Table of Contents

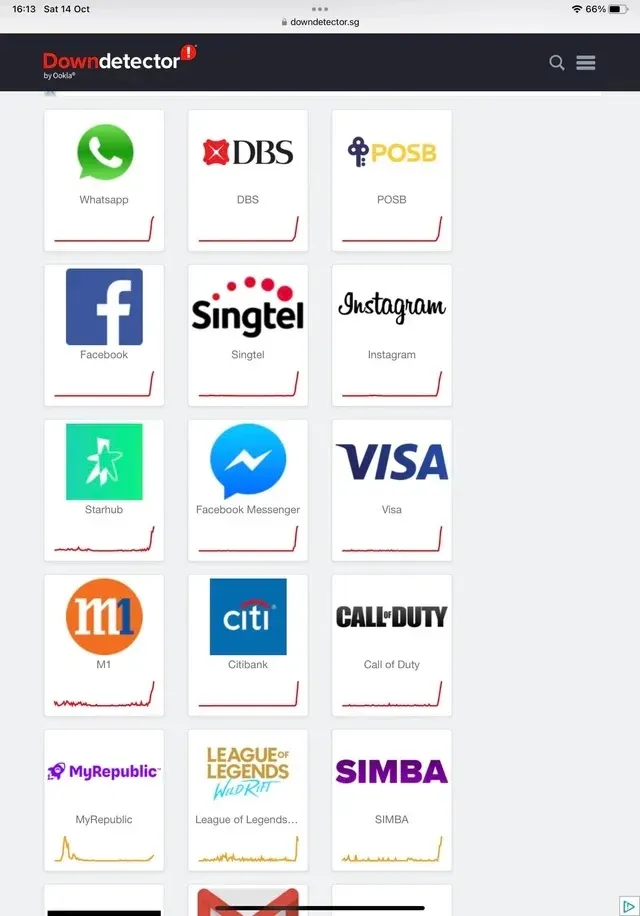

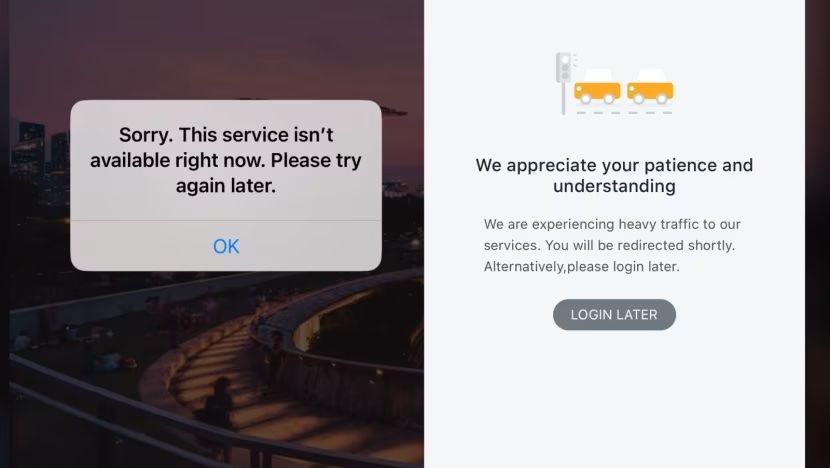

Over the weekend, Singaporeans found themselves at the mercy of DBS and its traditional financial structures. Lasting more than 12 hours, Southeast Asia's largest bank and "the world's best digital bank," suffered an outage on Saturday, preventing online banking, in-store digital payments, and ATM withdrawals.

DBS blamed the disruption on "an issue at a data centre which is also being used by various other organisations." Its data centre provider Equinix acknowledged the "technical issue" and said it is "in contact with those impacted customers and expressed [its] sincere apologies."

Disruption was also experienced by Citibank, Starhub, Whatsapp, and bizarrely, even Call of Duty.

Proudly representing over 90% of Singapore's population, DBS is the dominant banking provider in the city-state. Its outage thereby resulted in chaos across the island as users were awkwardly left stranded at payment terminals.

Merchants who were unable to accept digital payments lost sales throughout the outage too.

@dbsbank @MAS_sg DBS living up to its motto. Been "banking less" throughout the day today. PayLah, ATM and card services are all down. #dbs #outage pic.twitter.com/1uuk0oF2WS

— Sai Balaji (@couchrishi) October 14, 2023

MAS has since responded by saying it is "following up closely with the banks, as they work towards a full resumption of their services, and provide timely communications and support to affected customers.”

Crypto to the Rescue

Predictably, crypto enthusiasts took the opportunity to remind us all of the alternative asset's superiority.

"Yesterday, an issue with a data centre in Singapore caused the outage of digital banking services from DBS bank. In case anyone’s thinking if crypto’s gonna die," tweeted one crypto fan.

"Singapore's DBS bank down... atm down... card payment down... that's why we need crypto payment," said another.

Yesterday, an issue with a data centre in Singapore caused the outage of digital banking services from DBS bank.

— Kit (@Kit_GPT) October 15, 2023

In case anyone’s thinking if crypto’s gonna die. pic.twitter.com/hWN9zYcE41

Singapore's DBS bank down... atm down... card payment down... that's why we need crypto payment 😁

— Hp 💎 (@hpility) October 14, 2023

Crypto payments firm dtcpay, which facilitates payments for real-world items with crypto, highlighted how blockchain can offer more secure payments. "Transactions that occur outside the traditional financial system; such as those that are settled on the blockchain can be an extra layer of resiliency to ensure finality," said dtcpay Group CEO Kanny Lee. dtcpay holds a Major Payment Institution license in Singapore.

Cash is King

Crypto is great. We get it. But is it better than cash? It might be tough for a crypto aficionado to admit, but crypto payments are still vulnerable to outages. Solana is notorious for its countless outages whilst crypto exchanges suffer disruptions like clockwork.

During DBS' outage, disgruntled users were quick to express their frustration on the bank's Facebook post. Whilst some shared anecdotes of being unable to pay for their haircuts, one commenter's rather humorous post highlights an important issue.

"Dear DBS, I could not even use PayNow, PayLah! and credit card to buy food. Then I decided to go to ATM. But all of the ATM machines were offline. The only solution was to use CDC vouchers to make payment," wrote Facebook user Faith Lim.

It's a facetious comment but resorting to CDC vouchers underscores the vulnerability of digital payments. Whilst decentralised cryptocurrency ecosystems offer a compelling alternative to centralised traditional financial structures, instances like this weekend's outage remind us that cash is still king.

Elsewhere,

- Australian Crypto Exchanges Face New Regulatory Measures: Australia's federal government has announced stricter regulatory controls on cryptocurrency exchanges. Revealed by Assistant Treasurer Stephen Jones at the Australian Financial Review Crypto Summit, exchanges must now hold a financial services license from the corporate regulator, AFR reported. Exchanges with over $5 million in holdings, or more than $1,500 for an individual, will need an Australian Financial Services Licence (AFSL). The objective is to enhance consumer protection, especially after the FTX crypto exchange collapse impacted 30,000 Australians. Major domestic exchanges support this decision. Additional standards, inspired by global regulations, will also be introduced.

- Bhutan Introduces Blockchain-Based National Digital Identity: Bhutan has launched a pioneering blockchain-based National Digital Identity (NDI) system, the first country to adopt such a decentralized identity framework. Initiated by Bhutan's GovTech Agency and Druk Holding & Investments, the system gives legal status to digital credentials, ensuring secure interactions between citizens and services. Built on self-sovereign identity principles, the NDI guarantees users exclusive control over their data. Available on iOS and Android, the NDI's mobile wallet facilitates interactions across users, government, and businesses. The move is viewed as Bhutan's significant step towards its digital nation aspiration, promising wider inclusivity and easier global market access.

- Coinbase Urges SEC for Clarity on Crypto Rules: The crypto exchange is again pressuring the U.S. Securities and Exchange Commission (SEC) for formal guidelines on which digital assets should be classified as securities. The request, made over a year ago, was followed by the SEC suing Coinbase in June, accusing the exchange of being an unregistered securities platform. In recent court filings, Coinbase accuses the SEC of a "troubling intransigence" pattern, with their lawyer, Eugene Scalia, stating that the SEC's lack of action has placed digital assets in a "Catch-22" situation. Scalia further called the SEC's recent report a "bureaucratic pantomime" and suggested that stronger measures might be needed to push the agency to fulfill its obligations. Meanwhile, SEC Chairman Gary Gensler maintains that the existing laws already provide clear guidelines for digital asset companies.

- Wen Lambo? Nah, it's "Wen Ferrari?" Now: So, you've amassed a crypto fortune and you're itching to flaunt it? How about a sleek Ferrari to do the talking? The Italian stallion is opening its gilded gates to crypto in the US, with Europe and other regions soon to follow, letting flashy aficionados buy their dream rides with digital gold. Move over traditional swipes and wires, the Prancing Horse now prances to the beats of Bitcoin and friends. And, while this makes for a snazzy headline, one has to wonder: Is this the evolution of luxury retail or just another brand playing catch-up in the crypto carnival?

Upcoming

Blockhead is a media partner of the Singapore Fintech Festival!

The 8th edition of the Singapore FinTech Festival (SFF) will take place from 15 -17 November 2023 at the Singapore Expo, bringing together the global fintech community to engage, connect, and collaborate on issues relating to the development of financial services, public policy, and technology. As the world’s most impactful fintech festival, last year’s edition brought together over 62,000 participants from 134 countries.

Blockhead readers enjoy 20% off Conference Passes (applicable to existing pass rates) Register Now.