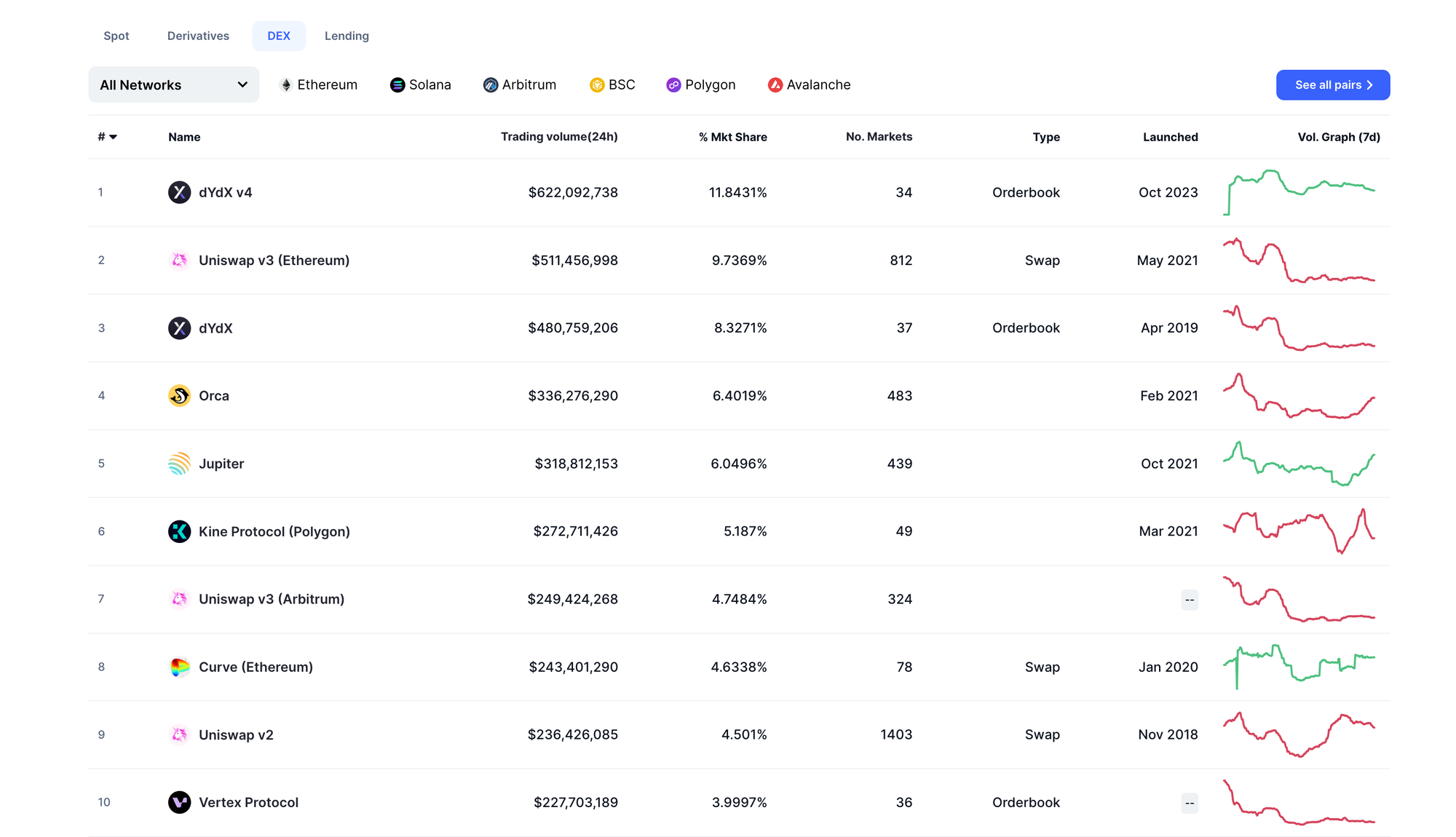

In the past 24 hours, dYdX v4 had a 24-hour trading volume of $622 million, compared to Uniswap v3, which had $511 million, according to data from CoinMarketCap. The previous Ethereum-based version of dYdX, which still operates, stands in third place, with about $481 million in trading volume in the same period.

On the other hand, Uniswap's popularity might have been dented by its introduction of a 0.15% frontend fee in October 2023, as part of a plan to foster growth of its ecosystem. This has led to users switching to alternative solutions to interact with Uniswap. In the three months after the fee rollout, Uniswap received some $2.6 million in fees, according to a Dune dashboard by backend engineer Alex Kroeger.

v4 boost

The dYdX v4 upgrade, launched in 2022, was aimed at fully decentralizing the protocol, which according to the team ensures the “decentralization of [the project’s] least decentralized component.”

The v4 update moved dYdX to a standalone blockchain based on the Cosmos SDK and Tendermint proof-of-stake consensus. The platform said it wanted to be able to process 1,000 orders per second by the year's end, and that Cosmos was able to provide the performance necessary.

There are currently 33 active markets on the dYdX Chain, including Ethereum, Bitcoin, Solana, Polygon, Avalanche and Chainlink.

The Cosmos network, dubbed the “Internet of Blockchains,” is emerging as a powerful ecosystem for DeFi protocols as it facilitates interoperability between unique blockchains, which means that data and assets can be exchanged between multiple blockchains under a single ecosystem.

Token poised for breakout

The past 24 hours have seen the price of $dYdX grow by 7.61% to $3.11, and is poised for a breakout, according to its 4H chart. Chaikin Money Flow also indicates buying pressure over the past month. Traders have now set their sights on the $4.3 level, and if crossed, to $5.7.