Table of Contents

FTX users, or should we say, victims, have long awaited the return of their assets. It's been well over a year since the demise of FTX and the fall of Sam Bankman-Fried's empire.

As the disgraced crypto mogul awaits his sentencing, the FTX debtors estate has been busy amending its Chapter 11 Plan of Reorganization.

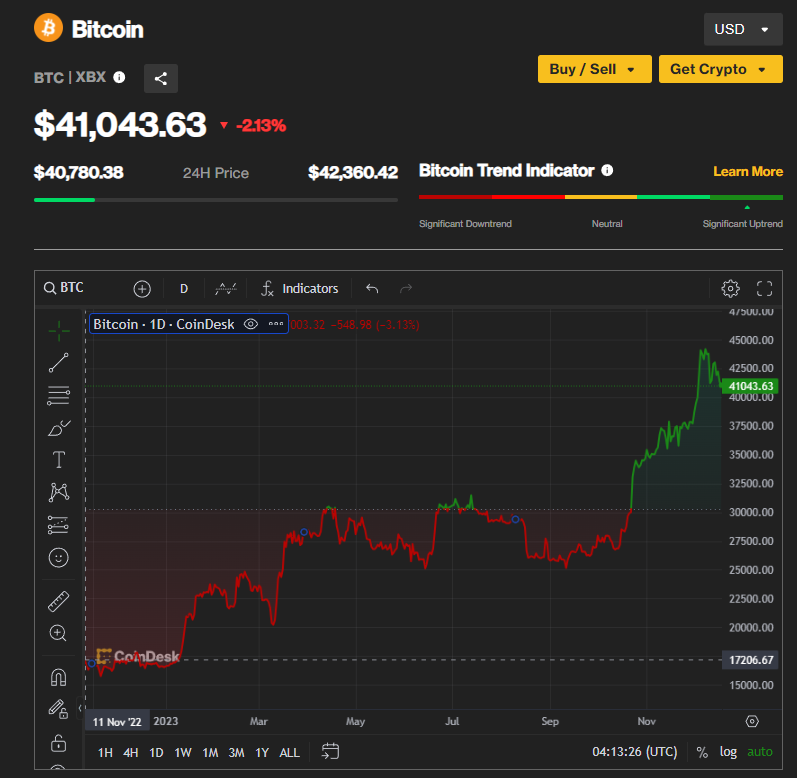

In a new filing by FTX CEO John Ray III and the lawyers of Sullivan & Cromwell, the debt estate said claimants' digital assets will be valued in cash at the time of the exchange's bankruptcy filing on 11 November 2022.

For those who may have forgotten, or may have just wiped it from their memory, Bitcoin was priced around the $17,000 mark towards the end of 2022. You don't need us to tell you where it's at now.

FTX creditor Sunil Kavuri said the reorganization plan violates FTX's Terms of Service, which states digital assets belong to customers, not the exchange.

"The reason SBF was convicted beyond reasonable doubt on all 7 counts was that he stole digital assets that were owned by FTX customers," Kavuri said.

Creditors from specific classes will be able to vote on a revised reorganization plan. In a statement, the Debtors emphasize the pains taken to get to this point, writing, "the Plan and this Disclosure Statement reflect many compromises to create the best, most equitable and economical outcome for all creditors and stakeholders in these Chapter 11 Cases."